library(ggplot2)

library(forecast)

library(fpp2)

library(astsa)

library(car)

library(TSA)

library(tseries)

library(urca)Tema VI: Modelos ARIMA de Box&Jenkins - Lab 1

Curso: Series Cronológicas

1 librerías

2 Modelo AR(1)

2.1 Funciones para simular un AR(1)

set.seed(1000)

gen_ar1a <- function(N = 150, phi1 = 0.8, sigma2 = 1) {

a <- rnorm(N,0,sigma2)

y <- as.numeric(0)

y[1] <- a[1]

for(i in 2:N){

y[i] <- phi1*y[i-1]+a[i]

}

return(y)

}

gen_ar1b <- function(N = 150, C=0, phi1 = 0.8, sigma2 = 1) {

NN <- 1000

a <- rnorm(NN+N,0,sigma2)

y <- as.numeric(0)

y[1] <- a[1]

for(i in 2:(NN+N)){

y[i] <- C + phi1*y[i-1] + a[i]

}

return(y[NN:(NN+N)])

}2.2 AR(1)

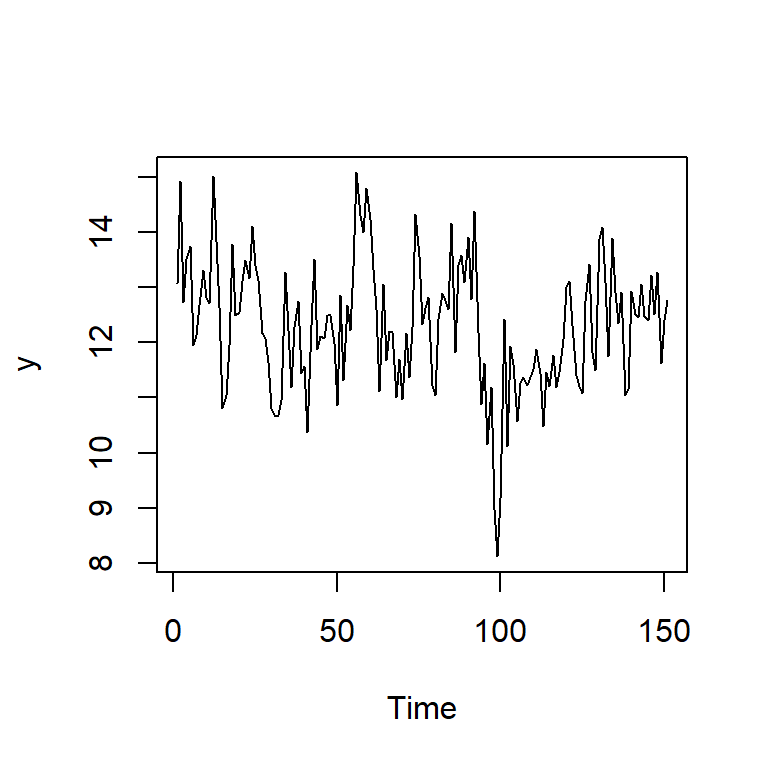

phi1=0.6

y <- gen_ar1b(N=150,C=5,phi1=phi1,sigma2=1)2.3 Simulación y el análisis descriptivo

# descriptiva

ts.plot(y)

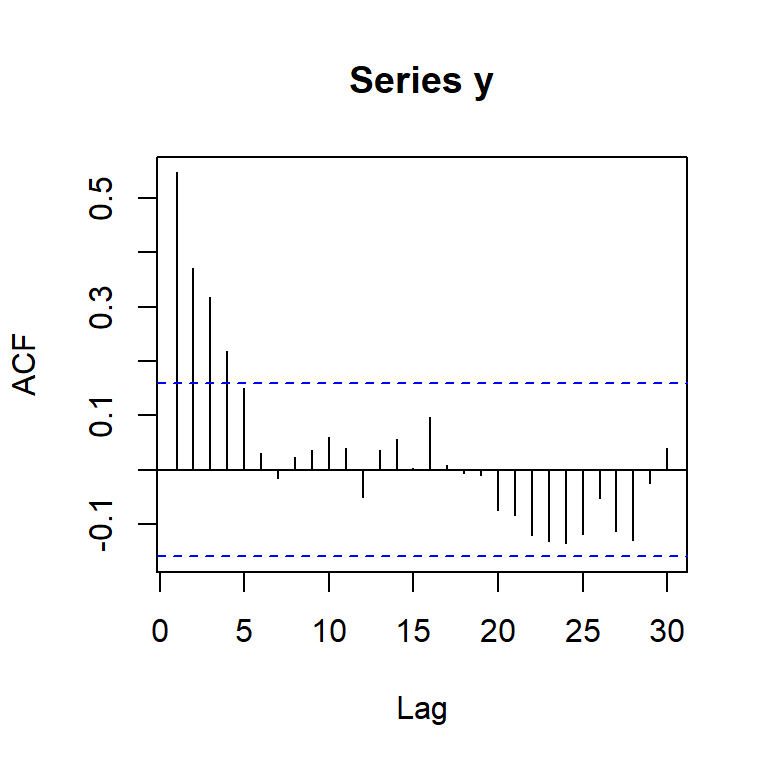

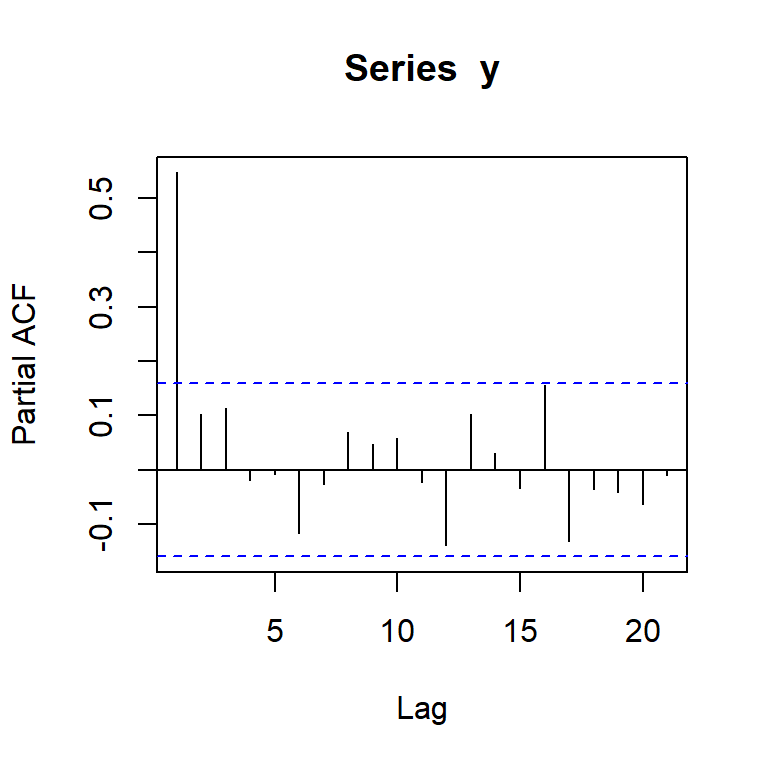

mean(y) #promedio teórico: 5/(1-phi1)[1] 12.29826acf(y,lag.max=30)

pacf(y)

acf2(y) #library(astsa)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.55 0.37 0.32 0.22 0.15 0.03 -0.01 0.02 0.04 0.06 0.04 -0.05 0.04

PACF 0.55 0.10 0.11 -0.02 -0.01 -0.12 -0.03 0.07 0.05 0.06 -0.02 -0.14 0.10

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23]

ACF 0.06 0.00 0.10 0.01 -0.01 -0.01 -0.07 -0.08 -0.12 -0.13

PACF 0.03 -0.03 0.16 -0.13 -0.03 -0.04 -0.06 -0.01 -0.02 -0.022.4 Estimación del modelo AR(1)

mod0a <- Arima(y, order=c(1,0,0),method="CSS-ML")

mod0b <- Arima(y, order=c(1,0,0),method="ML")

mod0c <- Arima(y, order=c(1,0,0),method="CSS")

summary(mod0a)Series: y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.5458 12.3079

s.e. 0.0677 0.1747

sigma^2 = 0.9791: log likelihood = -211.84

AIC=429.67 AICc=429.84 BIC=438.73

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.003583648 0.9829323 0.7777108 -0.7004689 6.441715 0.862108

ACF1

Training set -0.05598464summary(mod0b)Series: y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.5458 12.3079

s.e. 0.0677 0.1747

sigma^2 = 0.9791: log likelihood = -211.84

AIC=429.67 AICc=429.84 BIC=438.73

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.00358382 0.9829323 0.7777108 -0.7004712 6.441715 0.862108

ACF1

Training set -0.05598279summary(mod0c)Series: y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.5478 12.2906

s.e. 0.0680 0.1772

sigma^2 = 0.9763: log likelihood = -211.94

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -9.091757e-07 0.9815181 0.7736897 -0.6675575 6.406619 0.8576505

ACF1

Training set -0.06819174No está estimando el intercepto C, sino la media del proceso.

mean(y)[1] 12.298265/(1-phi1) #media teórica[1] 12.52.5 El paquete tseries

Este paquete permite la estimación del intercepto.

mod0e<-tseries::arma(y,order=c(1,0),include.intercept=TRUE)

summary(mod0e)

Call:

tseries::arma(x = y, order = c(1, 0), include.intercept = TRUE)

Model:

ARMA(1,0)

Residuals:

Min 1Q Median 3Q Max

-2.70023 -0.62982 0.01873 0.59927 2.49800

Coefficient(s):

Estimate Std. Error t value Pr(>|t|)

ar1 0.54778 0.06799 8.056 8.88e-16 ***

intercept 5.55805 0.83982 6.618 3.64e-11 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Fit:

sigma^2 estimated as 0.9763, Conditional Sum-of-Squares = 145.47, AIC = 428.92.6 El diagnóstico del modelo AR(1)

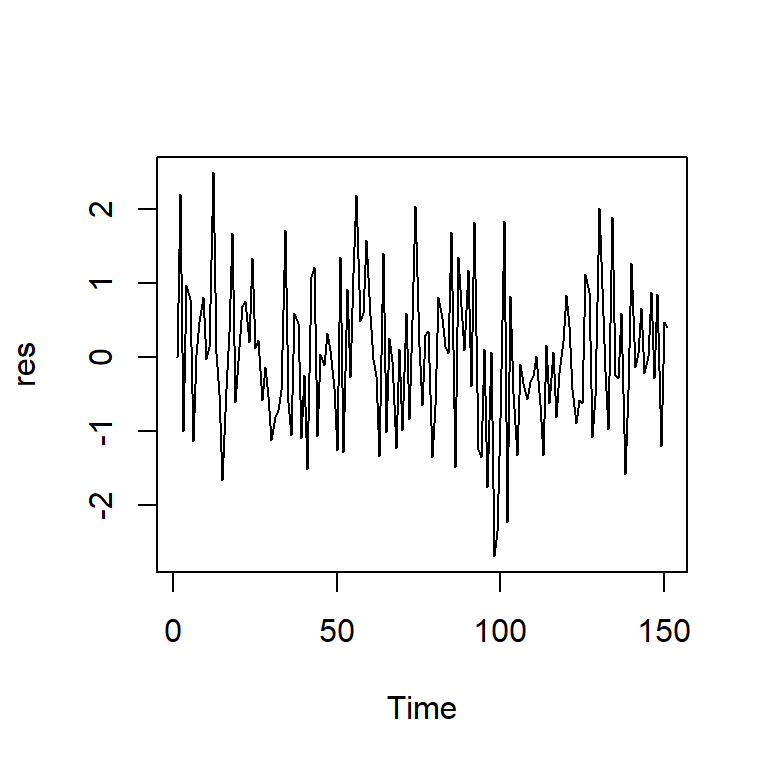

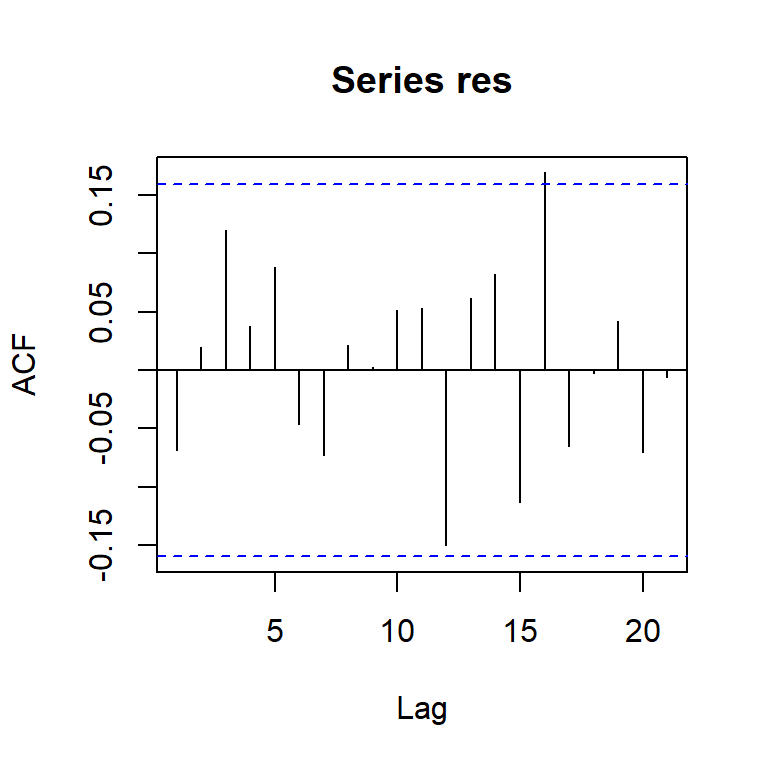

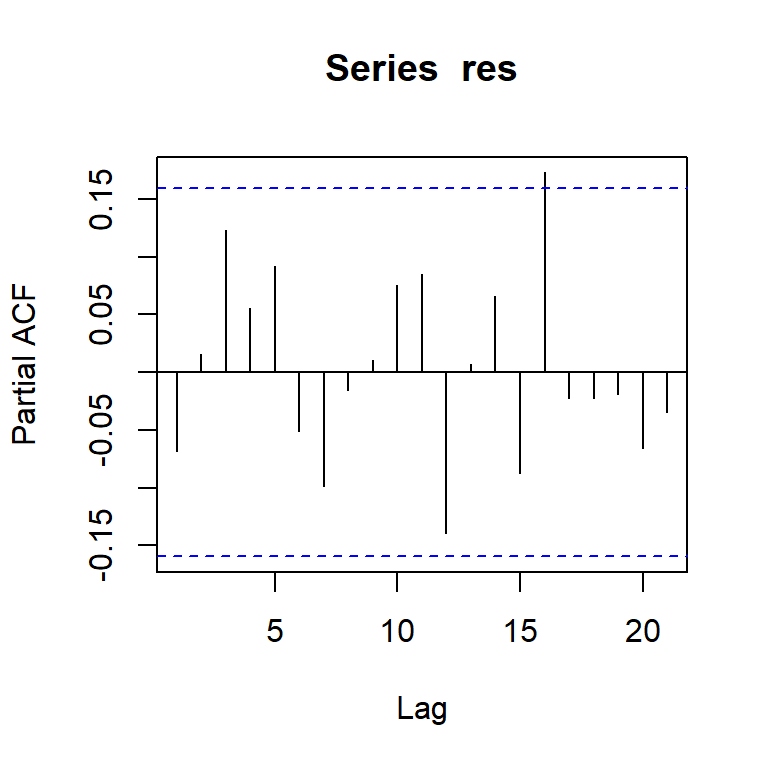

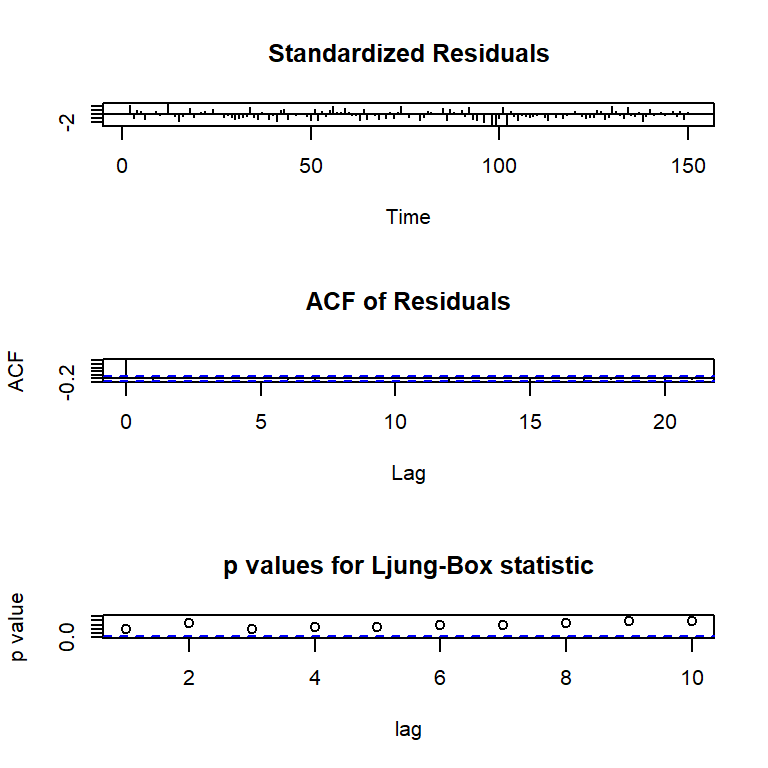

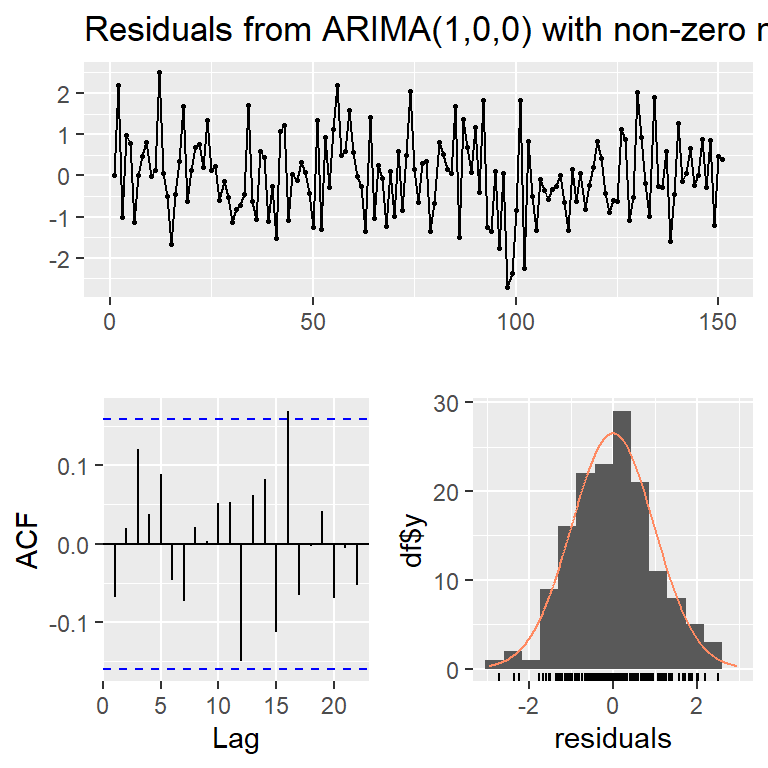

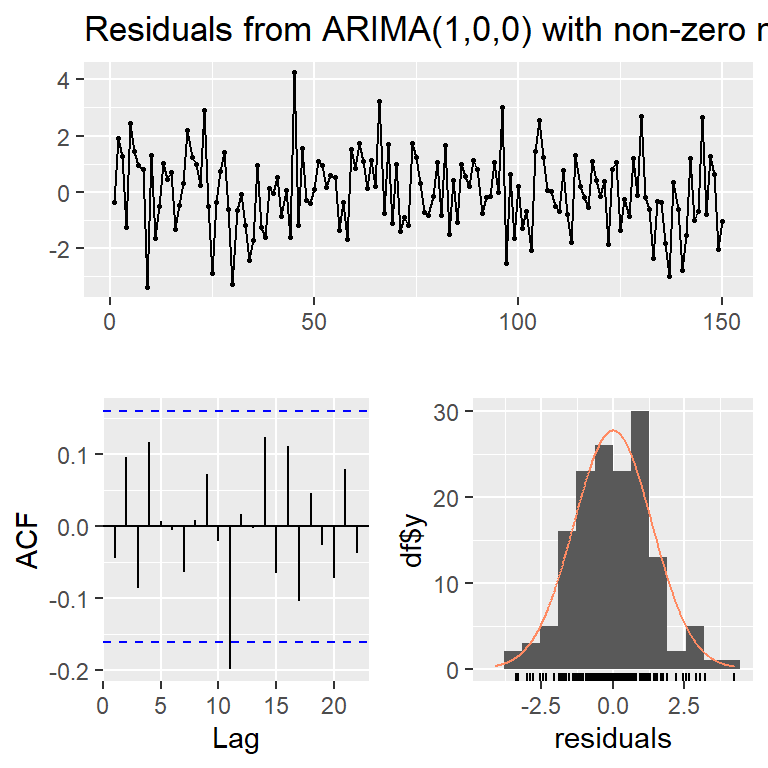

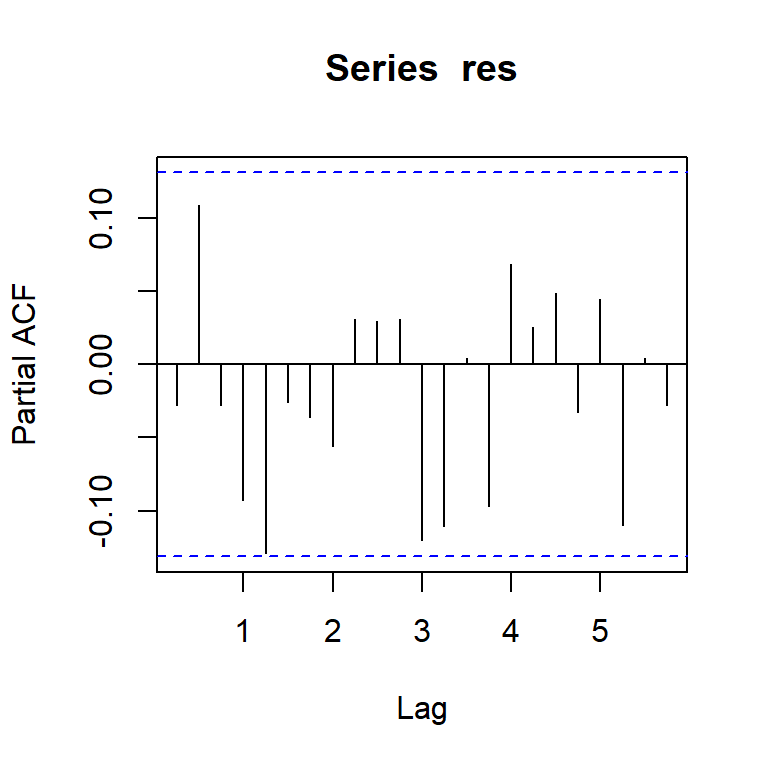

#devolvemos al mod0c

res<-mod0c$residuals

ts.plot(res)

acf(res)

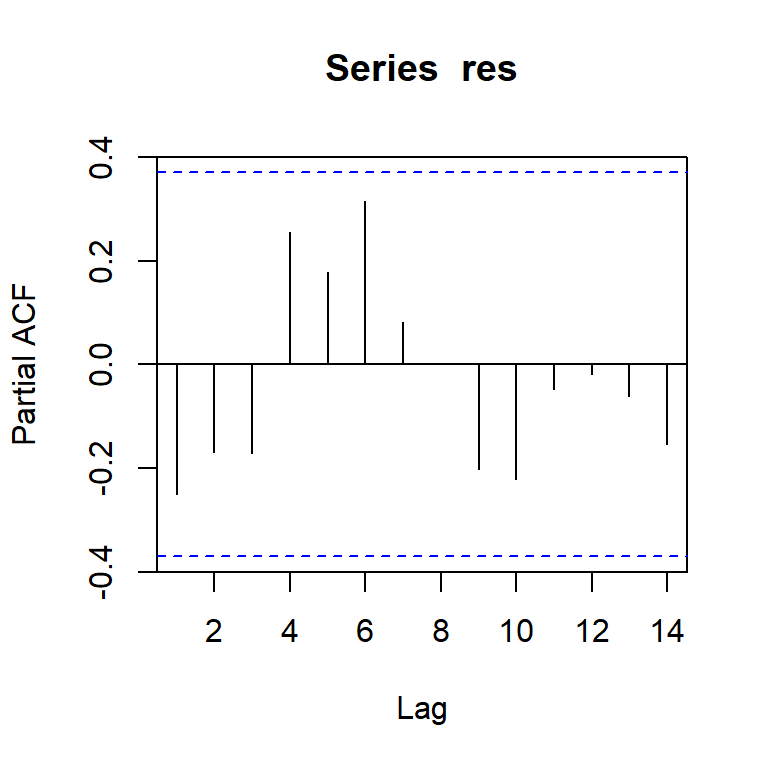

pacf(res)

acf2(res)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF -0.07 0.02 0.12 0.04 0.09 -0.05 -0.07 0.02 0.00 0.05 0.05 -0.15 0.06

PACF -0.07 0.02 0.12 0.06 0.09 -0.05 -0.10 -0.02 0.01 0.08 0.09 -0.14 0.01

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23]

ACF 0.08 -0.11 0.17 -0.07 0.00 0.04 -0.07 -0.01 -0.05 -0.05

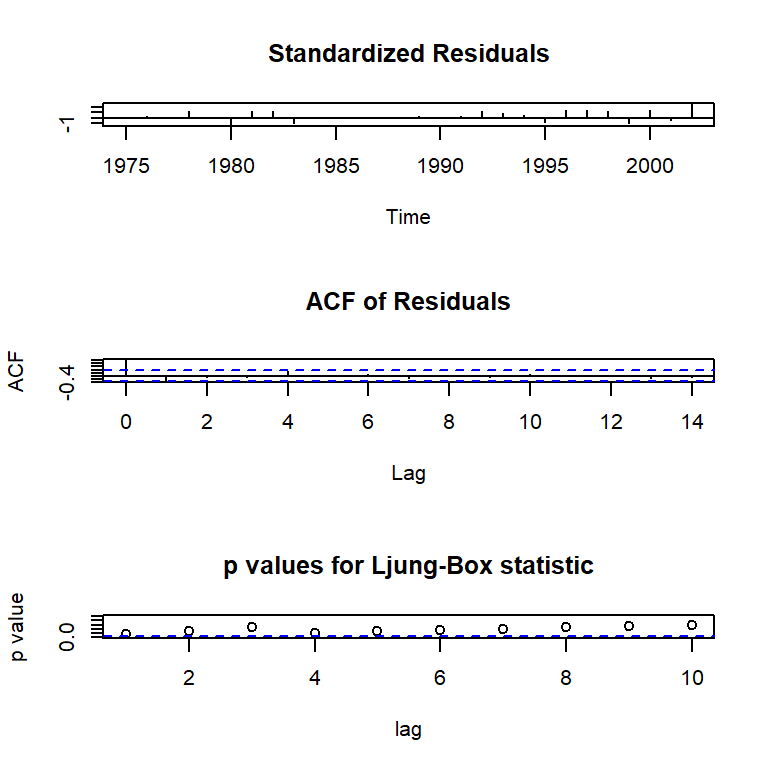

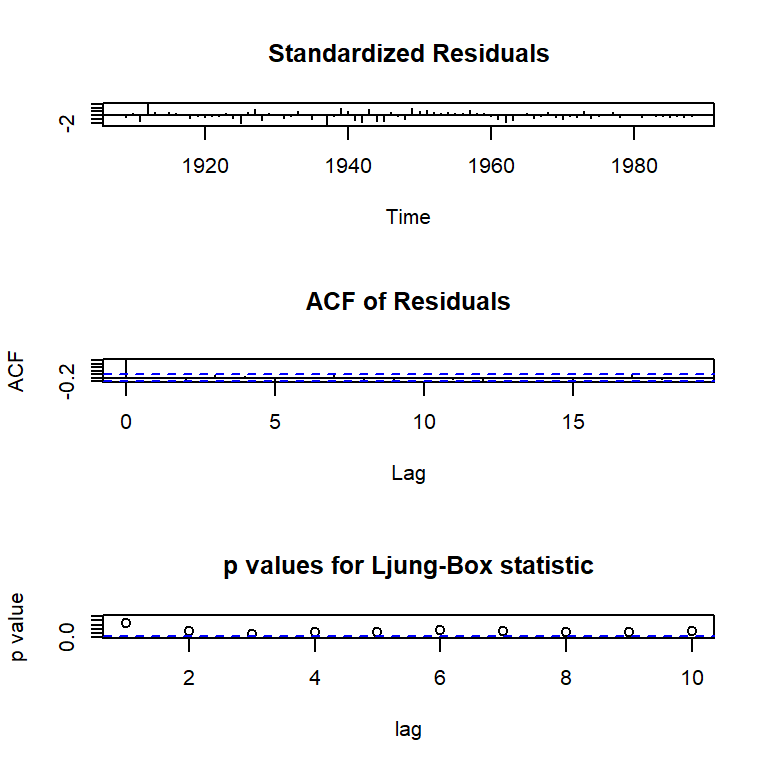

PACF 0.07 -0.09 0.17 -0.02 -0.02 -0.02 -0.07 -0.03 -0.02 -0.01tsdiag(mod0c) #library(stats)

checkresiduals(mod0c,lag=10)

Ljung-Box test

data: Residuals from ARIMA(1,0,0) with non-zero mean

Q* = 6.1954, df = 9, p-value = 0.7202

Model df: 1. Total lags used: 10checkresiduals(mod0c,lag=30)

Ljung-Box test

data: Residuals from ARIMA(1,0,0) with non-zero mean

Q* = 30.38, df = 29, p-value = 0.3952

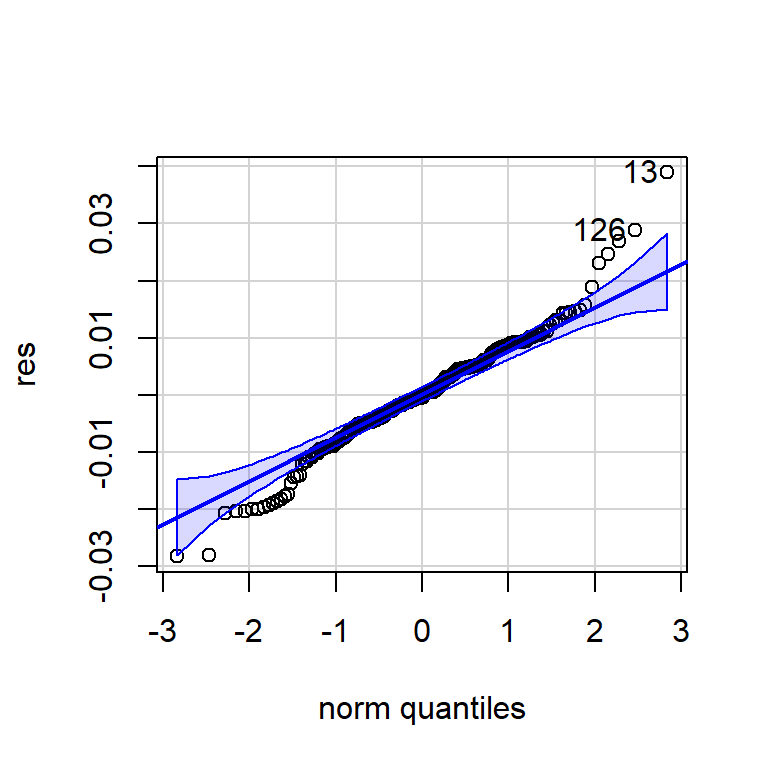

Model df: 1. Total lags used: 302.7 Normalidad

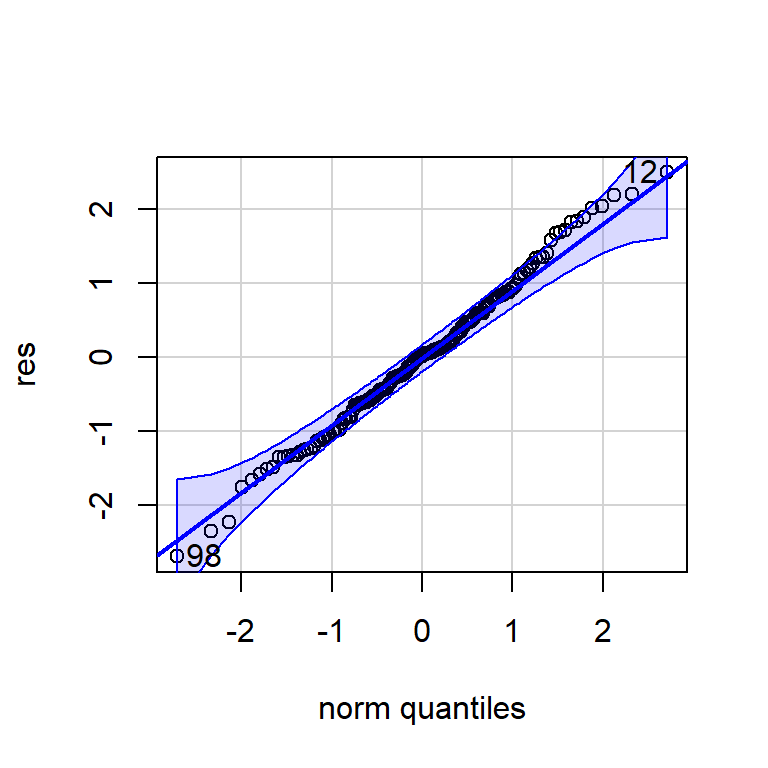

shapiro.test(res)

Shapiro-Wilk normality test

data: res

W = 0.99372, p-value = 0.7572jarque.bera.test(res)

Jarque Bera Test

data: res

X-squared = 0.34556, df = 2, p-value = 0.8413qqPlot(res)

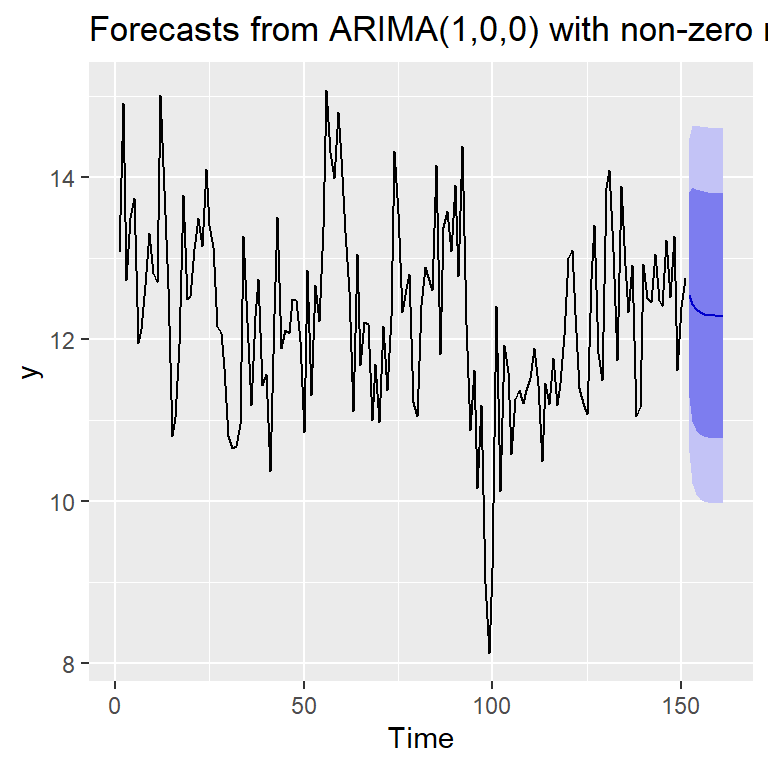

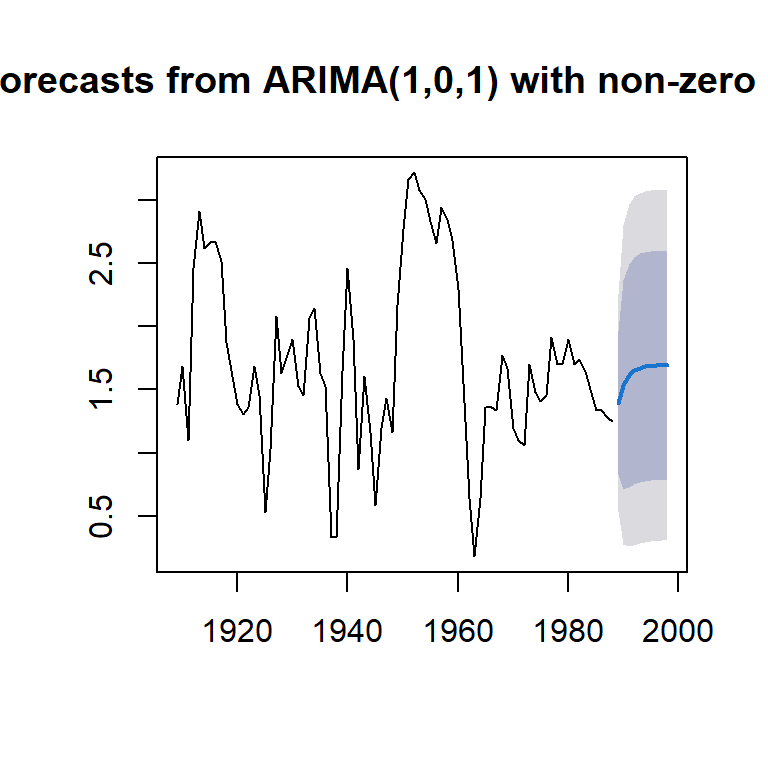

[1] 98 122.8 Pronóstico

forecast(mod0c) Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

152 12.54741 11.28113 13.81369 10.610804 14.48402

153 12.43127 10.98746 13.87508 10.223155 14.63938

154 12.36765 10.87469 13.86061 10.084359 14.65094

155 12.33280 10.82540 13.84020 10.027432 14.63817

156 12.31371 10.80201 13.82542 10.001760 14.62567

157 12.30326 10.79026 13.81625 9.989332 14.61718

158 12.29753 10.78415 13.81091 9.983013 14.61205

159 12.29439 10.78090 13.80789 9.979699 14.60909

160 12.29267 10.77914 13.80621 9.977927 14.60742

161 12.29173 10.77819 13.80527 9.976969 14.60649autoplot(forecast(mod0c))

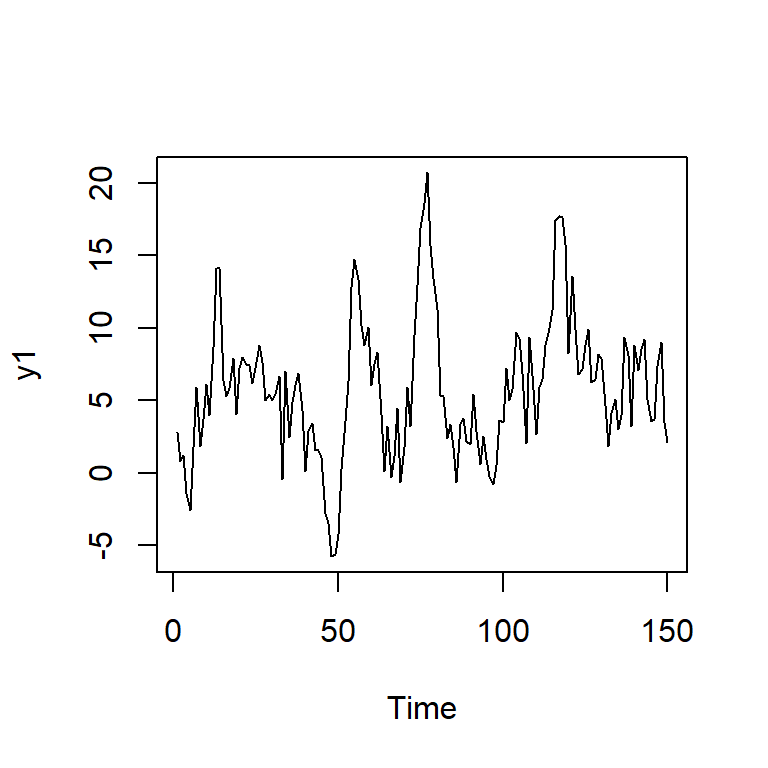

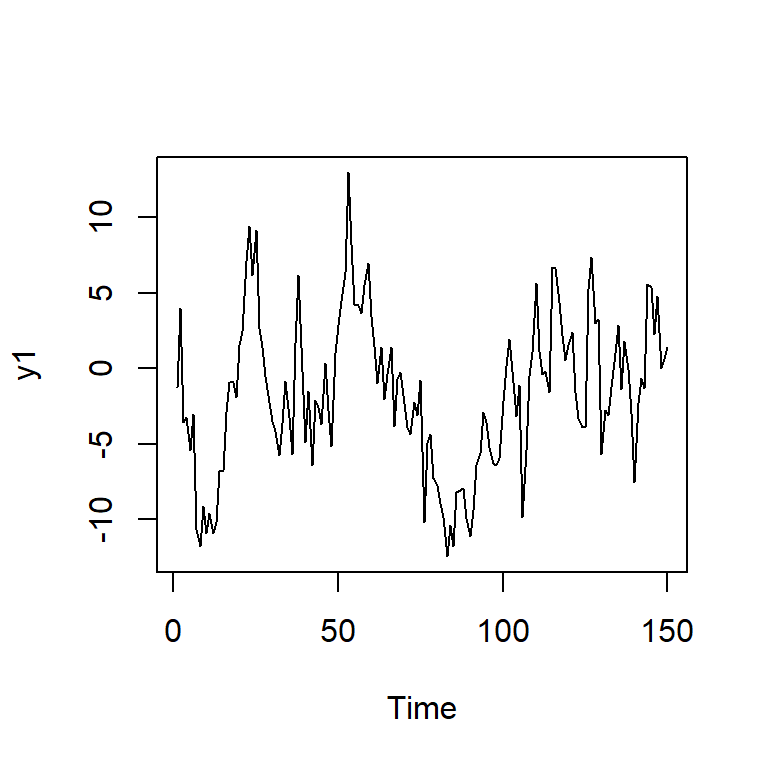

2.9 Simulación con arima.sim

#AR(1)

m<-5 #la media del proceso

y1 <- arima.sim(n = 150, model = list(order = c(1,0,0),ar = c(0.8)),sd=3,rand.gen= rnorm) + m

ts.plot(y1)

acf2(y1)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.79 0.63 0.51 0.33 0.15 0.00 -0.09 -0.17 -0.22 -0.22 -0.20 -0.16 -0.11

PACF 0.79 0.00 0.03 -0.23 -0.14 -0.13 0.08 -0.06 0.02 -0.01 0.04 0.00 0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23]

ACF -0.07 -0.08 -0.05 0.00 -0.01 -0.04 -0.01 0.00 -0.02 -0.05

PACF -0.07 -0.13 0.06 0.09 -0.08 -0.07 0.06 0.01 -0.01 -0.09mod1<- forecast::Arima(y1, order = c(1, 0, 0))

summary(mod1)Series: y1

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.7930 5.6271

s.e. 0.0489 1.1244

sigma^2 = 8.644: log likelihood = -374.1

AIC=754.19 AICc=754.36 BIC=763.23

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.02229917 2.920453 2.377549 -30.89234 154.6729 0.9571567

ACF1

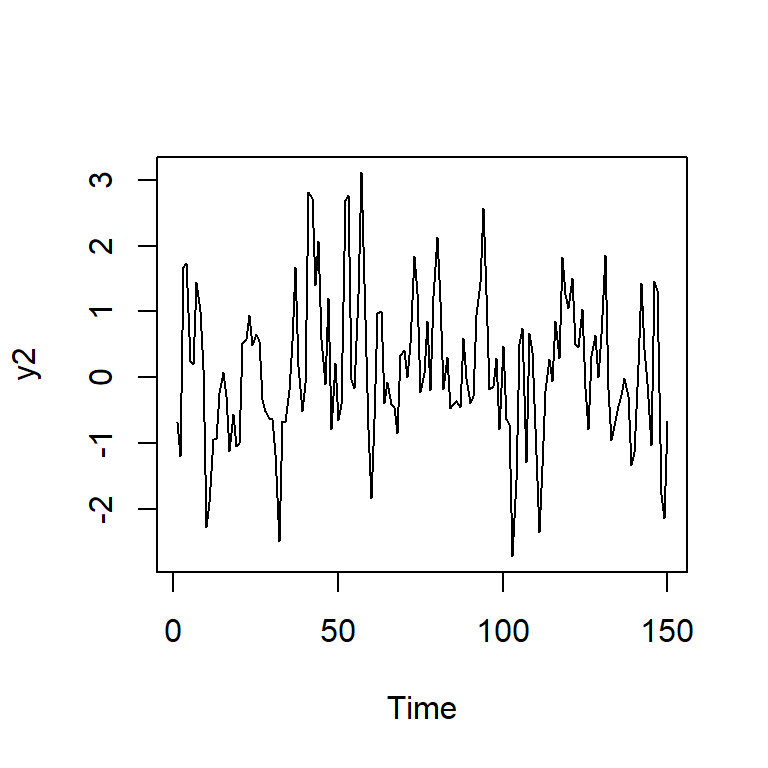

Training set -0.0014605193 Modelo AR(2)

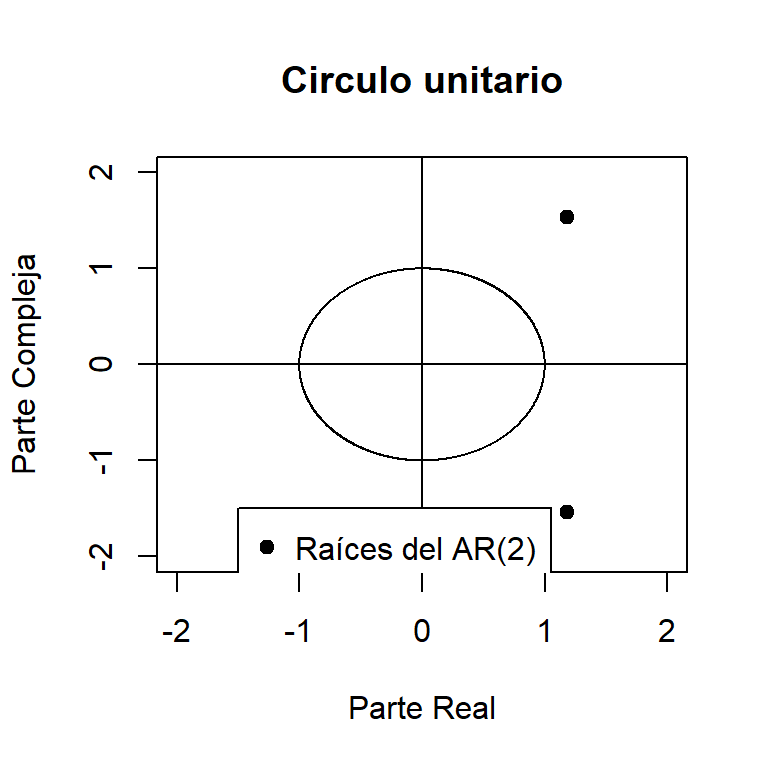

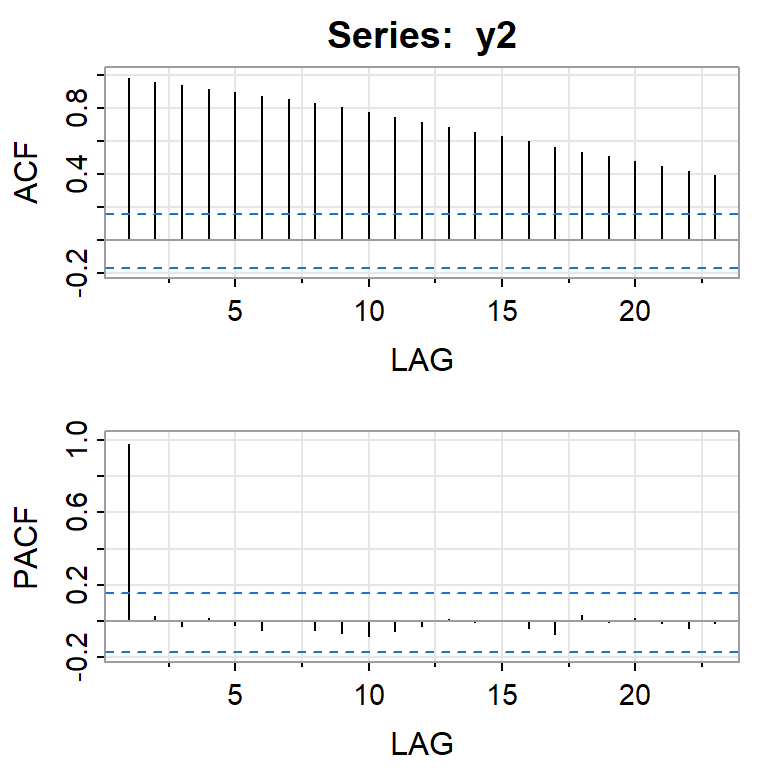

y2 <- arima.sim(n = 150, model = list(order = c(2,0,0),ar = c(0.6,-0.28)),sd=1,rand.gen= rnorm)

ts.plot(y2)

ar2.st <- arima(y2, c(2, 0, 0), include.mean=FALSE,

transform.pars=FALSE, method="ML")

ar2.st$coef ar1 ar2

0.6302657 -0.2673028 polyroot(c(1, -ar2.st$coef))[1] 1.178936+1.533358i 1.178936-1.533358iMod(polyroot(c(1, -ar2.st$coef)))[1] 1.934186 1.934186root.comp <- Im(polyroot(c(1, -ar2.st$coef)))

root.real <- Re(polyroot(c(1, -ar2.st$coef)))

# Plotting the roots in a unit circle

x <- seq(-1, 1, length = 1000)

y1 <- sqrt(1- x^2)

y2 <- -sqrt(1- x^2)

plot(c(x, x), c(y1, y2), xlab='Parte Real',

ylab='Parte Compleja', type='l',

main='Circulo unitario', ylim=c(-2, 2), xlim=c(-2, 2))

abline(h=0)

abline(v=0)

points(Re(polyroot(c(1, -ar2.st$coef))),

Im(polyroot(c(1, -ar2.st$coef))), pch=19)

legend(-1.5, -1.5, legend="Raíces del AR(2)", pch=19)

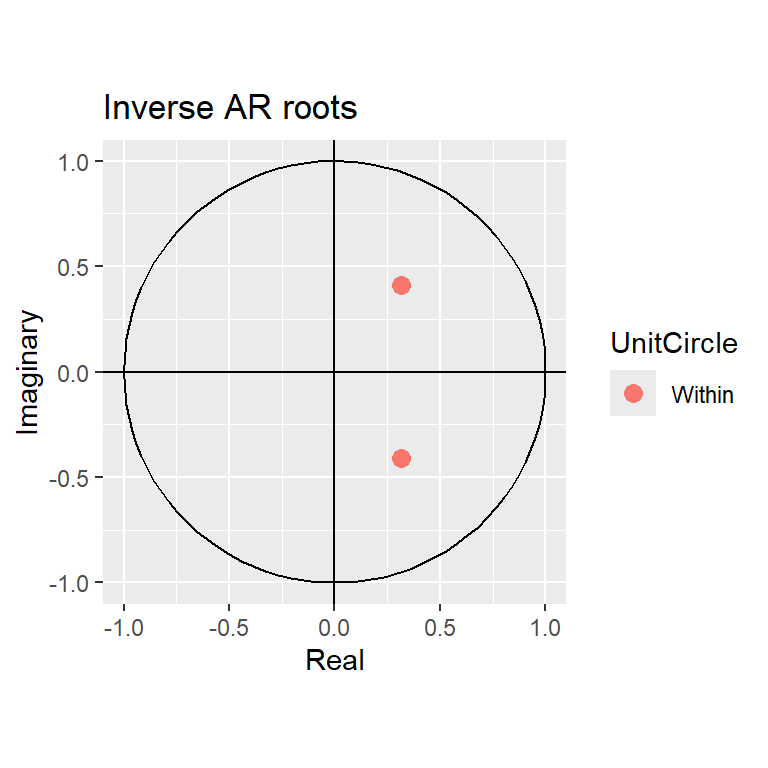

#Otra posibilidad es usar el inverso de las raíces.

autoplot(ar2.st)

4 Modelo ARMA(1,1)

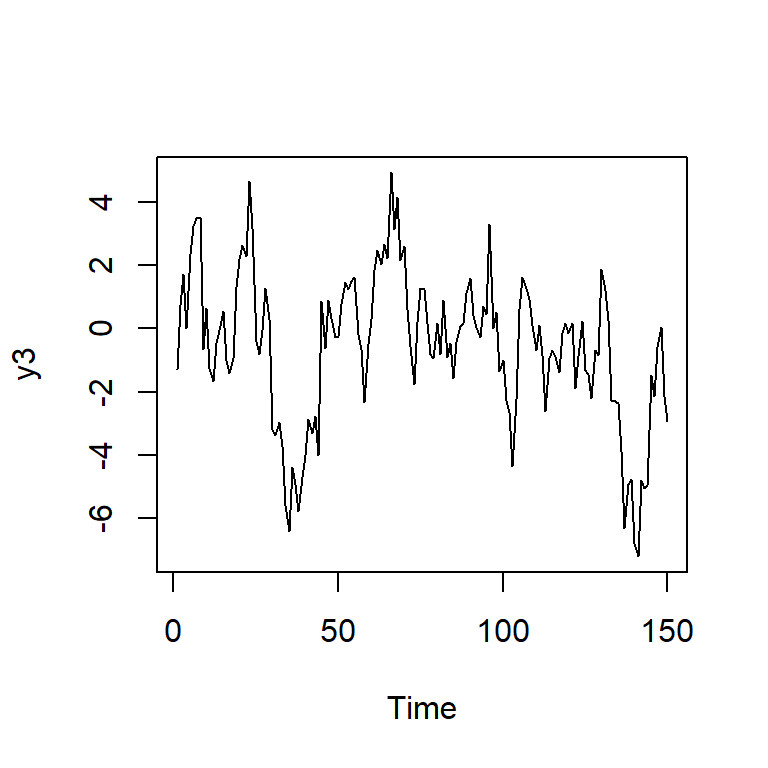

y3<-arima.sim(n = 150, list(order = c(1,0,1),ar = c(0.88), ma = c(-0.23)),

sd = sqrt(2))

ts.plot(y3)

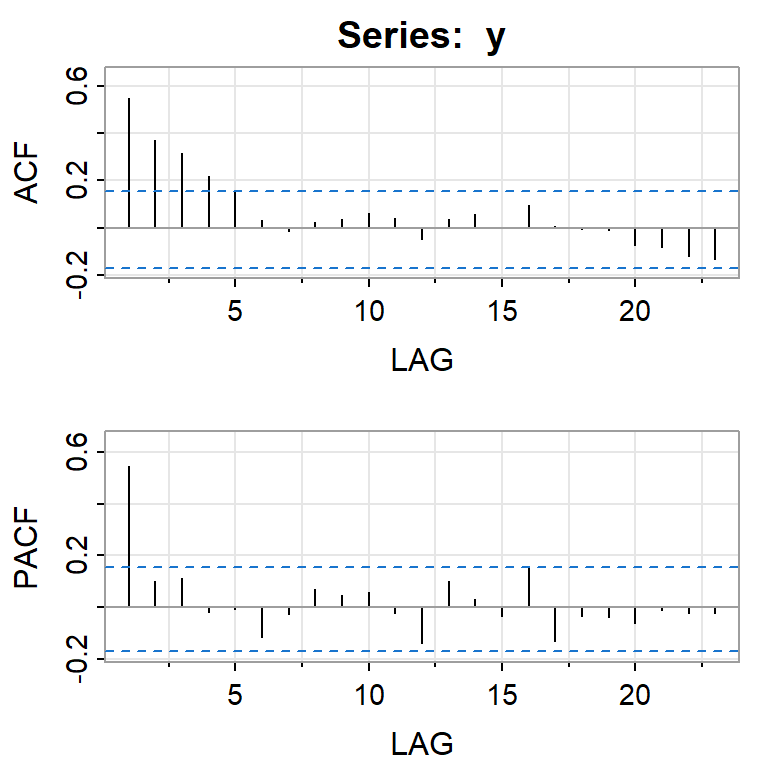

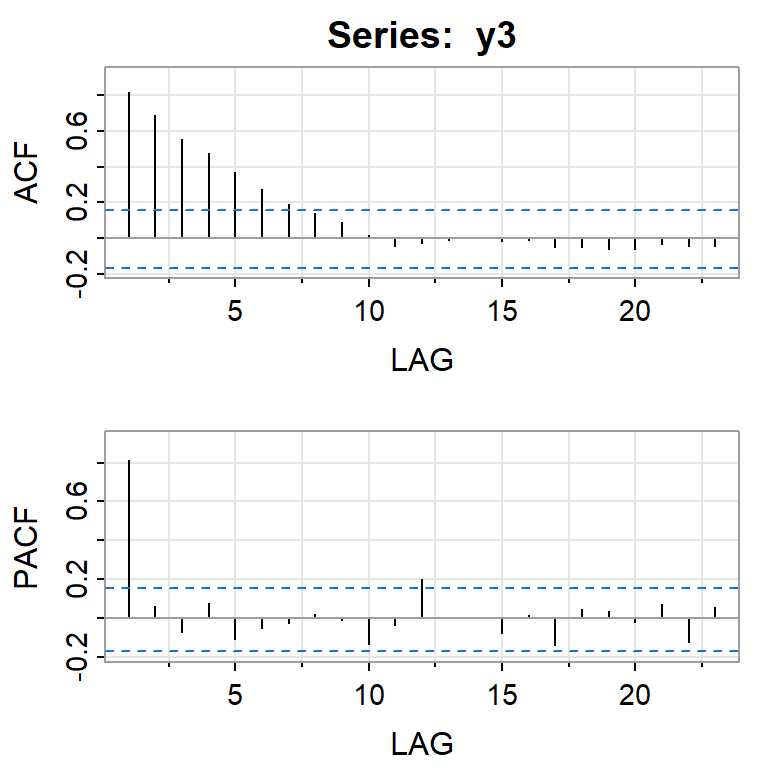

acf2(y3)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.82 0.69 0.55 0.47 0.37 0.27 0.19 0.14 0.09 0.02 -0.05 -0.03 -0.01

PACF 0.82 0.06 -0.07 0.08 -0.11 -0.05 -0.03 0.02 -0.01 -0.13 -0.04 0.20 0.01

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23]

ACF 0.01 -0.02 -0.01 -0.05 -0.05 -0.06 -0.06 -0.03 -0.05 -0.05

PACF 0.00 -0.08 0.02 -0.14 0.05 0.04 -0.02 0.07 -0.12 0.06#ARMA(1,1)

mod3<- forecast::Arima(y3, order = c(1, 0, 1))

summary(mod3)Series: y3

ARIMA(1,0,1) with non-zero mean

Coefficients:

ar1 ma1 mean

0.8357 -0.0605 -0.6783

s.e. 0.0523 0.0920 0.6173

sigma^2 = 1.899: log likelihood = -259.99

AIC=527.98 AICc=528.26 BIC=540.02

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.00444155 1.364335 1.089917 -143.1311 358.1284 0.96821

ACF1

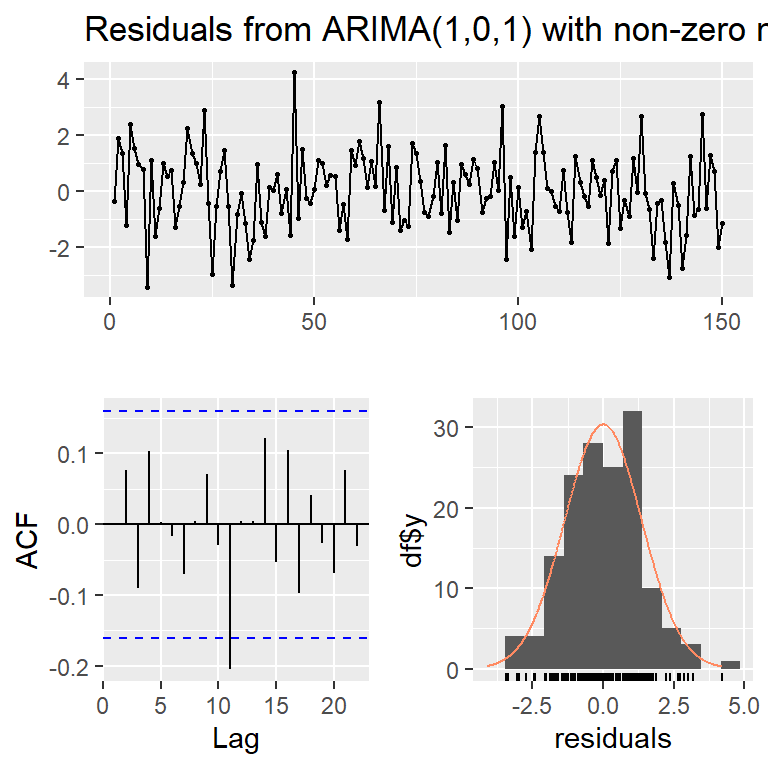

Training set 0.0003472122checkresiduals(mod3,lag=10)

Ljung-Box test

data: Residuals from ARIMA(1,0,1) with non-zero mean

Q* = 5.5925, df = 8, p-value = 0.6928

Model df: 2. Total lags used: 10#AR(1)

mod3ar1<- forecast::Arima(y3, order = c(1, 0, 0))

summary(mod3ar1)Series: y3

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.8158 -0.6744

s.e. 0.0463 0.5890

sigma^2 = 1.892: log likelihood = -260.21

AIC=526.41 AICc=526.58 BIC=535.45

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.004989702 1.366326 1.092374 -151.9529 362.4927 0.9703933

ACF1

Training set -0.04392361checkresiduals(mod3ar1,lag=10)

Ljung-Box test

data: Residuals from ARIMA(1,0,0) with non-zero mean

Q* = 6.5639, df = 9, p-value = 0.6824

Model df: 1. Total lags used: 10mod3$aic[1] 527.9802mod3ar1$aic[1] 526.41434.1 Identificación con auto.arima

#procedimiento automático (pero tener mucho cuidado!!!)

auto.arima(y3,ic="aicc") #por defectoSeries: y3

ARIMA(0,1,0)

sigma^2 = 2.06: log likelihood = -265.27

AIC=532.54 AICc=532.57 BIC=535.54auto.arima(y3,ic="aic")Series: y3

ARIMA(0,1,0)

sigma^2 = 2.06: log likelihood = -265.27

AIC=532.54 AICc=532.57 BIC=535.54auto.arima(y3,ic="bic")Series: y3

ARIMA(0,1,0)

sigma^2 = 2.06: log likelihood = -265.27

AIC=532.54 AICc=532.57 BIC=535.545 Contraste de raíz unitaria

5.1 Probamos con dos tamaño de series

TT=150

# prueben con TT=5005.2 AR(1)

y1 <- arima.sim(n = TT, model = list(order = c(1,0,0),ar = c(0.8)),sd=3,rand.gen= rnorm)

ts.plot(y1)

adf.test(y1)

Augmented Dickey-Fuller Test

data: y1

Dickey-Fuller = -2.6633, Lag order = 5, p-value = 0.3

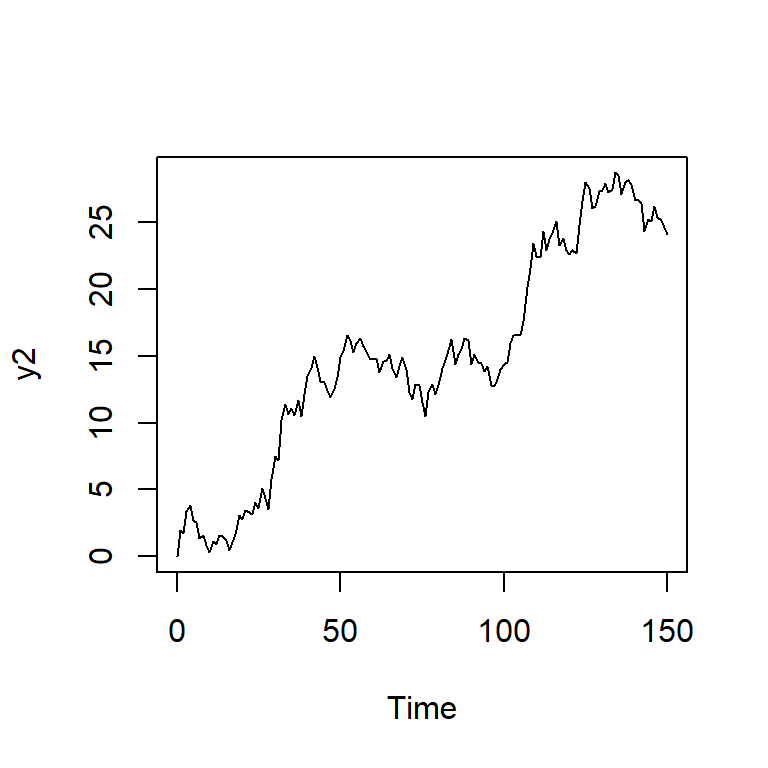

alternative hypothesis: stationary5.3 ARIMA(0,1,0)

y2 <- arima.sim(n = TT, model = list(order = c(0,1,0),sd=1,rand.gen= rnorm))

ts.plot(y2)

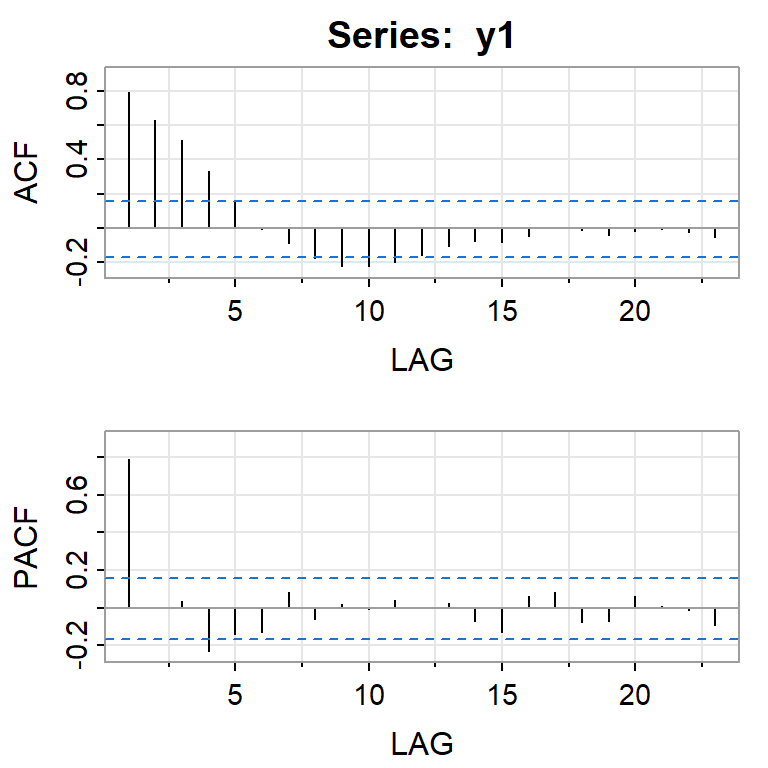

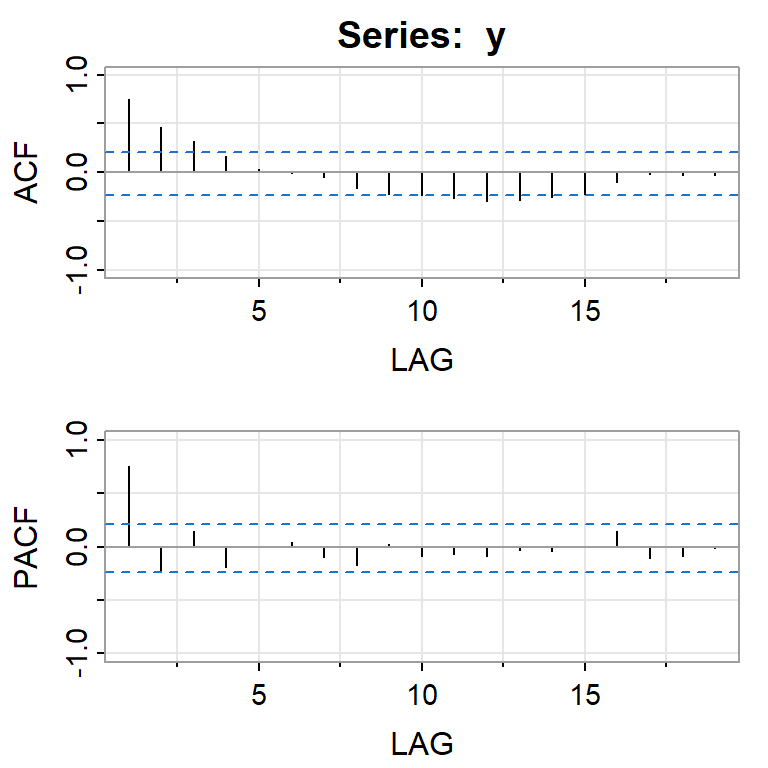

acf2(y2)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.98 0.96 0.94 0.92 0.89 0.87 0.85 0.83 0.80 0.77 0.74 0.71 0.68

PACF 0.98 0.03 -0.03 0.02 -0.02 -0.05 0.01 -0.05 -0.07 -0.08 -0.05 -0.03 0.01

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23]

ACF 0.65 0.63 0.60 0.57 0.54 0.51 0.48 0.45 0.42 0.39

PACF -0.01 0.00 -0.04 -0.07 0.03 -0.01 0.02 -0.01 -0.04 -0.01adf.test(y2)

Augmented Dickey-Fuller Test

data: y2

Dickey-Fuller = -2.1354, Lag order = 5, p-value = 0.52

alternative hypothesis: stationary6 Ejemplos reales

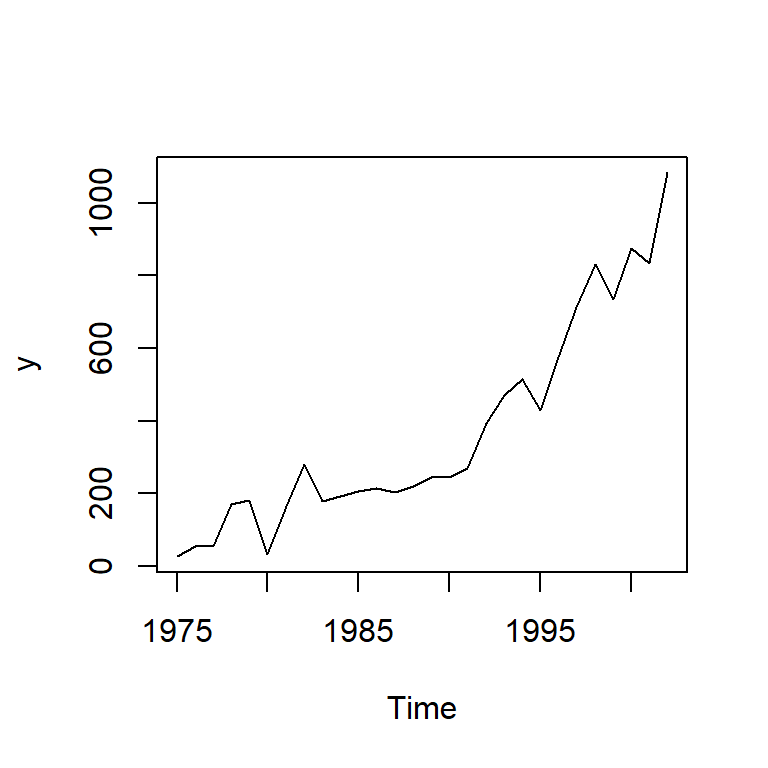

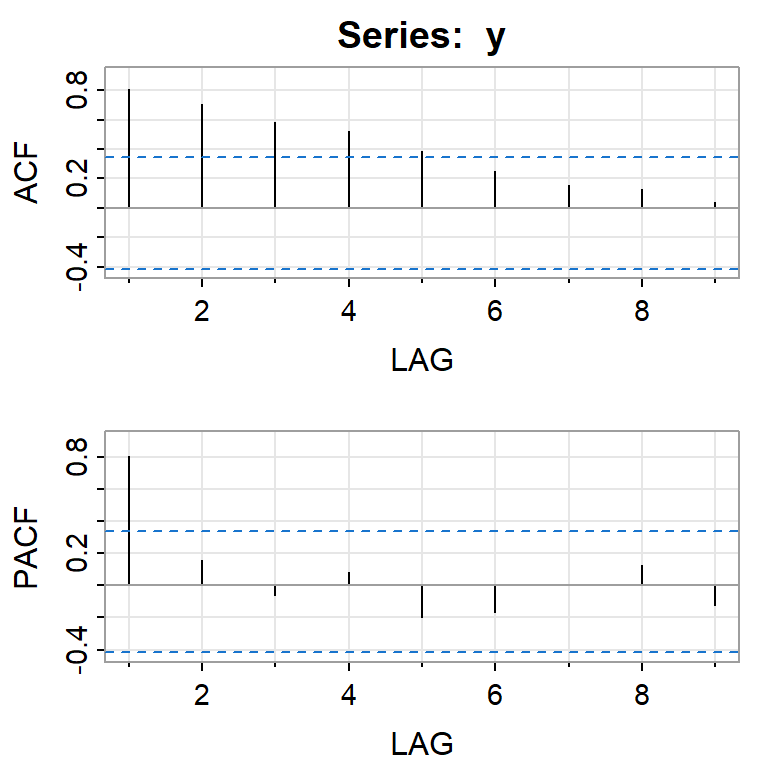

6.1 Ejemplo con graduados de ITCR de 1975 a 2002

itcrgrad<-read.csv("ITCR.csv",sep=",")

y<-ts(itcrgrad$graduados,start=1975)

ts.plot(y)

acf2(y)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9]

ACF 0.81 0.71 0.59 0.52 0.39 0.25 0.15 0.12 0.04

PACF 0.81 0.16 -0.06 0.08 -0.20 -0.17 0.01 0.13 -0.12Indicación de no estacionariedad. Como ejemplo vamos a ajustar un AR(1) ignorando la no estacionariedad. (1 rezago de f.a.c.p. significativo)

try(mod0 <- Arima(y, order=c(1,0,0)))Error in stats::arima(x = x, order = order, seasonal = seasonal, include.mean = include.mean, :

non-stationary AR part from CSStry(mod0a <- Arima(y, order=c(1,0,0),method="CSS-ML"))Error in stats::arima(x = x, order = order, seasonal = seasonal, include.mean = include.mean, :

non-stationary AR part from CSSmod0b <- Arima(y, order=c(1,0,0),method="ML")

mod0c <- Arima(y, order=c(1,0,0),method="CSS")

summary(mod0b)Series: y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

1 700.0827

s.e. 0 22667.9113

sigma^2 = 9939: log likelihood = -168.06

AIC=342.12 AICc=343.12 BIC=346.12

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

Training set 37.67579 96.06853 72.60758 -3.574074 35.35438 0.9652411 -0.2506579summary(mod0c)Series: y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

1.0535 -385.7770

s.e. 0.0647 937.6708

sigma^2 = 8159: log likelihood = -165.3

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.06042778 87.04048 66.72368 -19.4297 37.70421 0.8870208

ACF1

Training set -0.3141227adf.test(y) #no estacionarioWarning in adf.test(y): p-value greater than printed p-value

Augmented Dickey-Fuller Test

data: y

Dickey-Fuller = 0.18783, Lag order = 3, p-value = 0.99

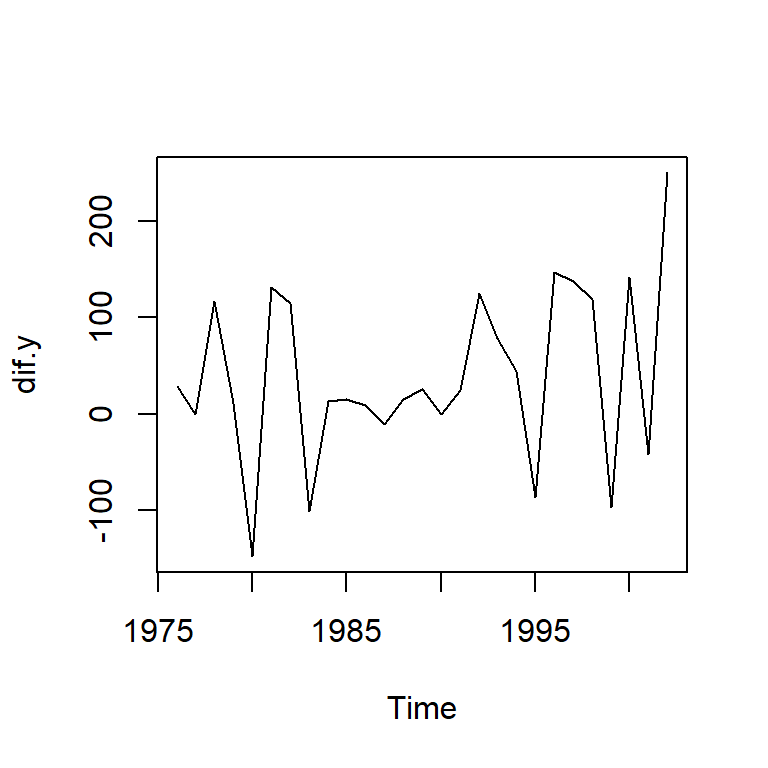

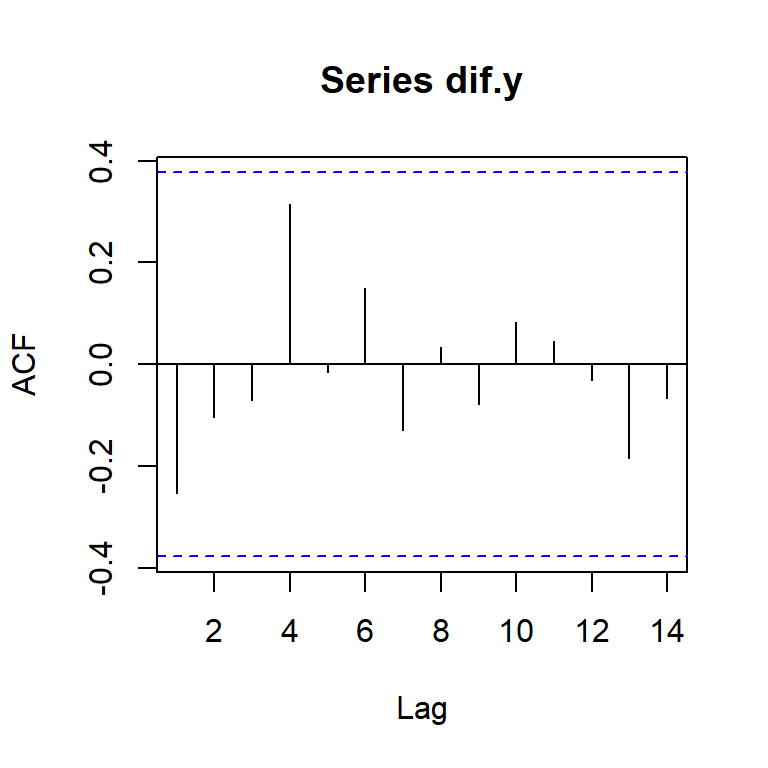

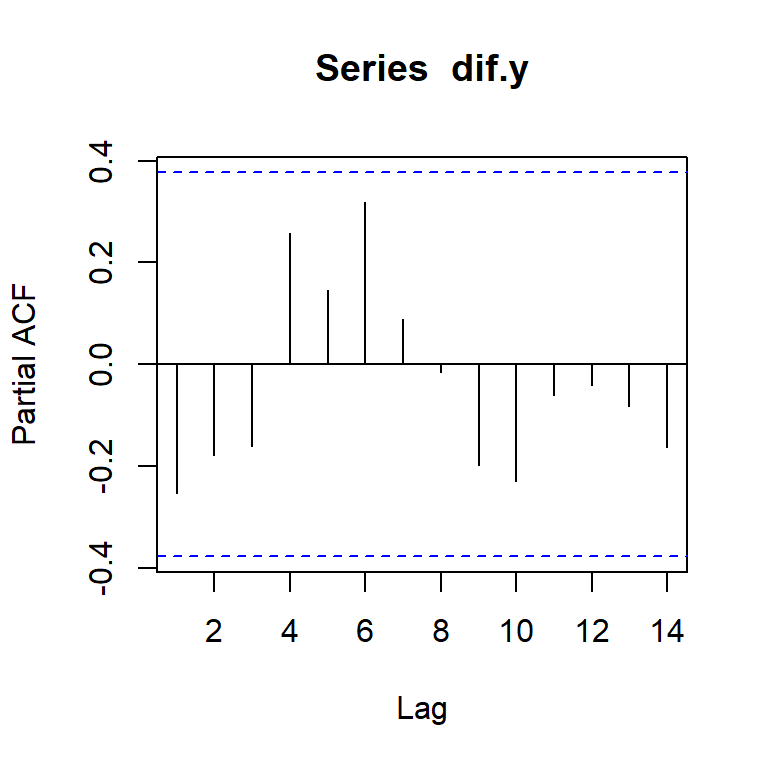

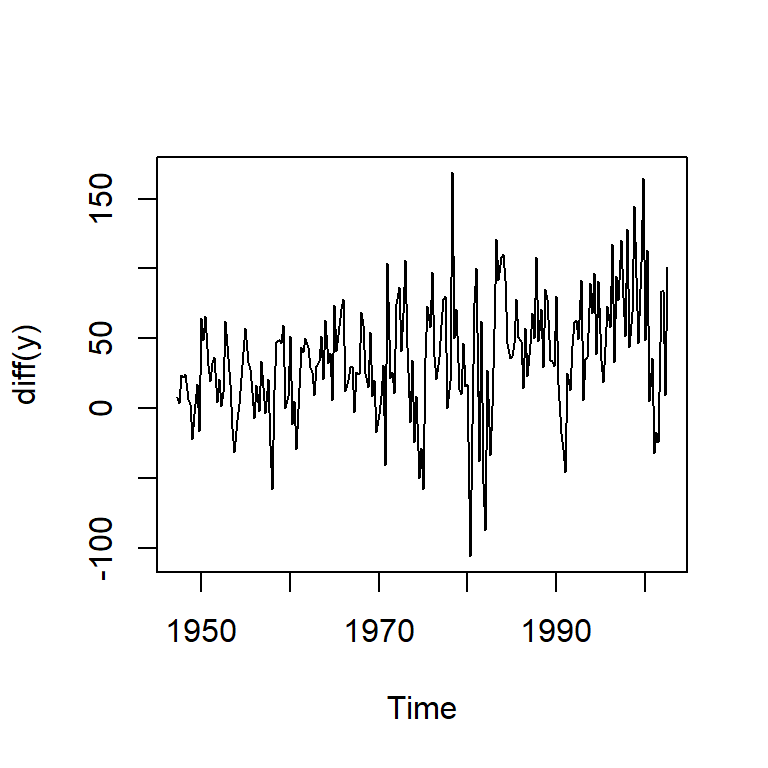

alternative hypothesis: stationarydif.y<-diff(y)

ts.plot(dif.y)

acf(dif.y)

pacf(dif.y)

adf.test(dif.y)Warning in adf.test(dif.y): p-value smaller than printed p-value

Augmented Dickey-Fuller Test

data: dif.y

Dickey-Fuller = -5.427, Lag order = 2, p-value = 0.01

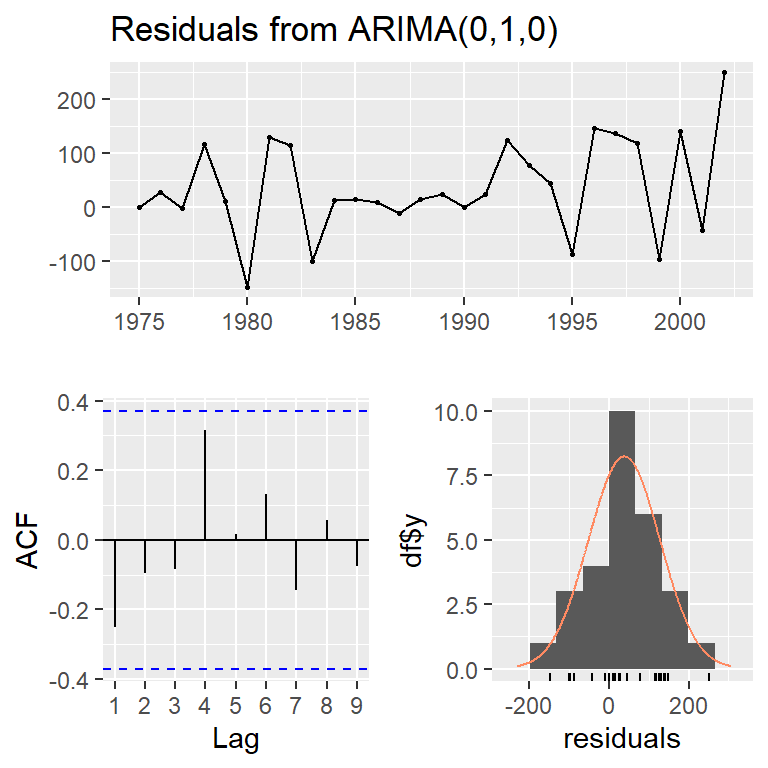

alternative hypothesis: stationarymod1 <- Arima(y, order=c(0,1,0))

summary(mod1)Series: y

ARIMA(0,1,0)

sigma^2 = 9571: log likelihood = -162.06

AIC=326.12 AICc=326.28 BIC=327.41

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

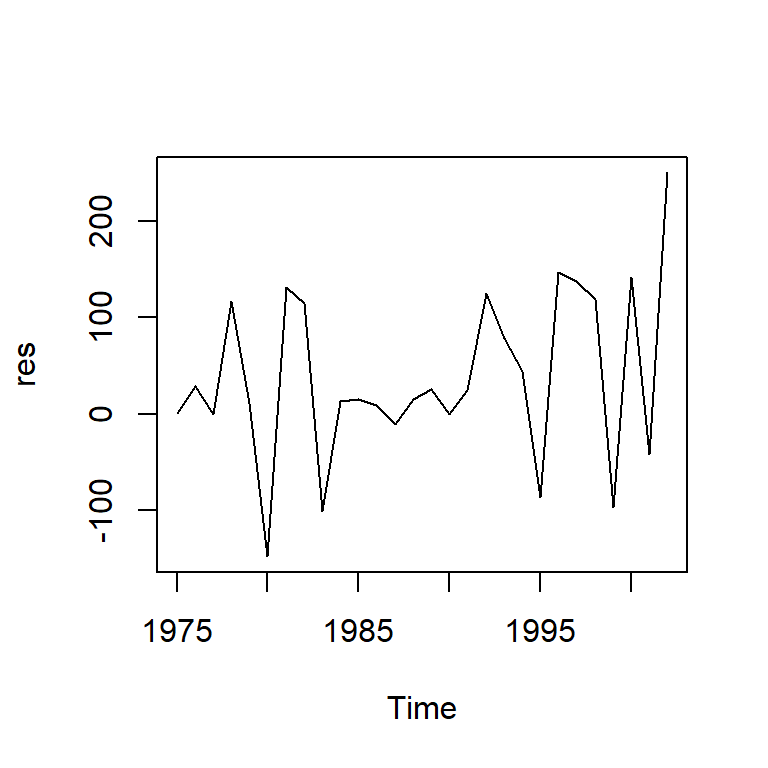

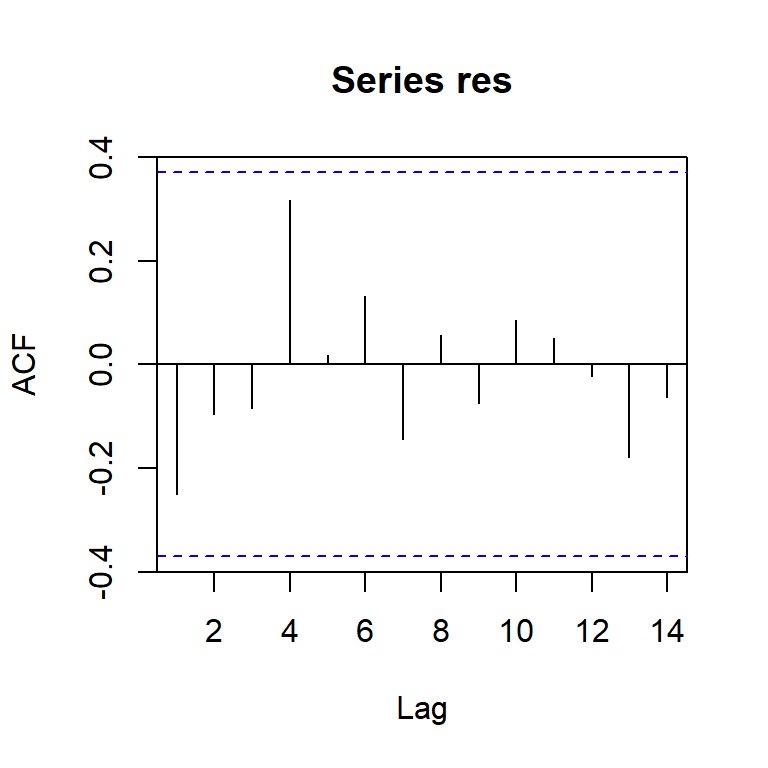

Training set 37.75096 96.06824 72.53668 -3.300231 35.08901 0.9642985 -0.25088146.1.1 Diagnóstico

res<-mod1$res

ts.plot(res)

acf(res)

pacf(res)

tsdiag(mod1)

checkresiduals(mod1,lag=10)

Ljung-Box test

data: Residuals from ARIMA(0,1,0)

Q* = 8.2233, df = 10, p-value = 0.607

Model df: 0. Total lags used: 106.1.1.1 Normalidad

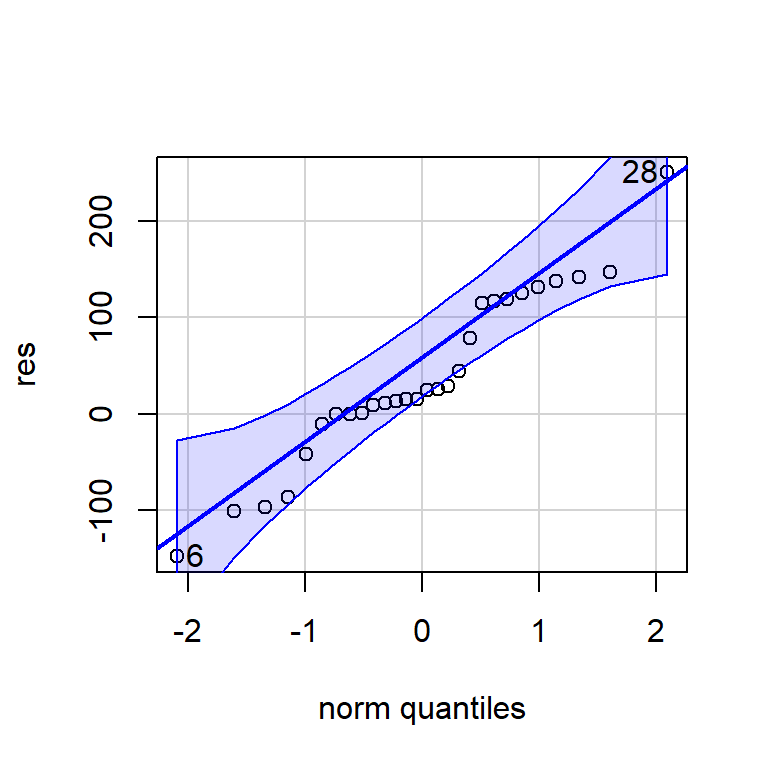

shapiro.test(res)

Shapiro-Wilk normality test

data: res

W = 0.95826, p-value = 0.3168jarque.bera.test(res)

Jarque Bera Test

data: res

X-squared = 0.067392, df = 2, p-value = 0.9669qqPlot(res)

[1] 28 66.1.1.2 Pronóstico

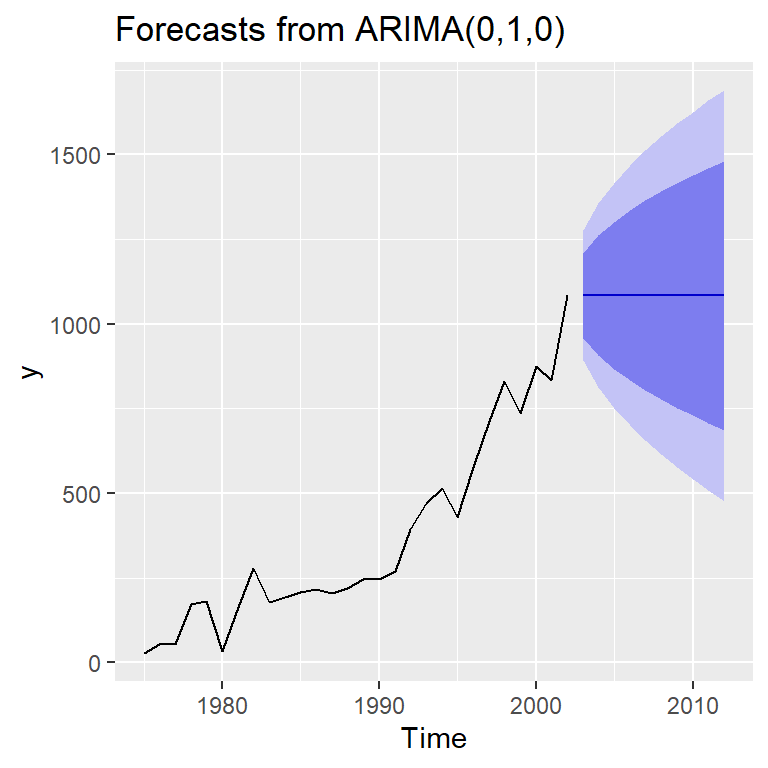

forecast(mod1) Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

2003 1084 958.6244 1209.376 892.2545 1275.745

2004 1084 906.6921 1261.308 812.8310 1355.169

2005 1084 866.8431 1301.157 751.8871 1416.113

2006 1084 833.2488 1334.751 700.5091 1467.491

2007 1084 803.6516 1364.348 655.2441 1512.756

2008 1084 776.8937 1391.106 614.3215 1553.679

2009 1084 752.2873 1415.713 576.6892 1591.311

2010 1084 729.3842 1438.616 541.6620 1626.338

2011 1084 707.8732 1460.127 508.7636 1659.236

2012 1084 687.5275 1480.472 477.6476 1690.352autoplot(forecast(mod1))

6.1.1.3 Identificación automática

auto.arima(y,ic="aicc", allowdrift = FALSE) #por defectoSeries: y

ARIMA(0,1,0)

sigma^2 = 9571: log likelihood = -162.06

AIC=326.12 AICc=326.28 BIC=327.41auto.arima(y,ic="aic", allowdrift = FALSE)Series: y

ARIMA(0,1,0)

sigma^2 = 9571: log likelihood = -162.06

AIC=326.12 AICc=326.28 BIC=327.41auto.arima(y,ic="bic", allowdrift = FALSE)Series: y

ARIMA(0,1,0)

sigma^2 = 9571: log likelihood = -162.06

AIC=326.12 AICc=326.28 BIC=327.41auto.arima(y,ic="aicc") #por defectoSeries: y

ARIMA(0,1,1) with drift

Coefficients:

ma1 drift

-0.3872 36.5960

s.e. 0.1712 10.2477

sigma^2 = 7686: log likelihood = -158.14

AIC=322.28 AICc=323.33 BIC=326.17auto.arima(y,ic="aic")Series: y

ARIMA(0,1,1) with drift

Coefficients:

ma1 drift

-0.3872 36.5960

s.e. 0.1712 10.2477

sigma^2 = 7686: log likelihood = -158.14

AIC=322.28 AICc=323.33 BIC=326.17auto.arima(y,ic="bic")Series: y

ARIMA(0,1,0) with drift

Coefficients:

drift

39.1481

s.e. 17.2545

sigma^2 = 8348: log likelihood = -159.7

AIC=323.41 AICc=323.91 BIC=326¿Qué es un modelo con desvío? \(ARIMA(0,1,0)\) se define como: \((1-B)Y_t = C + a_t\)

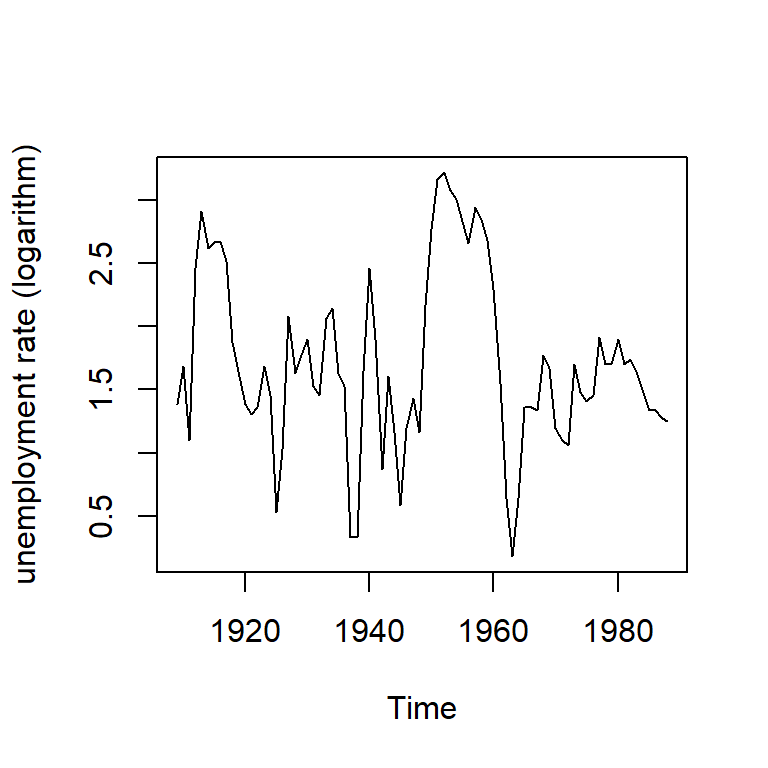

6.2 Tasa de desempleo

Ejemplo 1-3 tomado de Bernhard (2008): Tasa de desempleo

data(npext)

y <- ts(na.omit(npext$unemploy), start=1909, end=1988,

frequency=1)

plot(y, ylab="unemployment rate (logarithm)")

acf2(y,ylim=c(-1, 1))

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.75 0.46 0.32 0.17 0.04 -0.01 -0.05 -0.16 -0.22 -0.23 -0.27 -0.30 -0.28

PACF 0.75 -0.23 0.15 -0.19 0.00 0.04 -0.10 -0.17 0.03 -0.09 -0.07 -0.08 -0.03

[,14] [,15] [,16] [,17] [,18] [,19]

ACF -0.25 -0.22 -0.10 -0.01 -0.03 -0.03

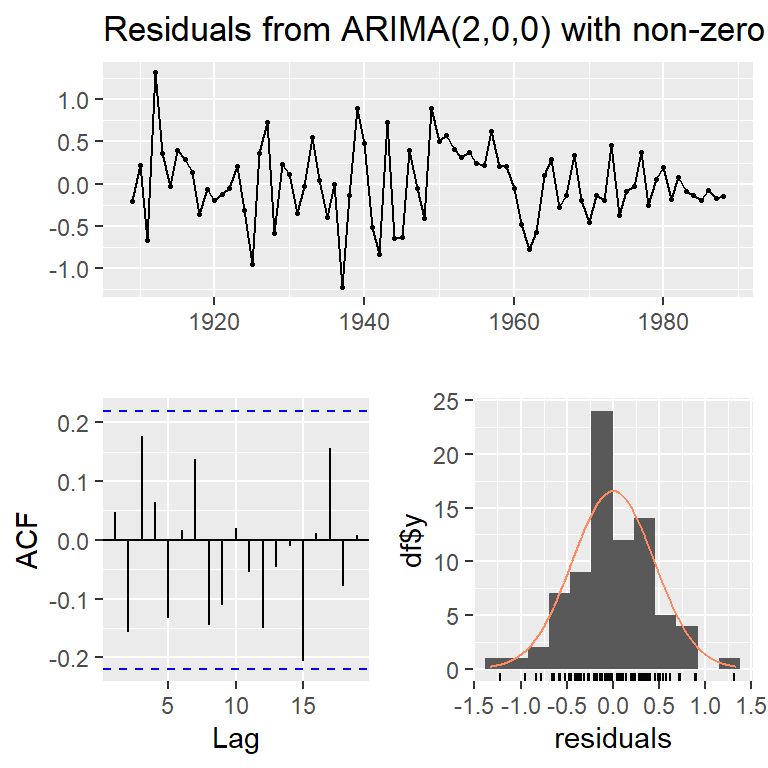

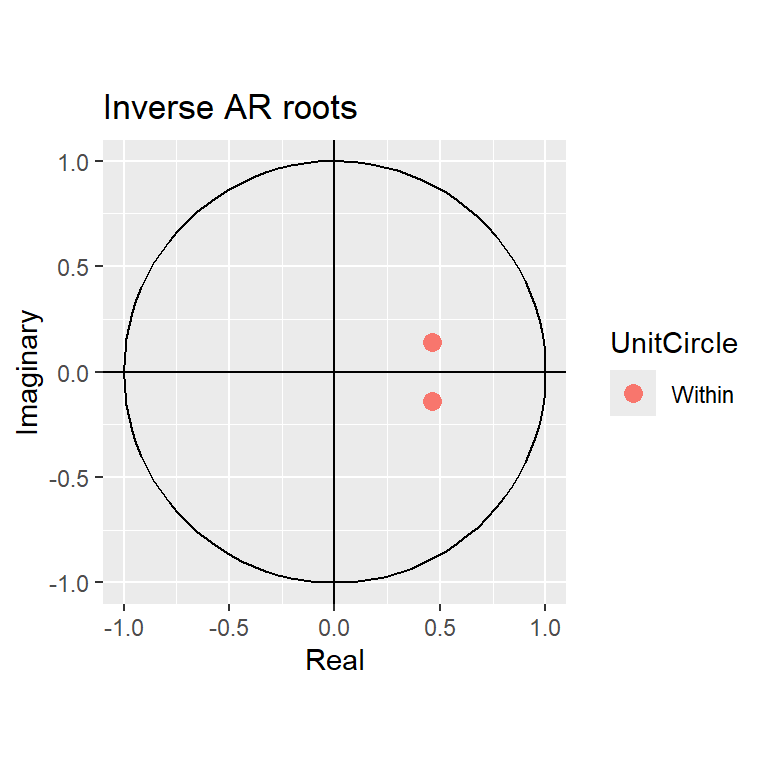

PACF -0.04 0.01 0.14 -0.10 -0.09 -0.016.2.1 ARMA(2,0)

arma20 <- Arima(y, order=c(2, 0, 0))

summary(arma20)Series: y

ARIMA(2,0,0) with non-zero mean

Coefficients:

ar1 ar2 mean

0.9297 -0.2356 1.6988

s.e. 0.1079 0.1077 0.1586

sigma^2 = 0.2026: log likelihood = -48.59

AIC=105.18 AICc=105.71 BIC=114.71

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.003310401 0.4415365 0.3455724 -14.36729 31.38812 0.9642293

ACF1

Training set 0.046519876.2.1.1 Log-verosimilitud

#AIC

loglik <- arma20$loglik

(aic<- -2*loglik+2*(2+1+1))[1] 105.1803arma20$aic[1] 105.1803#AICC

TT <- length(y)

(aicc <- aic+(2*(2+1+1)*(2+1+2))/(TT-2-1-2))[1] 105.7136arma20$aicc[1] 105.7136#BIC

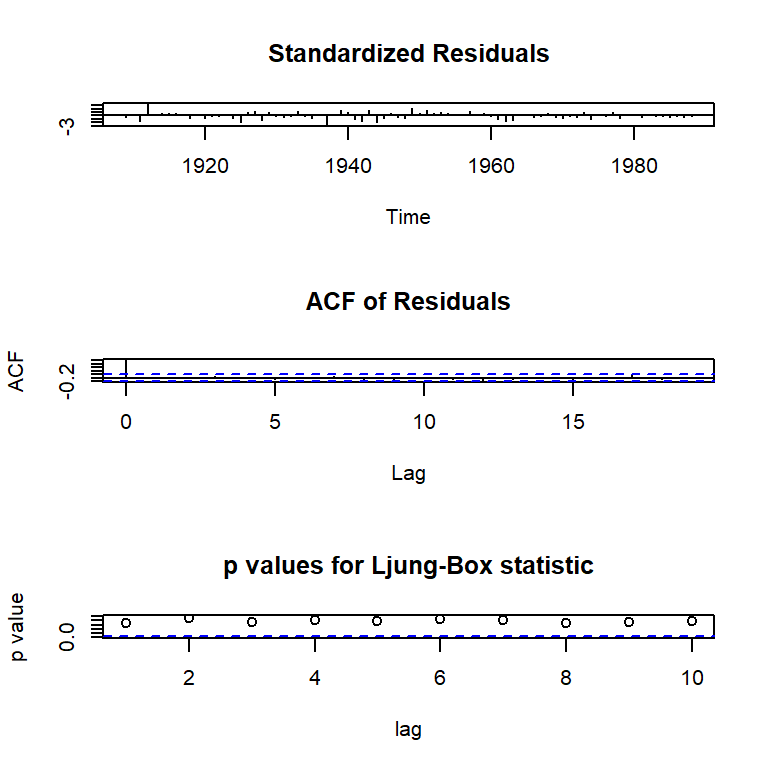

(bic <- aic+(log(TT)-2)*(2+1+1))[1] 114.7084arma20$bic[1] 114.70846.2.1.2 Diagnóstico

res20 <- residuals(arma20)

tsdiag(arma20)

checkresiduals(arma20)

Ljung-Box test

data: Residuals from ARIMA(2,0,0) with non-zero mean

Q* = 11.648, df = 8, p-value = 0.1676

Model df: 2. Total lags used: 10# Raíces del polinomio autorregresivo

arma20$coef ar1 ar2 intercept

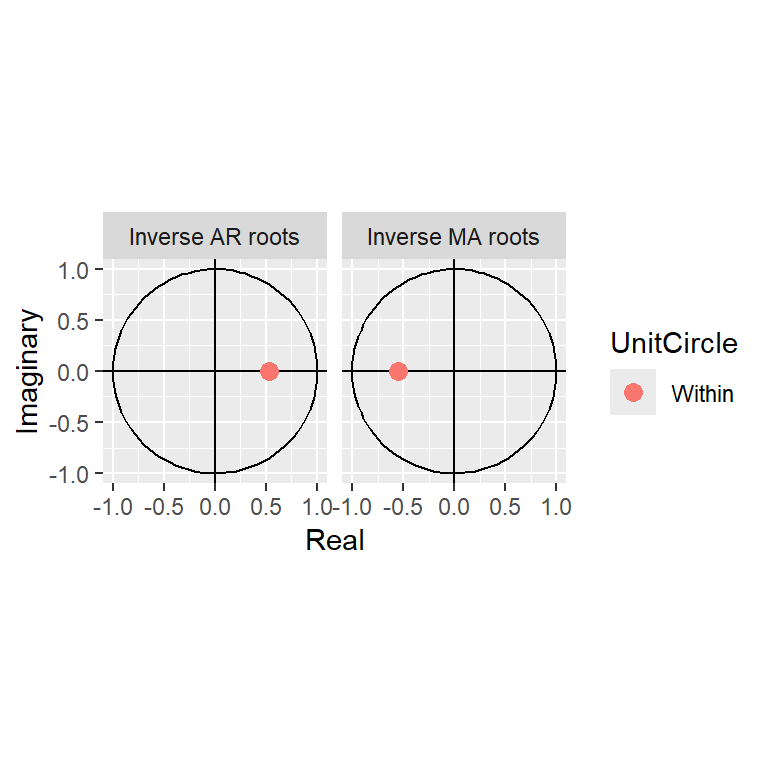

0.9296974 -0.2355995 1.6988330 autoplot(arma20)

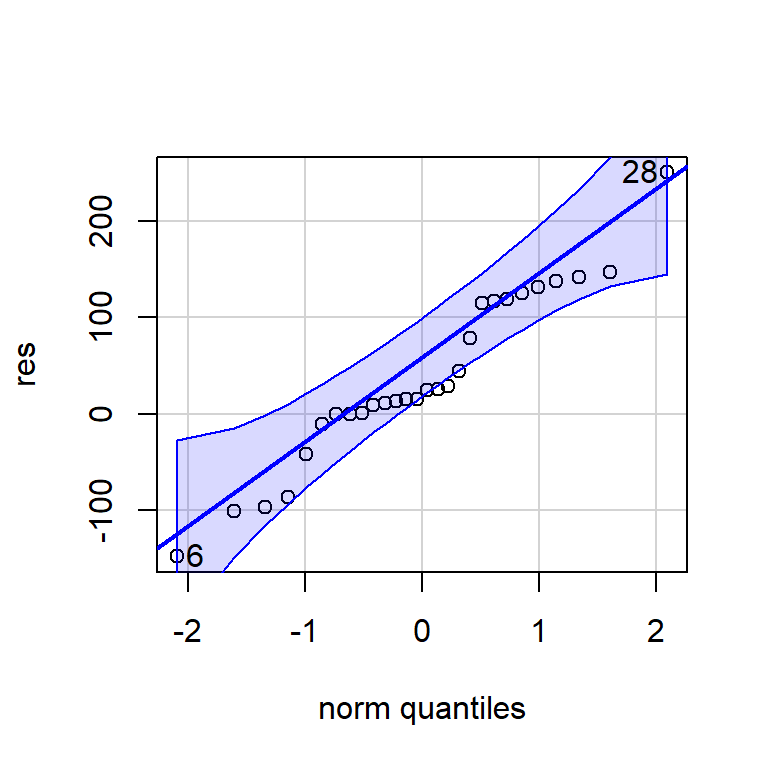

#Normalidad

shapiro.test(res20)

Shapiro-Wilk normality test

data: res20

W = 0.99313, p-value = 0.9501qqPlot(res)

[1] 28 66.2.2 ARMA(1,1)

arma11 <- Arima(y, order = c(1, 0, 1))

summary(arma11)Series: y

ARIMA(1,0,1) with non-zero mean

Coefficients:

ar1 ma1 mean

0.5272 0.5487 1.6934

s.e. 0.1221 0.1456 0.1546

sigma^2 = 0.1917: log likelihood = -46.51

AIC=101.01 AICc=101.55 BIC=110.54

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.005141342 0.4295382 0.3319403 -13.06918 29.72265 0.9261926

ACF1

Training set -0.0428558tsdiag(arma11)

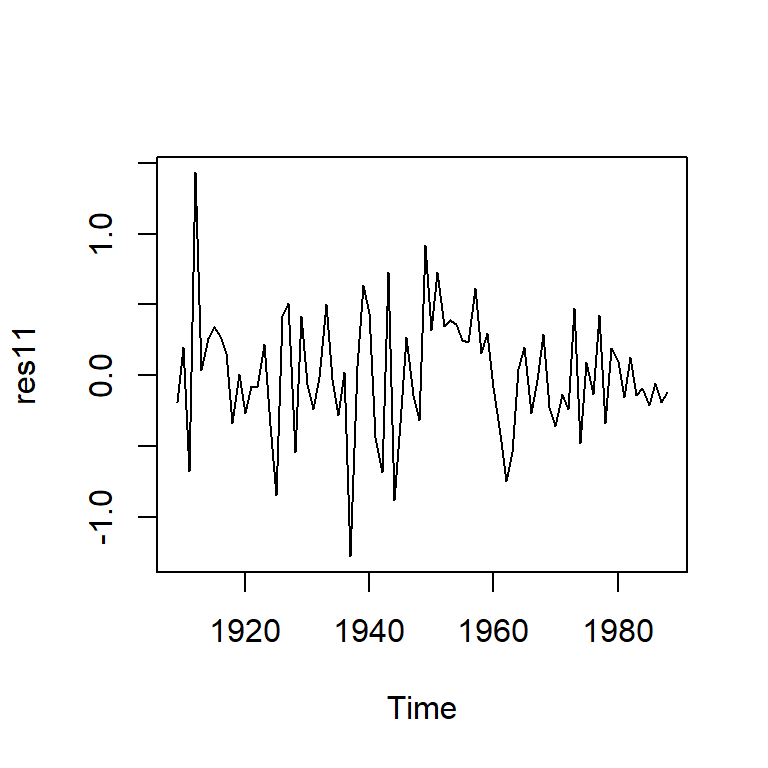

c(arma20$aic,arma20$aicc,arma20$bic)[1] 105.1803 105.7136 114.7084c(arma11$aic,arma11$aicc,arma11$bic)[1] 101.0149 101.5482 110.5430res11 <- residuals(arma11)

ts.plot(res11)

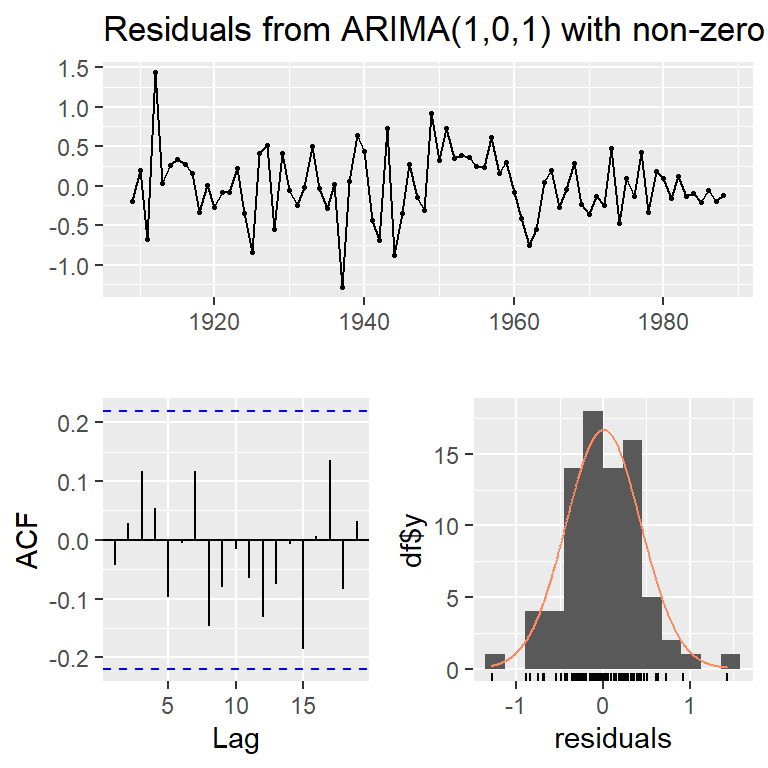

shapiro.test(res11)

Shapiro-Wilk normality test

data: res11

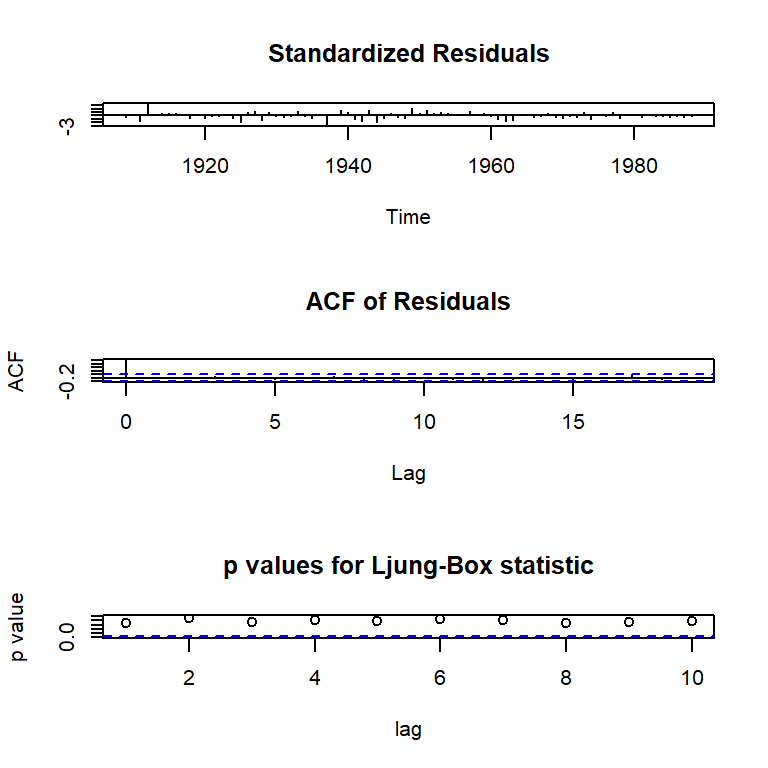

W = 0.98617, p-value = 0.5456tsdiag(arma11)

checkresiduals(arma11)

Ljung-Box test

data: Residuals from ARIMA(1,0,1) with non-zero mean

Q* = 6.2487, df = 8, p-value = 0.6194

Model df: 2. Total lags used: 10autoplot(arma11)

arma20$aic[1] 105.1803arma11$aic[1] 101.01496.2.3 auto.arima()

arma.auto<-auto.arima(y, max.p = 3, max.q = 3, start.p = 1,

start.q = 1, ic = "aic")

arma.autoSeries: y

ARIMA(1,0,1) with non-zero mean

Coefficients:

ar1 ma1 mean

0.5272 0.5487 1.6934

s.e. 0.1221 0.1456 0.1546

sigma^2 = 0.1917: log likelihood = -46.51

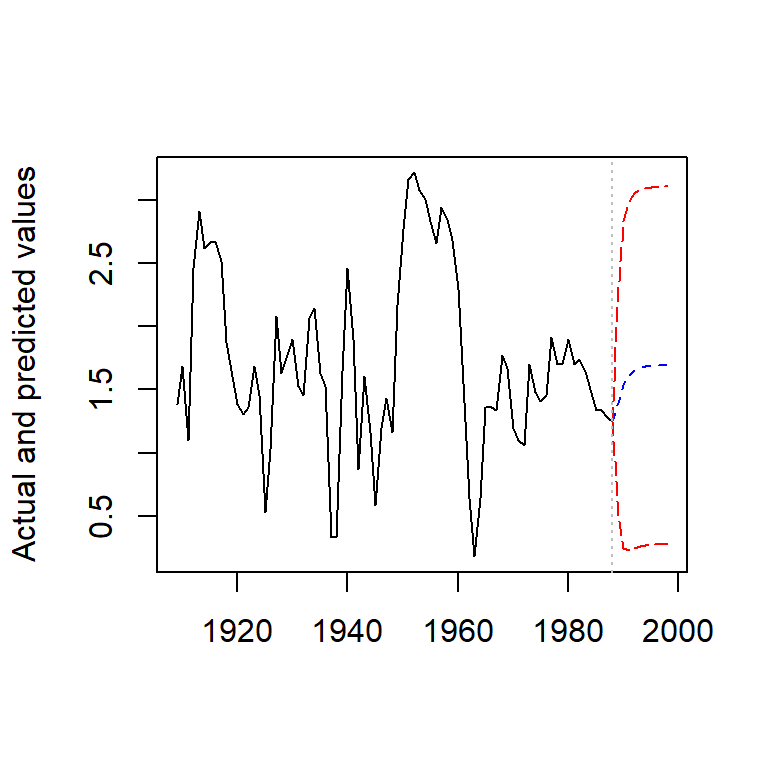

AIC=101.01 AICc=101.55 BIC=110.546.2.3.1 Pronóstico

plot(forecast(arma11))

6.2.3.2 Comprobación de cálculo del pronóstico

arma11.pred <- predict(arma11, n.ahead = 10)

predict <- ts(c(rep(NA, length(y) - 1), y[length(y)],

arma11.pred$pred), start = 1909,

frequency = 1)

upper <- ts(c(rep(NA, length(y) - 1), y[length(y)],

arma11.pred$pred + 2 * arma11.pred$se),

start = 1909, frequency = 1)

lower <- ts(c(rep(NA, length(y) - 1), y[length(y)],

arma11.pred$pred - 2 * arma11.pred$se),

start = 1909, frequency = 1)

observed <- ts(c(y, rep(NA, 10)), start=1909,

frequency = 1)

## Plot of actual and forecasted values

plot(observed, type = "l",

ylab = "Actual and predicted values", xlab = "")

lines(predict, col = "blue", lty = 2)

lines(lower, col = "red", lty = 5)

lines(upper, col = "red", lty = 5)

abline(v = 1988, col = "gray", lty = 3)

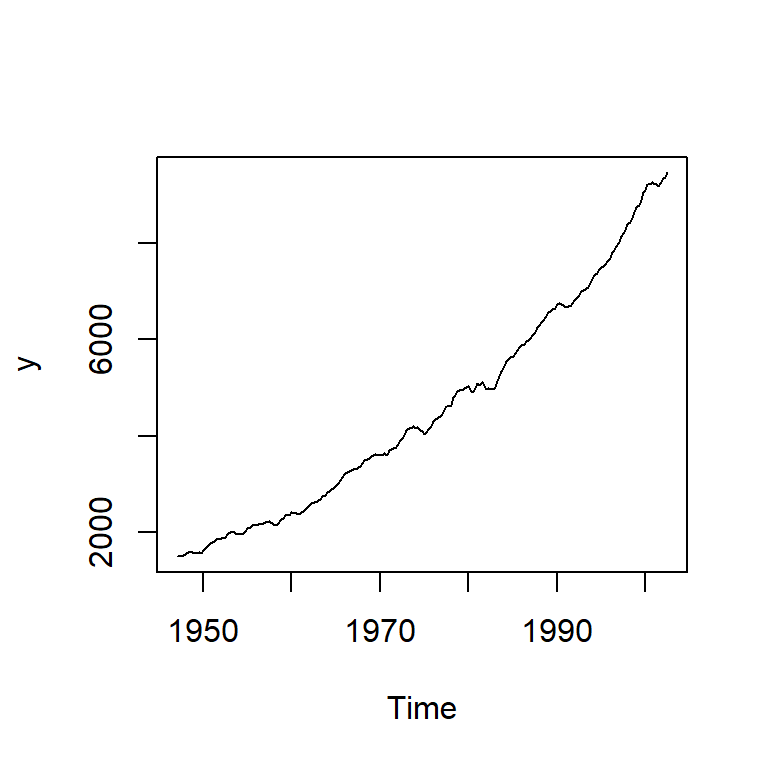

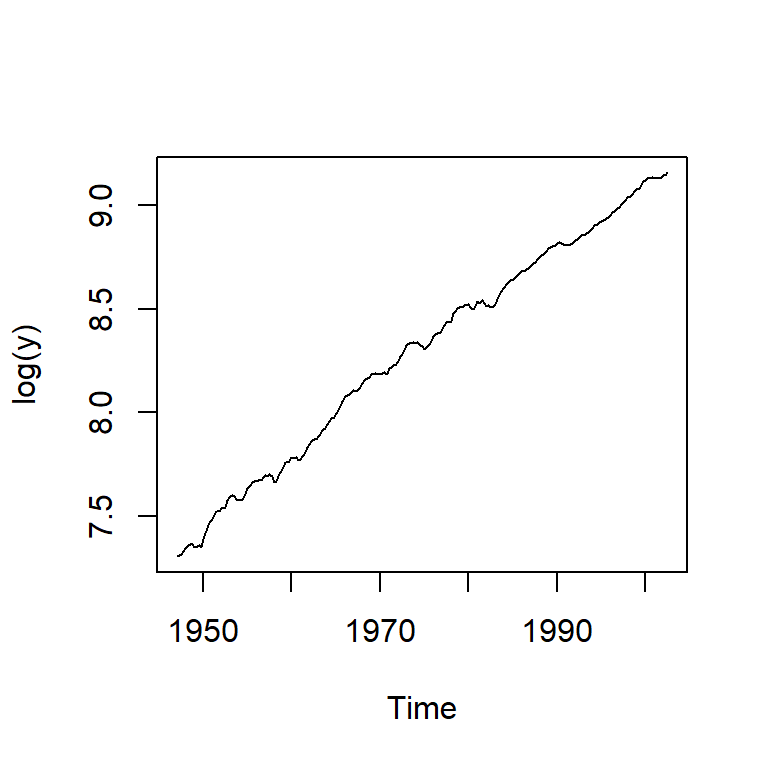

6.3 Producto nacional bruto

Producto nacional bruto, U.S. (en mil millones y son datos trimestrales de 1947 a 2002) los datos fueron ajustada estacionalmente. (Ejemplo 3.40, Shumway&Stoffer)

y<-astsa::gnp

ts.plot(y)

acf2(y, 50)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.99 0.97 0.96 0.94 0.93 0.91 0.90 0.88 0.87 0.85 0.83 0.82 0.80

PACF 0.99 0.00 -0.02 0.00 0.00 -0.02 -0.02 -0.02 -0.01 -0.02 0.00 -0.01 0.01

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF 0.79 0.77 0.76 0.74 0.73 0.72 0.7 0.69 0.68 0.66 0.65 0.64

PACF 0.00 0.00 0.00 0.01 0.00 -0.01 0.0 -0.01 -0.01 0.00 0.00 0.00

[,26] [,27] [,28] [,29] [,30] [,31] [,32] [,33] [,34] [,35] [,36] [,37]

ACF 0.62 0.61 0.60 0.59 0.57 0.56 0.55 0.54 0.52 0.51 0.5 0.49

PACF -0.01 0.00 -0.01 -0.01 -0.01 -0.01 -0.01 0.00 -0.01 0.00 0.0 0.00

[,38] [,39] [,40] [,41] [,42] [,43] [,44] [,45] [,46] [,47] [,48] [,49]

ACF 0.48 0.47 0.45 0.44 0.43 0.42 0.41 0.40 0.38 0.37 0.36 0.35

PACF -0.01 -0.01 -0.01 0.00 -0.01 -0.01 -0.01 -0.01 -0.01 -0.01 -0.02 -0.02

[,50]

ACF 0.33

PACF -0.016.3.1 Contraste de Dickey-Fuller

adf.test(y)Warning in adf.test(y): p-value greater than printed p-value

Augmented Dickey-Fuller Test

data: y

Dickey-Fuller = -0.29497, Lag order = 6, p-value = 0.99

alternative hypothesis: stationaryts.plot(diff(y))

ts.plot(log(y))

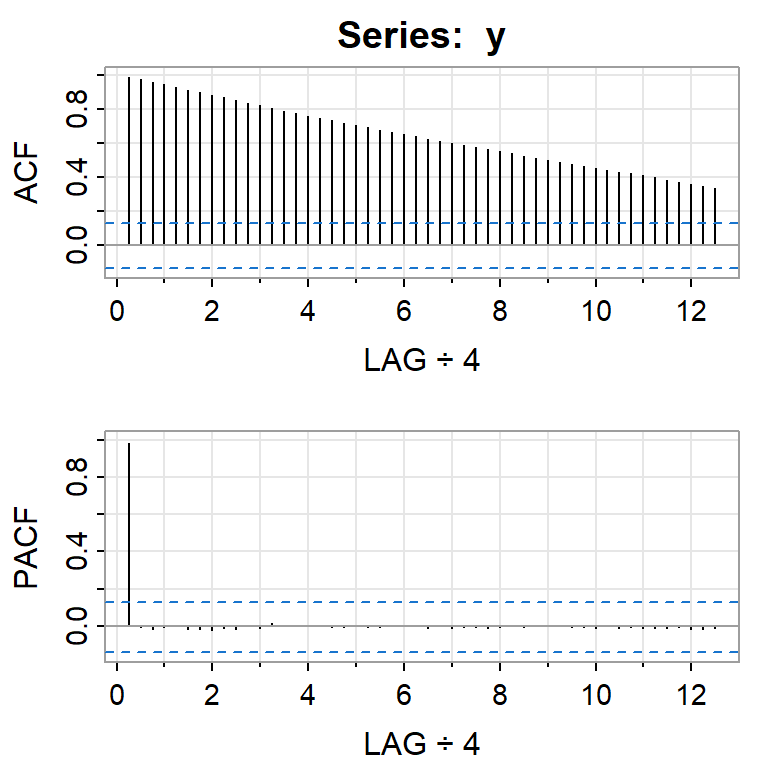

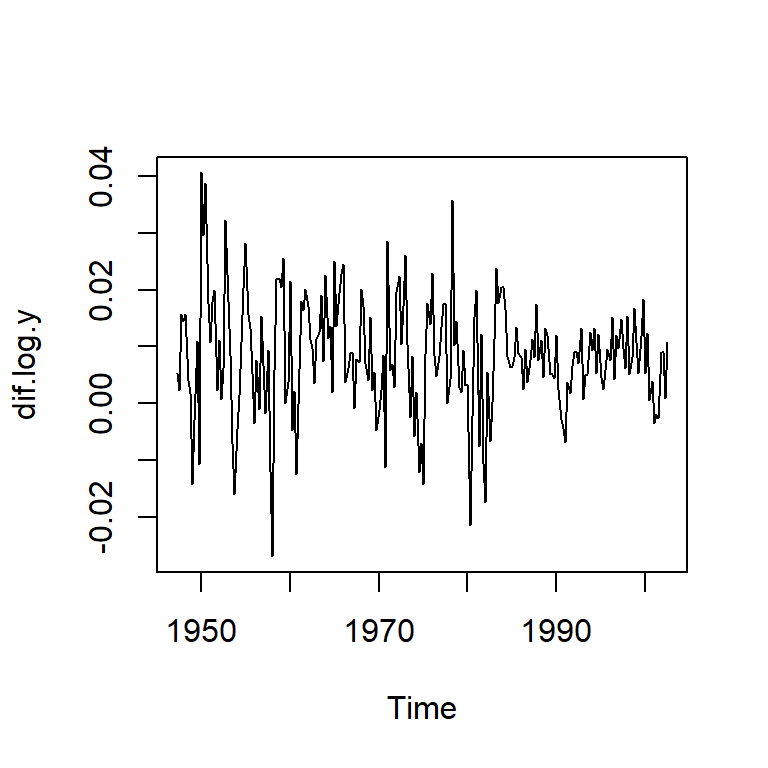

dif.log.y = diff(log(y)) # taza de crecimiento

plot(dif.log.y)

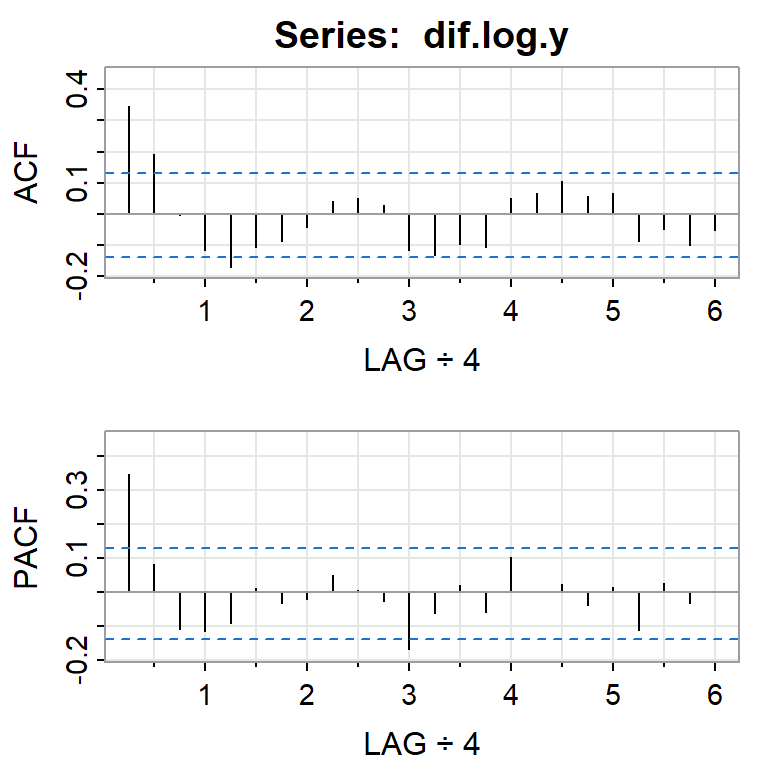

acf2(dif.log.y, 24)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.35 0.19 -0.01 -0.12 -0.17 -0.11 -0.09 -0.04 0.04 0.05 0.03 -0.12 -0.13

PACF 0.35 0.08 -0.11 -0.12 -0.09 0.01 -0.03 -0.02 0.05 0.01 -0.03 -0.17 -0.06

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24]

ACF -0.10 -0.11 0.05 0.07 0.10 0.06 0.07 -0.09 -0.05 -0.10 -0.05

PACF 0.02 -0.06 0.10 0.00 0.02 -0.04 0.01 -0.11 0.03 -0.03 0.00adf.test(dif.log.y)Warning in adf.test(dif.log.y): p-value smaller than printed p-value

Augmented Dickey-Fuller Test

data: dif.log.y

Dickey-Fuller = -6.1756, Lag order = 6, p-value = 0.01

alternative hypothesis: stationary6.3.2 Identificación de modelos

#AR(1)

moda<-Arima(dif.log.y, order=c(1,0,0))

summary(moda)Series: dif.log.y

ARIMA(1,0,0) with non-zero mean

Coefficients:

ar1 mean

0.3467 0.0083

s.e. 0.0627 0.0010

sigma^2 = 9.112e-05: log likelihood = 718.61

AIC=-1431.22 AICc=-1431.11 BIC=-1421.01

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 5.572162e-06 0.009502405 0.00713417 -Inf Inf 0.6207883

ACF1

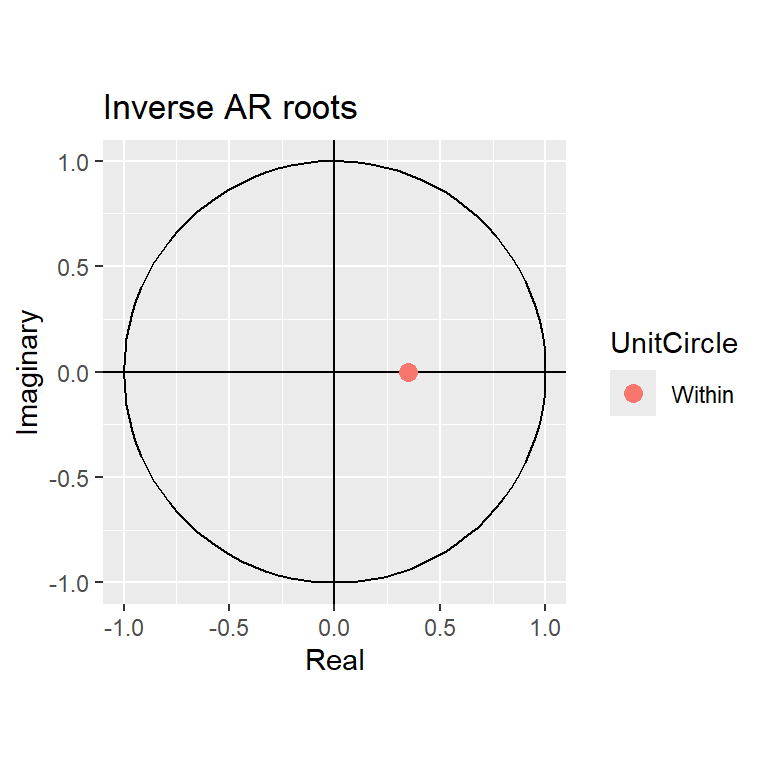

Training set -0.02706632autoplot(moda)

#MA(2)

modb<-Arima(dif.log.y, order=c(0,0,2))

summary(modb)Series: dif.log.y

ARIMA(0,0,2) with non-zero mean

Coefficients:

ma1 ma2 mean

0.3028 0.2035 0.0083

s.e. 0.0654 0.0644 0.0010

sigma^2 = 9.041e-05: log likelihood = 719.96

AIC=-1431.93 AICc=-1431.75 BIC=-1418.32

Training set error measures:

ME RMSE MAE MPE MAPE MASE ACF1

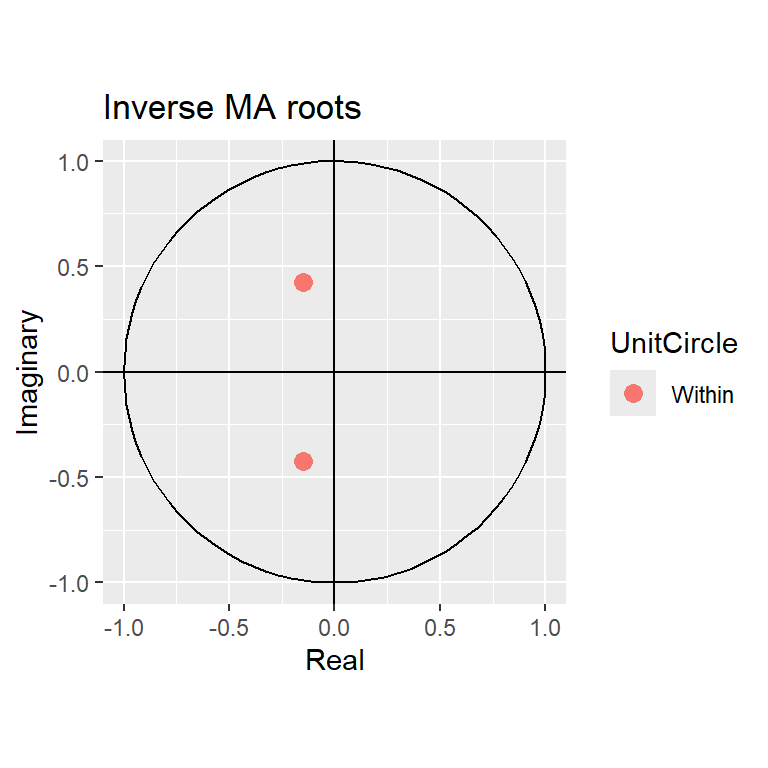

Training set 9.940243e-06 0.00944414 0.007108452 -Inf Inf 0.6185504 0.01725908autoplot(modb)

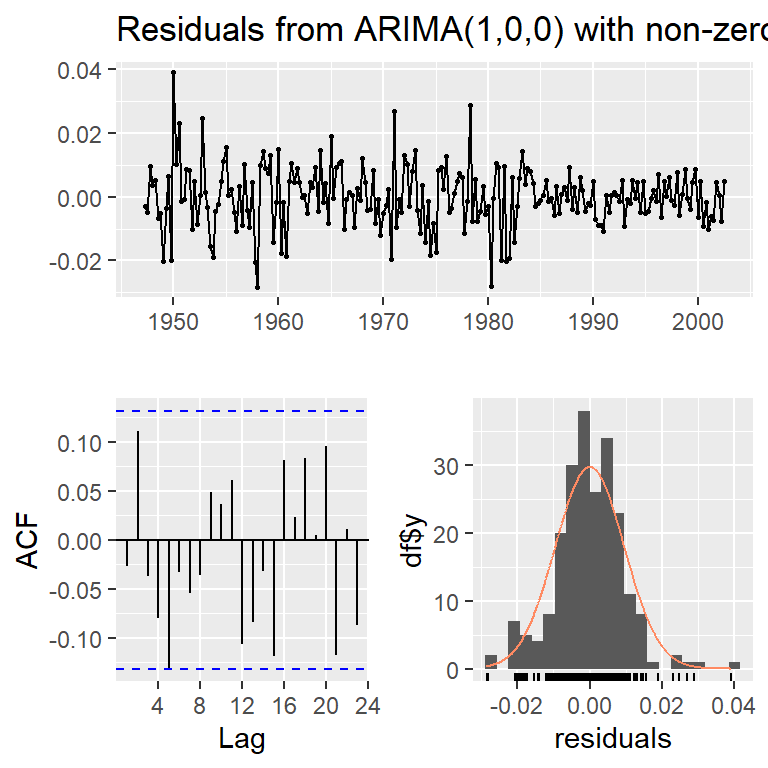

checkresiduals(moda)

Ljung-Box test

data: Residuals from ARIMA(1,0,0) with non-zero mean

Q* = 9.8979, df = 7, p-value = 0.1944

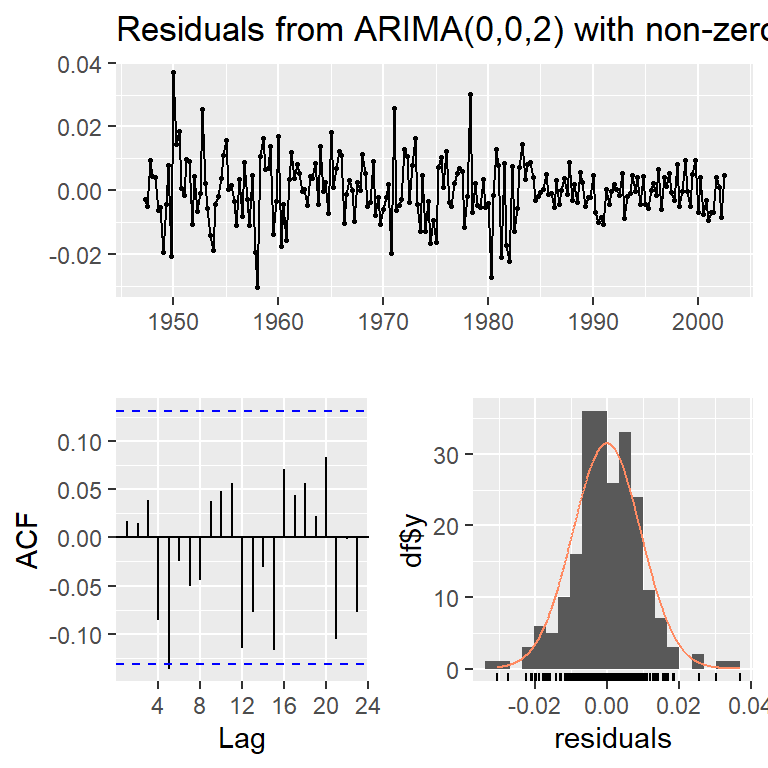

Model df: 1. Total lags used: 8checkresiduals(modb)

Ljung-Box test

data: Residuals from ARIMA(0,0,2) with non-zero mean

Q* = 7.6054, df = 6, p-value = 0.2685

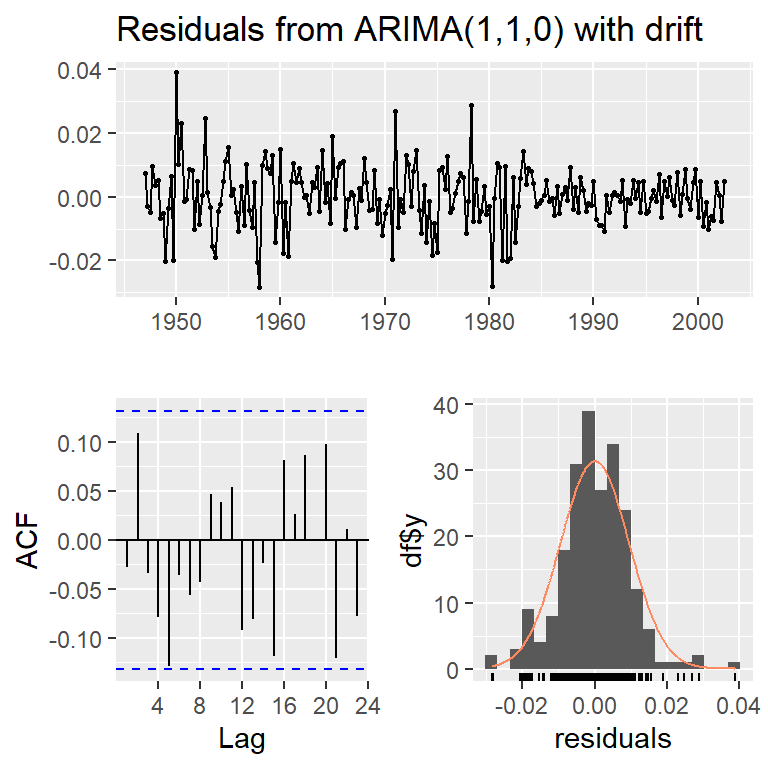

Model df: 2. Total lags used: 8c(moda$aic,moda$aicc,moda$bic)[1] -1431.221 -1431.111 -1421.013c(modb$aic,modb$aicc,modb$bic)[1] -1431.929 -1431.745 -1418.319modc<-Arima(log(y),order=c(1,1,0),include.drift=TRUE)

summary(modc)Series: log(y)

ARIMA(1,1,0) with drift

Coefficients:

ar1 drift

0.3467 0.0083

s.e. 0.0627 0.0010

sigma^2 = 9.136e-05: log likelihood = 718.61

AIC=-1431.22 AICc=-1431.11 BIC=-1421.01

Training set error measures:

ME RMSE MAE MPE MAPE

Training set 3.827644e-05 0.009493664 0.007134913 0.0009659935 0.08772583

MASE ACF1

Training set 0.1928199 -0.02800154modd<-Arima(y,order=c(1,1,0),include.drift=TRUE,lambda=0)

summary(modd)Series: y

ARIMA(1,1,0) with drift

Box Cox transformation: lambda= 0

Coefficients:

ar1 drift

0.3467 0.0083

s.e. 0.0627 0.0010

sigma^2 = 9.136e-05: log likelihood = 718.61

AIC=-1431.22 AICc=-1431.11 BIC=-1421.01

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -1.361224 37.96823 28.76763 -0.0006770822 0.7134792 0.1831012

ACF1

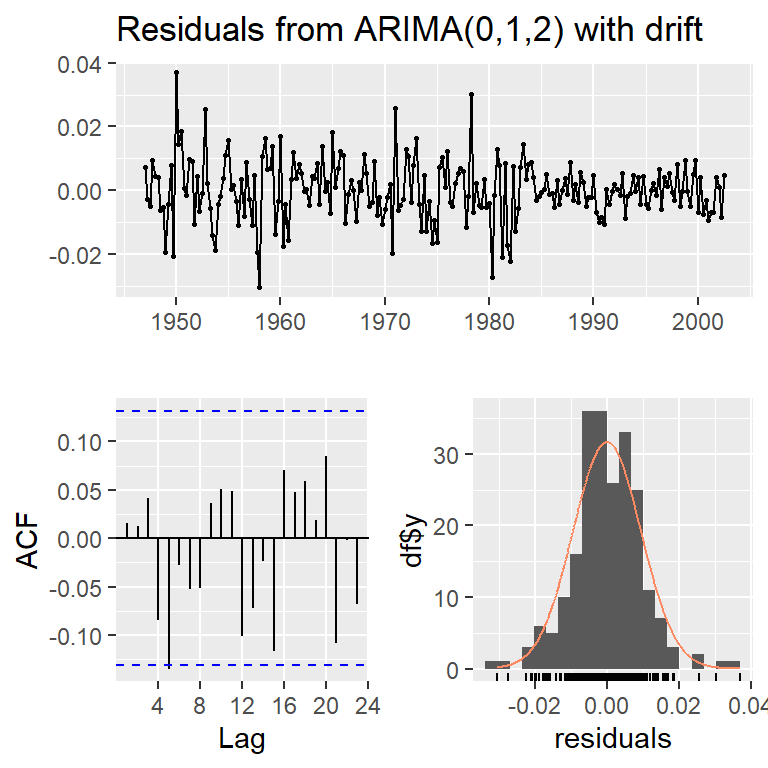

Training set -0.07755085mode<-Arima(y,order=c(0,1,2),include.drift=TRUE,lambda=0)

summary(mode)Series: y

ARIMA(0,1,2) with drift

Box Cox transformation: lambda= 0

Coefficients:

ma1 ma2 drift

0.3028 0.2035 0.0083

s.e. 0.0654 0.0644 0.0010

sigma^2 = 9.066e-05: log likelihood = 719.96

AIC=-1431.93 AICc=-1431.74 BIC=-1418.32

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -1.367236 37.76604 28.61229 -0.0001880699 0.7108687 0.1821125

ACF1

Training set -0.02703248checkresiduals(modd,lag=10)

Ljung-Box test

data: Residuals from ARIMA(1,1,0) with drift

Q* = 10.69, df = 9, p-value = 0.2976

Model df: 1. Total lags used: 10checkresiduals(mode,lag=10)

Ljung-Box test

data: Residuals from ARIMA(0,1,2) with drift

Q* = 8.6404, df = 8, p-value = 0.3735

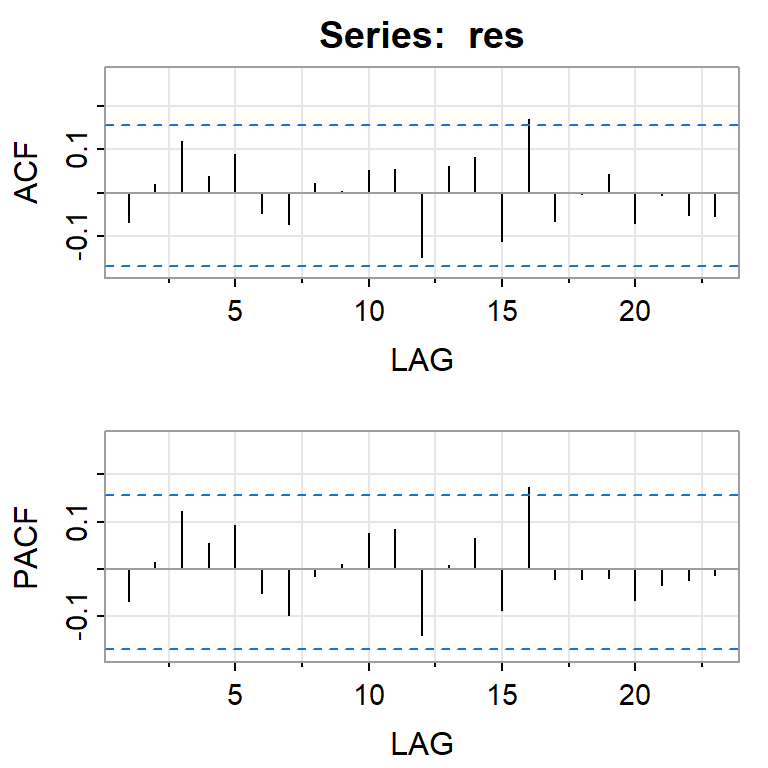

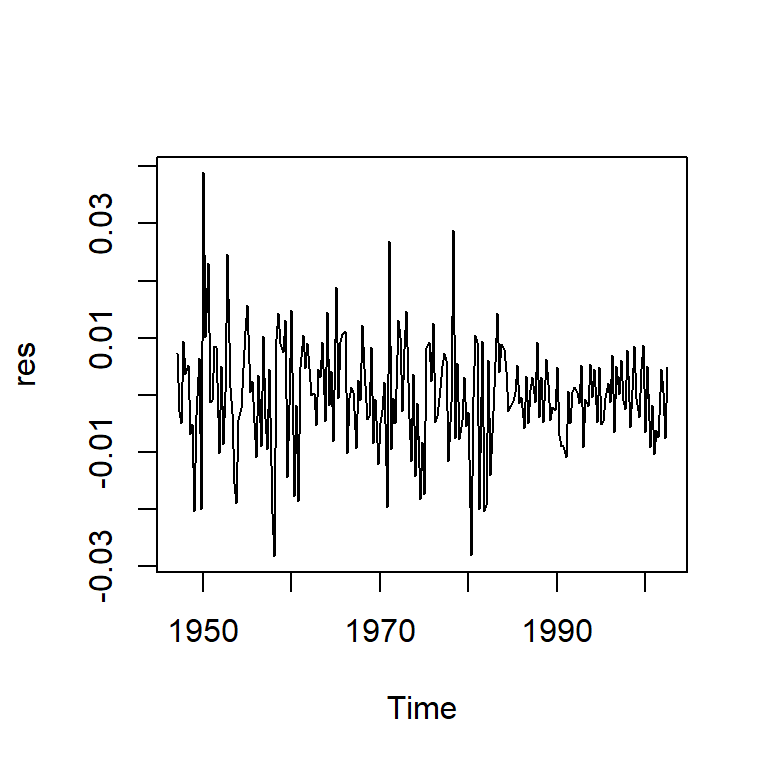

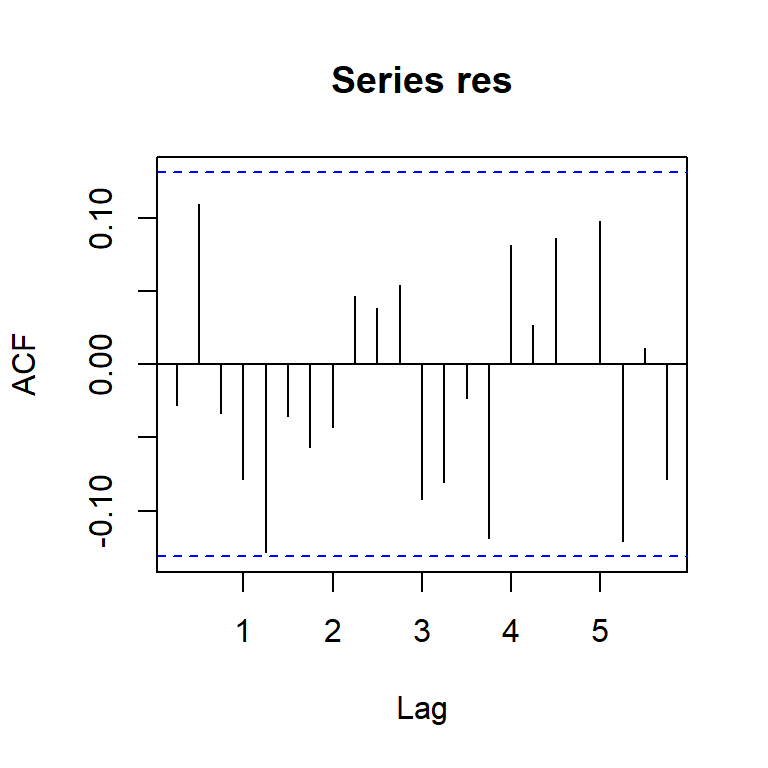

Model df: 2. Total lags used: 10res<-modd$res

ts.plot(res)

acf(res)

pacf(res)

#Normalidad

shapiro.test(res)

Shapiro-Wilk normality test

data: res

W = 0.97558, p-value = 0.0006627jarque.bera.test(res)

Jarque Bera Test

data: res

X-squared = 23.489, df = 2, p-value = 7.933e-06qqPlot(res)

[1] 13 126