library(ggplot2)

library(forecast)

library(fpp2)

library(astsa)

library(car)

library(TSA)

library(tseries)

library(urca)Tema VII: Modelos de regresión dinámica

Curso: Análisis de series temporales

1 librerías

2 Pronóstico del cambio de gasto basado en el ingreso personal

data(uschange)

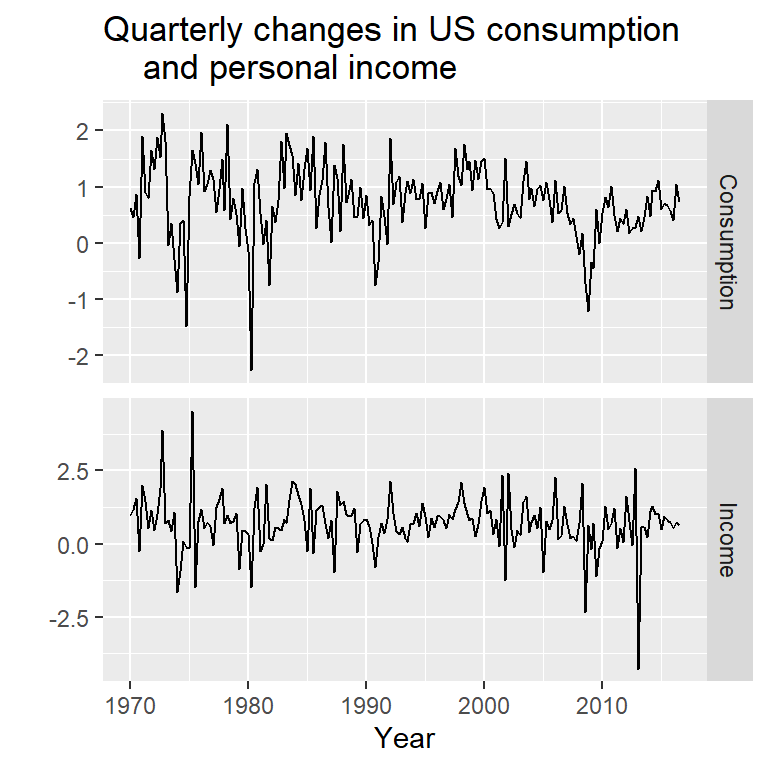

autoplot(uschange[,1:2], facets=TRUE) +

xlab("Year") + ylab("") +

ggtitle("Quarterly changes in US consumption

and personal income")

y<-uschange[,"Consumption"]

x<-uschange[,"Income"]2.1 Ilustración de un modelo con errores ARIMA y un modelo de regresión en diferencias

mod0 <- Arima(y, xreg=x, order=c(1,1,0))

summary(mod0)Series: y

Regression with ARIMA(1,1,0) errors

Coefficients:

ar1 xreg

-0.5412 0.1835

s.e. 0.0638 0.0429

sigma^2 = 0.3982: log likelihood = -177.46

AIC=360.93 AICc=361.06 BIC=370.61

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.002476011 0.6259787 0.4671324 21.24398 182.2579 0.7319011

ACF1

Training set -0.1727835Es equivalente a

mod1 <- Arima(diff(y), xreg=diff(x), order=c(1,0,0)) #asume que tiene intercepto

summary(mod1)Series: diff(y)

Regression with ARIMA(1,0,0) errors

Coefficients:

ar1 intercept xreg

-0.5413 0.0019 0.1835

s.e. 0.0638 0.0299 0.0429

sigma^2 = 0.4004: log likelihood = -177.46

AIC=362.93 AICc=363.15 BIC=375.83

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set -0.0003963677 0.6276524 0.4697909 -181.0816 364.3807 0.5583989

ACF1

Training set -0.1727715mod2 <- Arima(diff(y), xreg=diff(x), include.mean=FALSE , order=c(1,0,0))

summary(mod2)Series: diff(y)

Regression with ARIMA(1,0,0) errors

Coefficients:

ar1 xreg

-0.5412 0.1835

s.e. 0.0638 0.0429

sigma^2 = 0.3982: log likelihood = -177.46

AIC=360.93 AICc=361.06 BIC=370.61

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.002486969 0.6276592 0.4696416 -176.5324 360.0201 0.5582214

ACF1

Training set -0.17278812.2 auto.arima

mod <- auto.arima(y, xreg=x)

summary(mod)Series: y

Regression with ARIMA(1,0,2) errors

Coefficients:

ar1 ma1 ma2 intercept xreg

0.6922 -0.5758 0.1984 0.5990 0.2028

s.e. 0.1159 0.1301 0.0756 0.0884 0.0461

sigma^2 = 0.3219: log likelihood = -156.95

AIC=325.91 AICc=326.37 BIC=345.29

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.001714366 0.5597088 0.4209056 27.4477 161.8417 0.6594731

ACF1

Training set 0.006299231head(mod$residuals) Qtr1 Qtr2 Qtr3 Qtr4

1970 -0.16714211 -0.31981056 0.07199692 -0.69355381

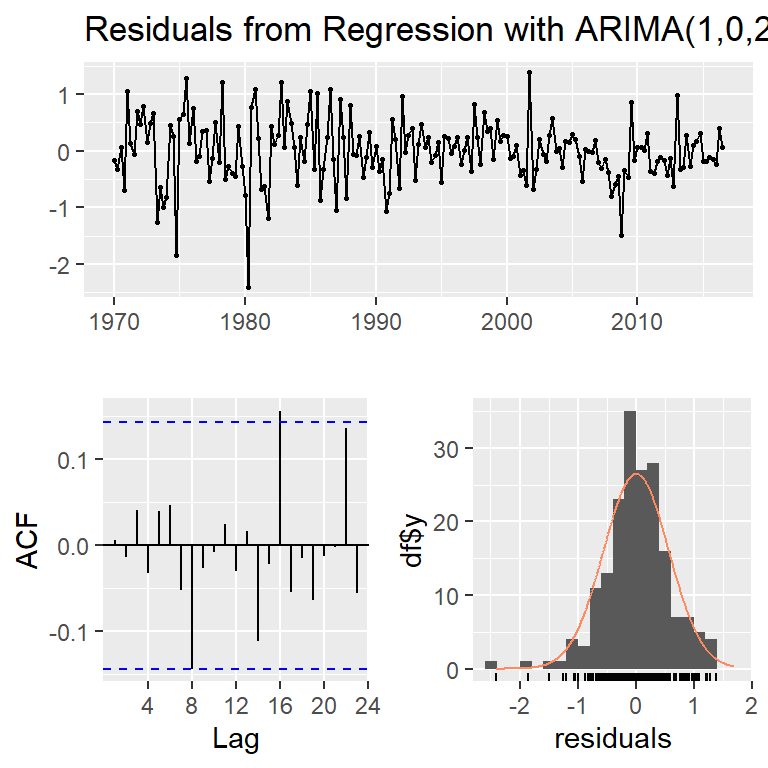

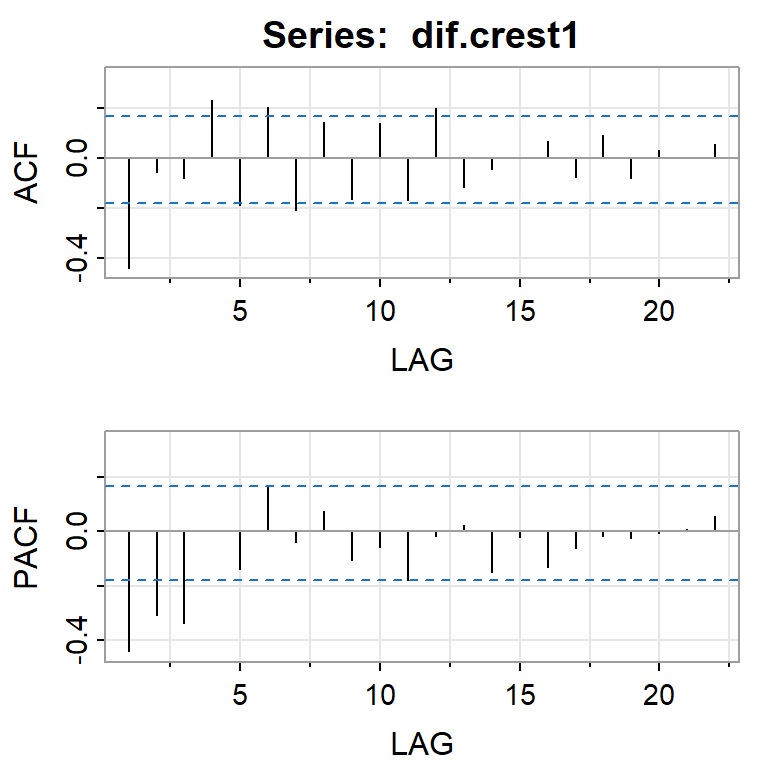

1971 1.05009349 0.14169806 checkresiduals(mod,lag=20)

Ljung-Box test

data: Residuals from Regression with ARIMA(1,0,2) errors

Q* = 15.622, df = 17, p-value = 0.5508

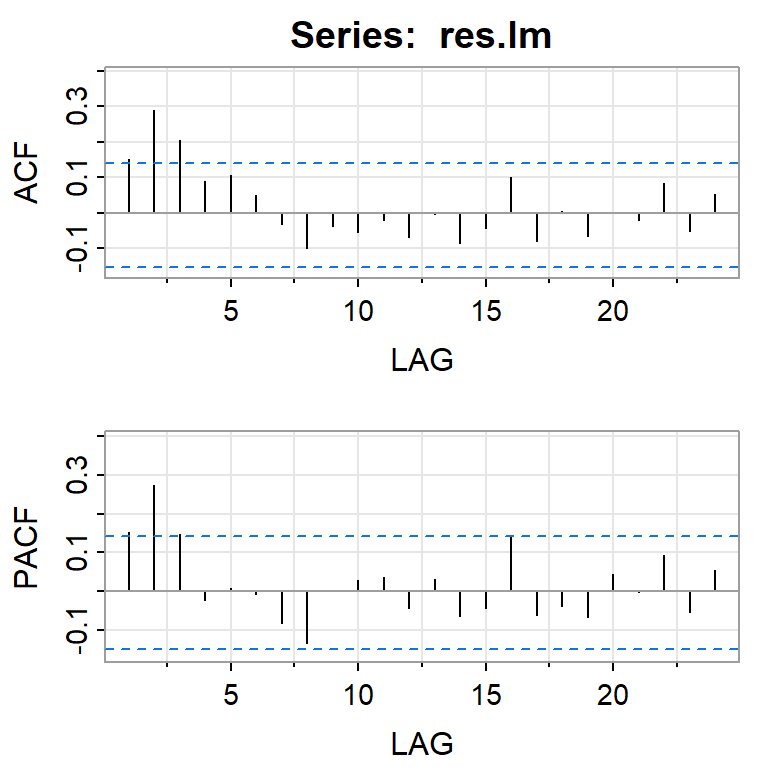

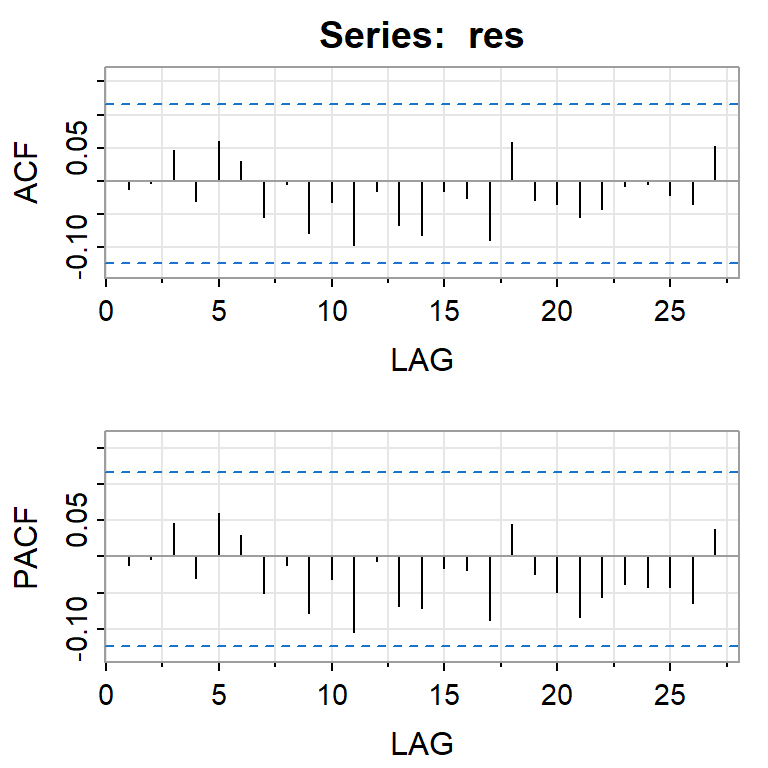

Model df: 3. Total lags used: 20res<-mod$res

ts.plot(res)

acf2(res)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.01 -0.01 0.04 -0.03 0.04 0.05 -0.05 -0.14 -0.03 -0.01 0.02 -0.03 0.02

PACF 0.01 -0.01 0.04 -0.03 0.04 0.04 -0.05 -0.15 -0.03 0.00 0.03 -0.04 0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24]

ACF -0.11 -0.02 0.16 -0.05 -0.02 -0.06 -0.01 0.00 0.14 -0.06 0.01

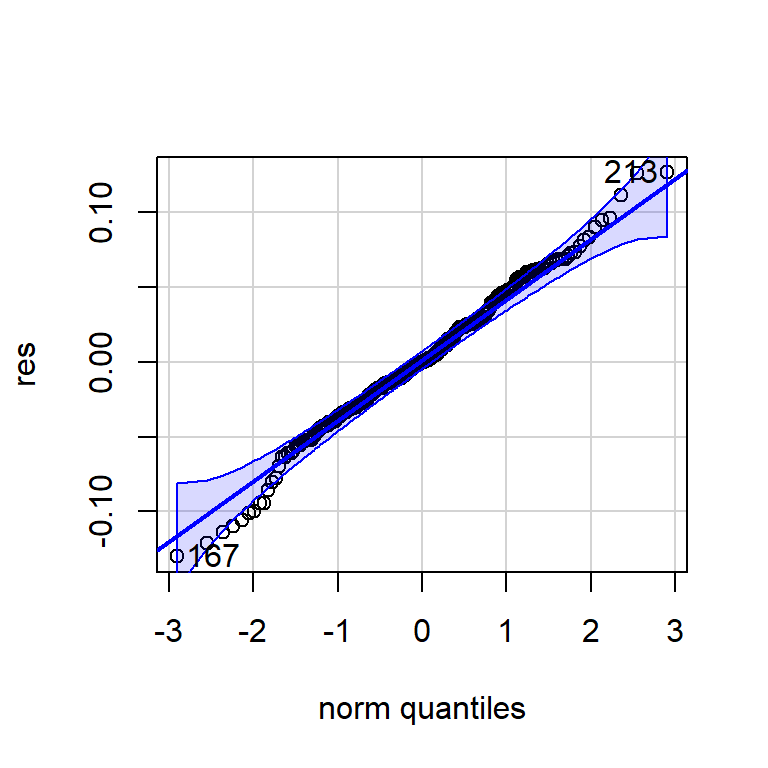

PACF -0.11 -0.03 0.13 -0.05 -0.02 -0.07 0.01 -0.02 0.11 -0.06 0.05shapiro.test(res)

Shapiro-Wilk normality test

data: res

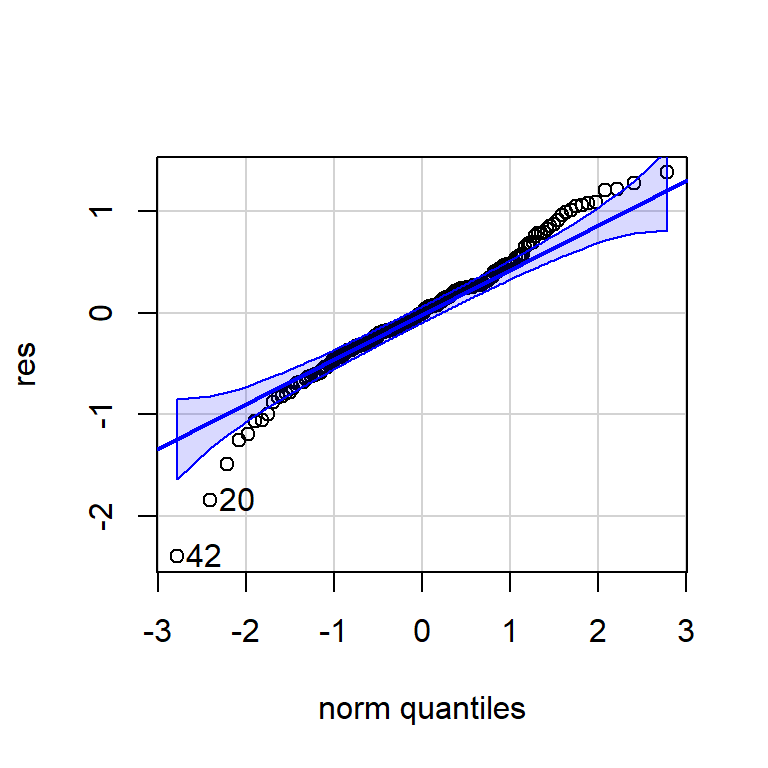

W = 0.97407, p-value = 0.001497qqPlot(res)

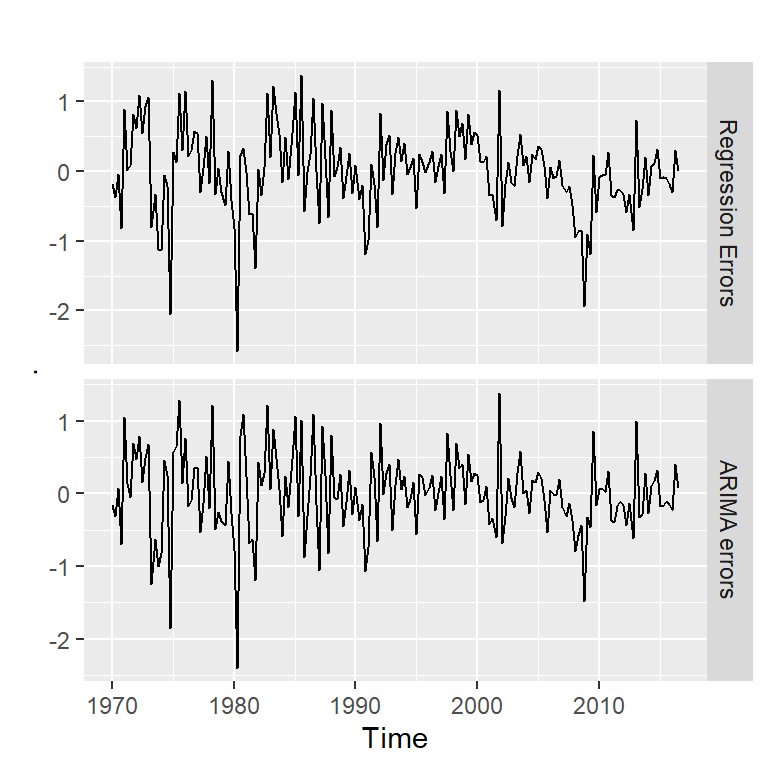

[1] 42 20errores<-cbind("Regression Errors" = residuals(mod, type="regression"),

"ARIMA errors" = residuals(mod, type="innovation"))

head(errores) Regression Errors ARIMA errors

1970 Q1 -0.18024704 -0.16714211

1970 Q2 -0.37577719 -0.31981056

1970 Q3 -0.03728173 0.07199692

1970 Q4 -0.82151101 -0.69355381

1971 Q1 0.89529777 1.05009349

1971 Q2 0.01940569 0.14169806errores %>%

autoplot(facets=TRUE)

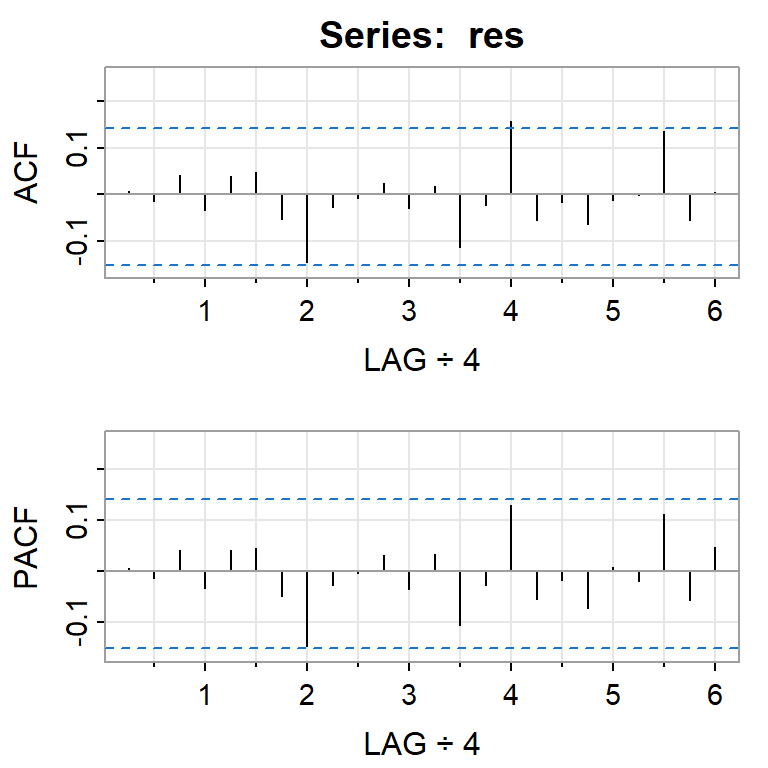

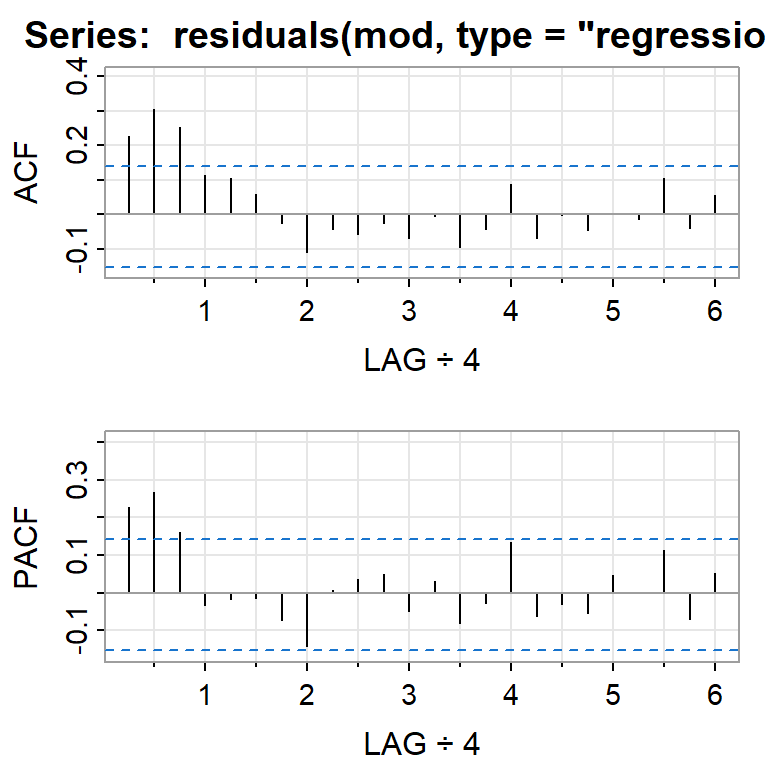

acf2(residuals(mod, type="regression"))

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.23 0.30 0.25 0.11 0.11 0.06 -0.02 -0.11 -0.04 -0.06 -0.02 -0.07 -0.01

PACF 0.23 0.27 0.16 -0.03 -0.02 -0.01 -0.07 -0.14 0.01 0.04 0.05 -0.05 0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24]

ACF -0.09 -0.04 0.09 -0.07 0.00 -0.05 0.00 -0.01 0.11 -0.04 0.05

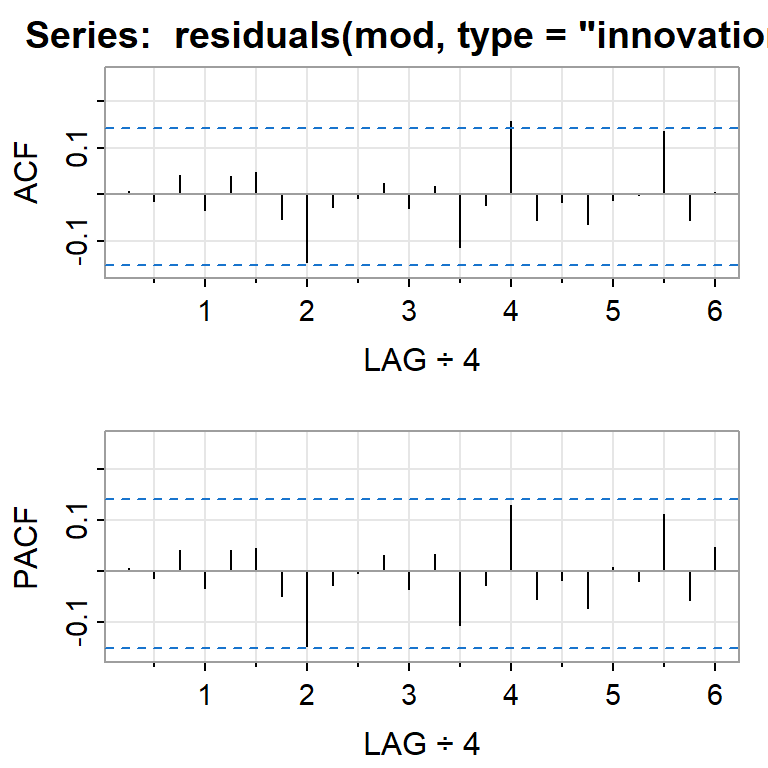

PACF -0.08 -0.03 0.13 -0.06 -0.03 -0.05 0.05 0.00 0.11 -0.07 0.05acf2(residuals(mod, type="innovation"))

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.01 -0.01 0.04 -0.03 0.04 0.05 -0.05 -0.14 -0.03 -0.01 0.02 -0.03 0.02

PACF 0.01 -0.01 0.04 -0.03 0.04 0.04 -0.05 -0.15 -0.03 0.00 0.03 -0.04 0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24]

ACF -0.11 -0.02 0.16 -0.05 -0.02 -0.06 -0.01 0.00 0.14 -0.06 0.01

PACF -0.11 -0.03 0.13 -0.05 -0.02 -0.07 0.01 -0.02 0.11 -0.06 0.052.3 Estimación del modelo de regresión asumiendo errores independientes y normales

mod.reg<-lm(y~x)

summary(mod.reg)

Call:

lm(formula = y ~ x)

Residuals:

Min 1Q Median 3Q Max

-2.40845 -0.31816 0.02558 0.29978 1.45157

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.54510 0.05569 9.789 < 2e-16 ***

x 0.28060 0.04744 5.915 1.58e-08 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.6026 on 185 degrees of freedom

Multiple R-squared: 0.159, Adjusted R-squared: 0.1545

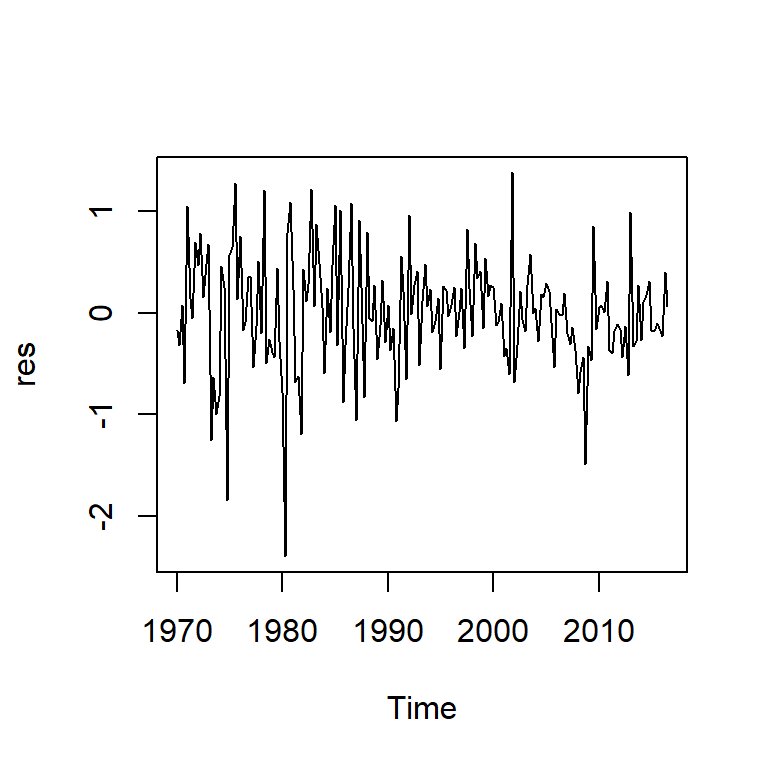

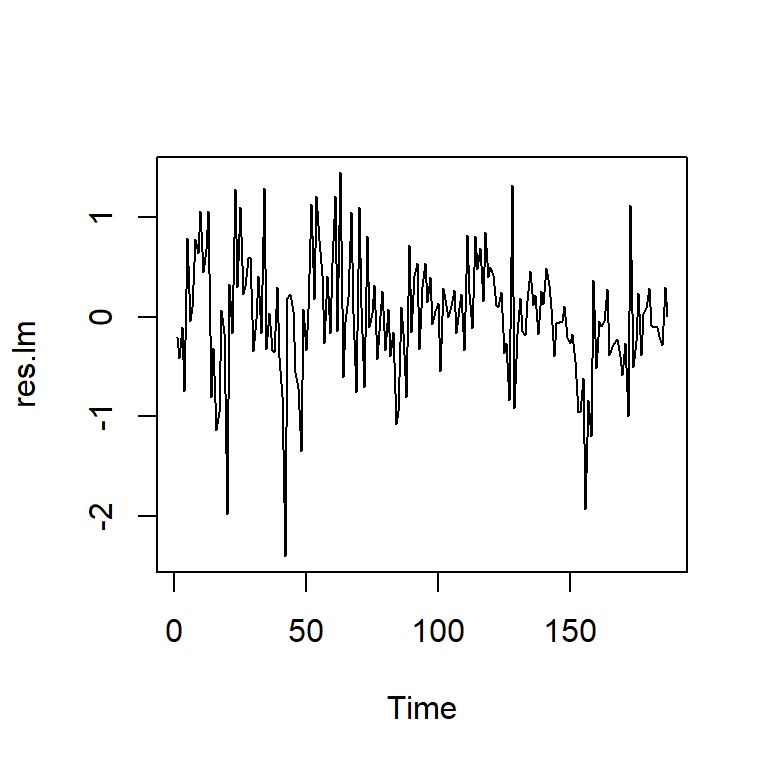

F-statistic: 34.98 on 1 and 185 DF, p-value: 1.577e-08res.lm<-mod.reg$residuals

ts.plot(res.lm)

acf2(res.lm)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.15 0.29 0.21 0.09 0.11 0.05 -0.03 -0.10 -0.04 -0.05 -0.02 -0.07 0.00

PACF 0.15 0.27 0.15 -0.02 0.01 -0.01 -0.08 -0.13 0.00 0.03 0.04 -0.04 0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24]

ACF -0.09 -0.04 0.10 -0.08 0.01 -0.06 0.00 -0.02 0.08 -0.05 0.05

PACF -0.07 -0.04 0.14 -0.06 -0.04 -0.07 0.04 0.00 0.09 -0.06 0.05Ajustar un modelo ARIMA a los errores en el segundo paso.

mod.res <- auto.arima(res.lm)

summary(mod.res)Series: res.lm

ARIMA(1,0,2) with zero mean

Coefficients:

ar1 ma1 ma2

0.6692 -0.5997 0.2138

s.e. 0.1318 0.1443 0.0715

sigma^2 = 0.3232: log likelihood = -158.34

AIC=324.67 AICc=324.89 BIC=337.6

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.0007856478 0.5639095 0.4195143 104.3124 140.7678 0.723367

ACF1

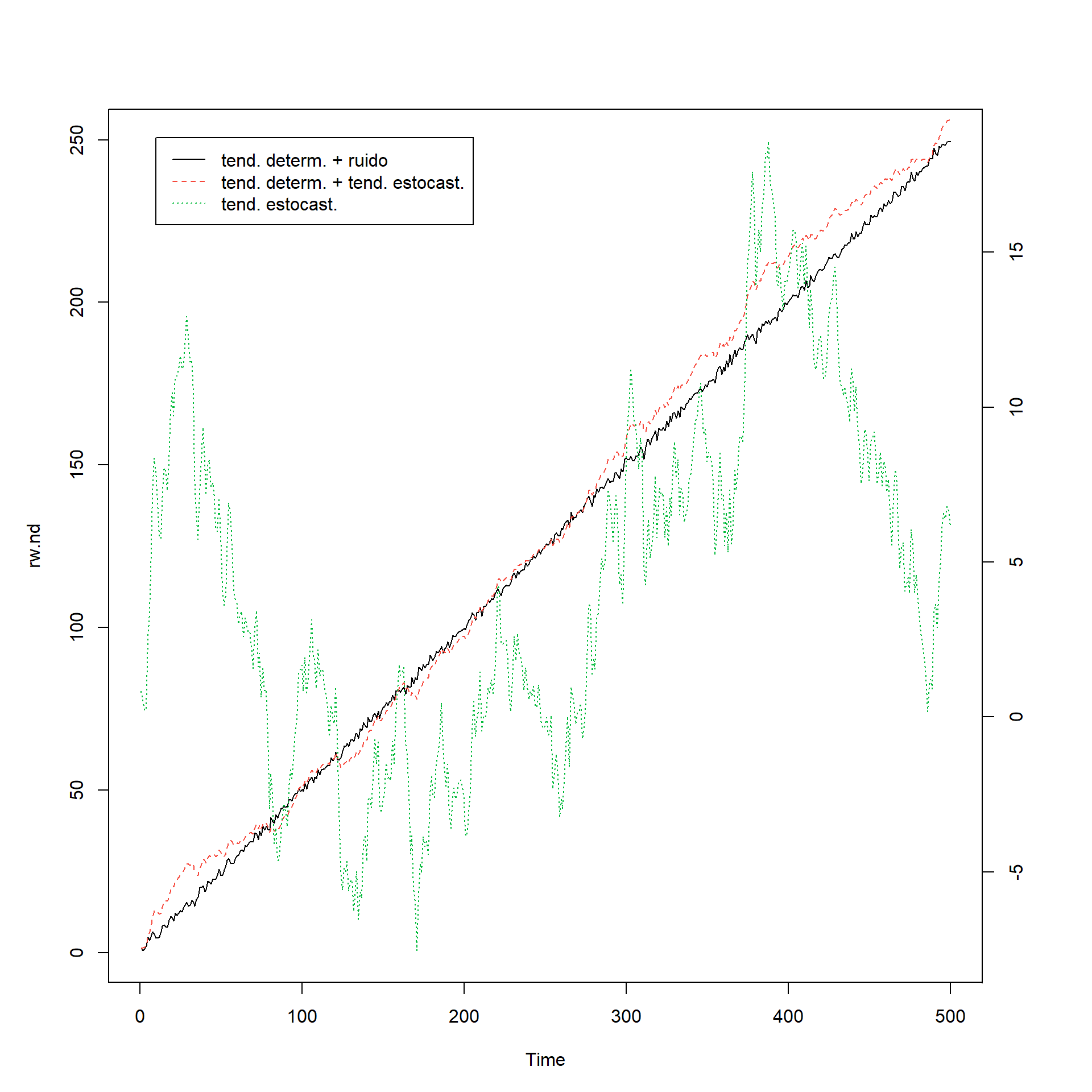

Training set 0.00090708183 Tendencia determinística y estocástica

set.seed(123456)

e <- rnorm(500)## caminata aleatoria

rw.nd <- cumsum(e)

## tendencia

tend <- 1:500

## caminata aleatoria con desvío

rw.wd <- 0.5*tend + cumsum(e)

## tendencia determinística con ruido

dt <- e + 0.5*tend

## plotting

par(mar=rep(5,4))

plot.ts(dt, lty=1, col=1, ylab='', xlab='')

lines(rw.wd, lty=2, col= 2)

par(new=T)

plot.ts(rw.nd, lty=3, col=3, axes=FALSE)

axis(4, pretty(range(rw.nd)))

legend(10, 18.7, legend=c('tend. determ. + ruido ',

'tend. determ. + tend. estocast.', 'tend. estocast.'),

lty=c(1, 2, 3),col=c(1,2,3))

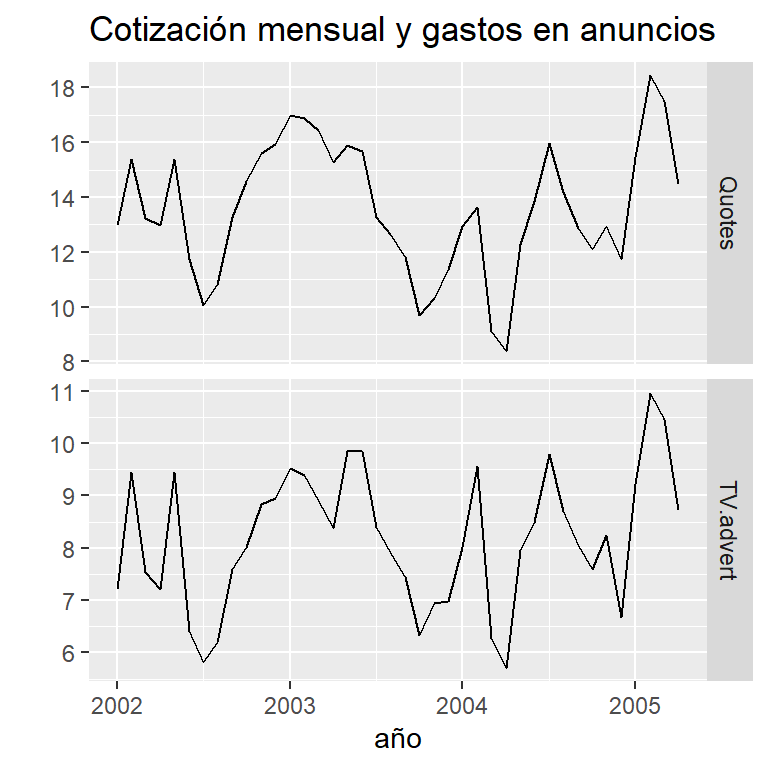

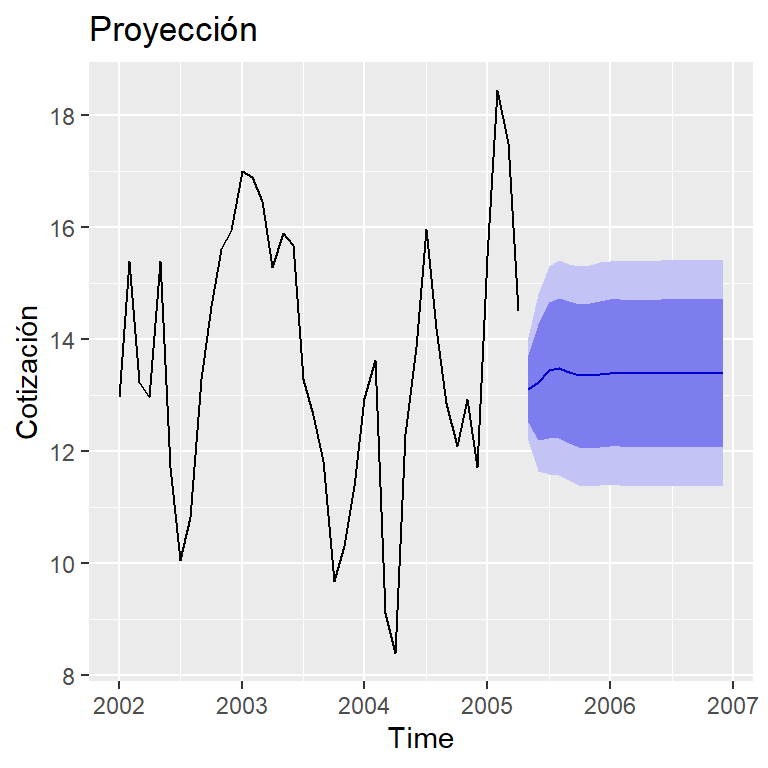

4 Regresión con variables independientes rezagadas

4.1 Cotización mensual y gastos en publicidad de una compañía estadounidense (enero, 2002- abril, 2005)

data(insurance)

autoplot(insurance, facets=TRUE) +

xlab("año") + ylab("") +

ggtitle("Cotización mensual y gastos en anuncios")

y<- insurance[,"Quotes"]

x<- insurance[,"TV.advert"]4.2 Predictores rezagadas (0,1,2 y 3 rezagos)

anuncios <- cbind(

x0 = x,

x1 = stats::lag(x,-1),

x2 = stats::lag(x,-2),

x3 = stats::lag(x,-3)) %>%

head(NROW(insurance)) #eliminar los NA al final

anuncios[1:10,] x0 x1 x2 x3

[1,] 7.212725 NA NA NA

[2,] 9.443570 7.212725 NA NA

[3,] 7.534250 9.443570 7.212725 NA

[4,] 7.212725 7.534250 9.443570 7.212725

[5,] 9.443570 7.212725 7.534250 9.443570

[6,] 6.415215 9.443570 7.212725 7.534250

[7,] 5.806990 6.415215 9.443570 7.212725

[8,] 6.203600 5.806990 6.415215 9.443570

[9,] 7.586430 6.203600 5.806990 6.415215

[10,] 8.004935 7.586430 6.203600 5.8069904.3 Restringir datos para comparar los modelos del mismo periodo

(mod1 <- auto.arima(insurance[4:40,1], xreg=anuncios[4:40,1],

stationary=TRUE))Series: insurance[4:40, 1]

Regression with ARIMA(2,0,0) errors

Coefficients:

ar1 ar2 intercept xreg

1.2321 -0.4642 3.4263 1.2413

s.e. 0.1636 0.1708 0.6805 0.0751

sigma^2 = 0.2891: log likelihood = -28.28

AIC=66.56 AICc=68.5 BIC=74.62(mod2 <- auto.arima(insurance[4:40,1], xreg=anuncios[4:40,1:2],

stationary=TRUE))Series: insurance[4:40, 1]

Regression with ARIMA(1,0,1) errors

Coefficients:

ar1 ma1 x0 x1

0.6718 0.6713 1.3770 0.2745

s.e. 0.1324 0.1302 0.0374 0.0362

sigma^2 = 0.2285: log likelihood = -24.04

AIC=58.09 AICc=60.02 BIC=66.14(mod3 <- auto.arima(insurance[4:40,1], xreg=anuncios[4:40,1:3],

stationary=TRUE))Series: insurance[4:40, 1]

Regression with ARIMA(1,0,1) errors

Coefficients:

ar1 ma1 x0 x1 x2

0.6701 0.6757 1.3843 0.2764 -0.0111

s.e. 0.1349 0.1311 0.0487 0.0369 0.0470

sigma^2 = 0.2352: log likelihood = -24.02

AIC=60.03 AICc=62.83 BIC=69.7(mod4 <- auto.arima(insurance[4:40,1], xreg=anuncios[4:40,1:4],

stationary=TRUE))Series: insurance[4:40, 1]

Regression with ARIMA(1,0,1) errors

Coefficients:

ar1 ma1 intercept x0 x1 x2 x3

0.7567 0.6071 3.6314 1.2901 0.1323 -0.1303 -0.0643

s.e. 0.1155 0.1369 1.8656 0.0656 0.0797 0.0759 0.0612

sigma^2 = 0.2262: log likelihood = -22.16

AIC=60.31 AICc=65.46 BIC=73.2c(mod1[["aicc"]],mod2[["aicc"]],mod3[["aicc"]],mod4[["aicc"]])[1] 68.49968 60.02357 62.83253 65.45747(mod.final <- auto.arima(insurance[,1], xreg=anuncios[,1:2],

stationary=TRUE))Series: insurance[, 1]

Regression with ARIMA(3,0,0) errors

Coefficients:

ar1 ar2 ar3 intercept x0 x1

1.4117 -0.9317 0.3591 2.0393 1.2564 0.1625

s.e. 0.1698 0.2545 0.1592 0.9931 0.0667 0.0591

sigma^2 = 0.2165: log likelihood = -23.89

AIC=61.78 AICc=65.4 BIC=73.434.4 pronóstico

pronostico <- forecast(mod.final, h=20,

xreg=cbind(x0 = rep(8,20),

x1 = c(anuncios[40,1], rep(8,19))))

autoplot(pronostico) + ylab("Cotización") +

ggtitle("Proyección")

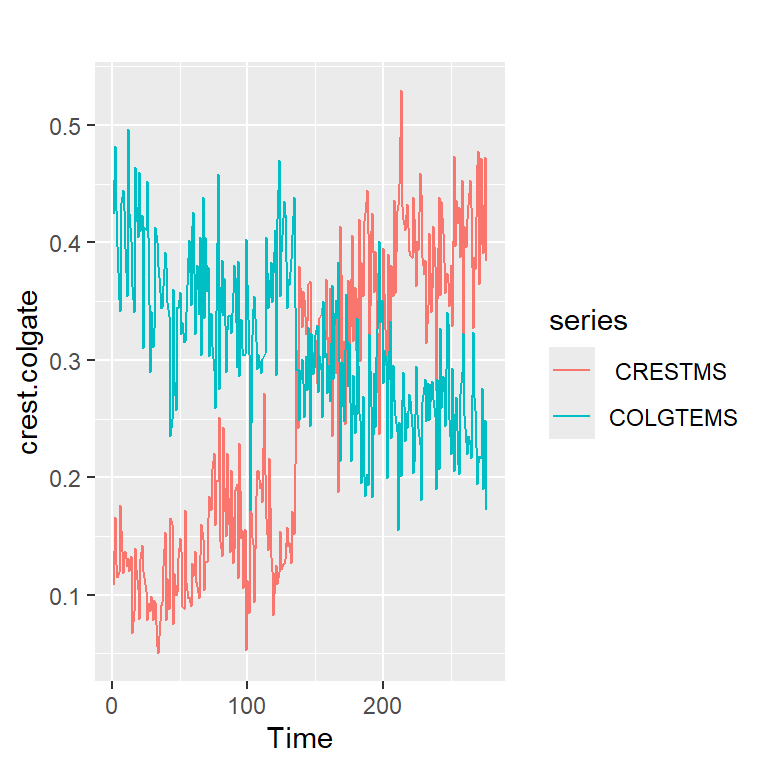

5 Intervención

5.1 Serie de colgate y crest

table<-read.table("crestcolgate.dat")

colnames(table)<-c( " CRESTMS", "COLGTEMS" ,"CRESTPR", "COLGTEPR")

names(table)[1] " CRESTMS" "COLGTEMS" "CRESTPR" "COLGTEPR"crest.colgate<-ts(table[,1:2])

autoplot(crest.colgate)

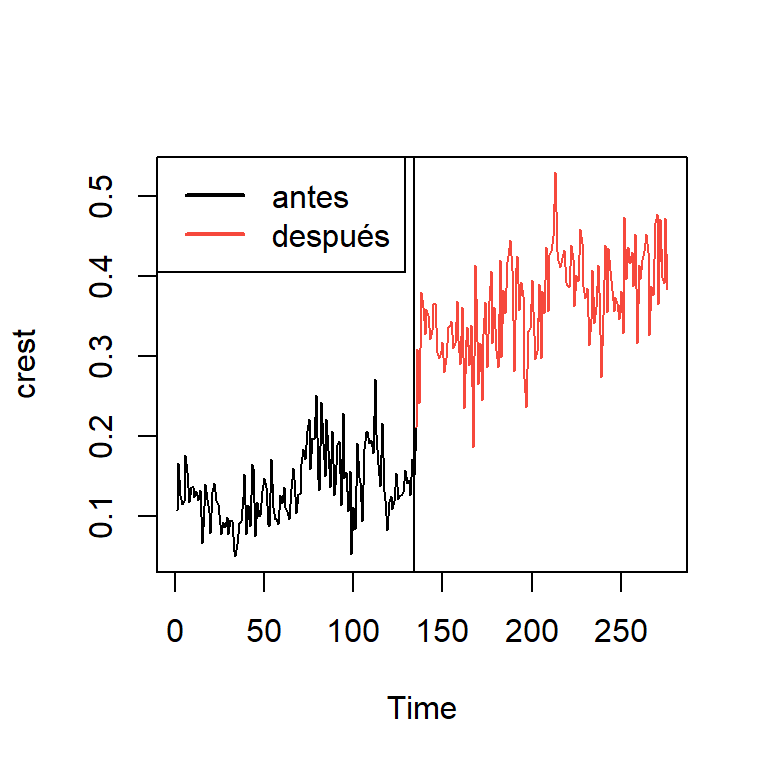

#Modelo ARIMA antes de la intervención

#las primeras 134 semanas:

dim(crest.colgate)[1] 276 2crest<-ts(table[,1])

crest1<-crest.colgate[1:134]

crest2<-crest.colgate[135:276]

ts.plot(crest)

points(135:276,crest2,col=2,type="l")

abline(v=134)

legend("topleft",c("antes","después"),lwd=2,col=1:2)

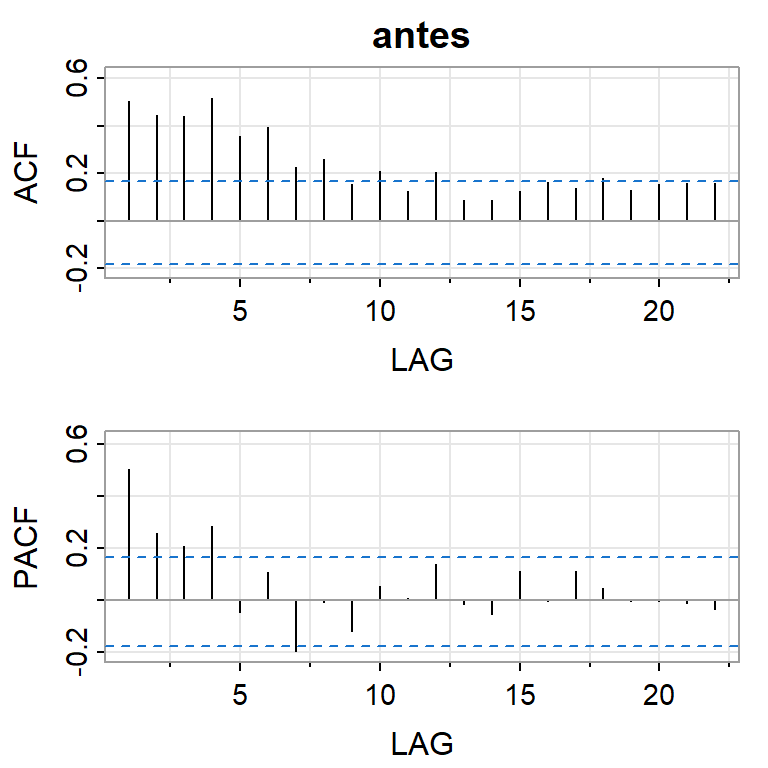

acf2(crest1,main="antes")

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.5 0.44 0.44 0.51 0.36 0.39 0.23 0.26 0.15 0.21 0.12 0.21 0.09

PACF 0.5 0.26 0.21 0.28 -0.05 0.10 -0.20 -0.01 -0.12 0.05 0.01 0.14 -0.02

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22]

ACF 0.09 0.12 0.16 0.14 0.18 0.13 0.16 0.16 0.16

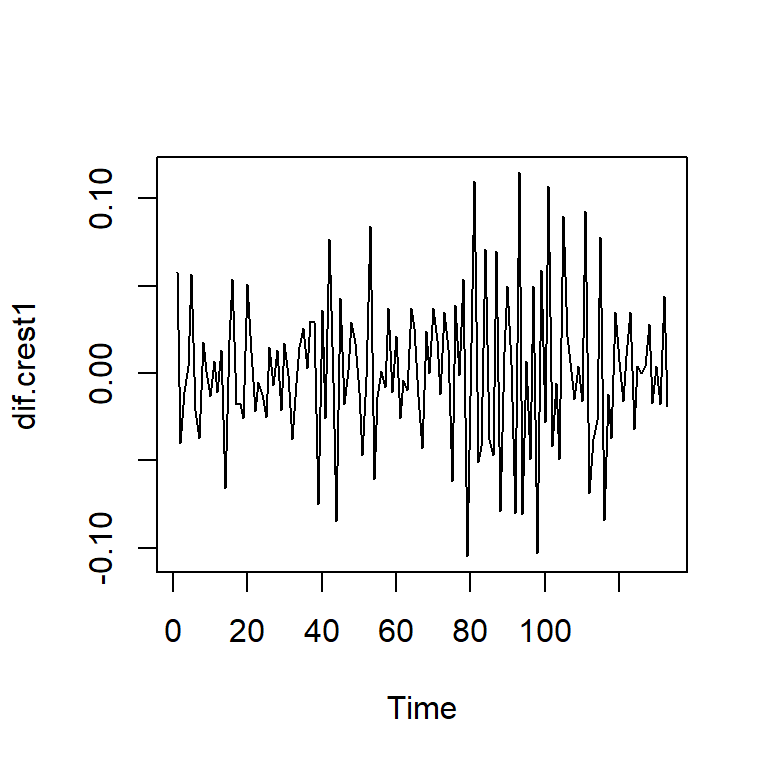

PACF -0.05 0.11 -0.01 0.11 0.05 -0.01 0.00 -0.01 -0.03dif.crest1<-diff(crest1)

ts.plot(dif.crest1)

acf2(dif.crest1)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF -0.44 -0.06 -0.08 0.23 -0.19 0.20 -0.21 0.15 -0.16 0.14 -0.17 0.20 -0.12

PACF -0.44 -0.31 -0.34 0.00 -0.14 0.16 -0.04 0.07 -0.10 -0.06 -0.18 -0.02 0.02

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22]

ACF -0.04 0.00 0.07 -0.08 0.09 -0.08 0.03 0.00 0.06

PACF -0.15 -0.02 -0.13 -0.06 -0.02 -0.03 -0.01 0.01 0.05moda <- Arima(crest1, order=c(0,1,1))

summary(moda)Series: crest1

ARIMA(0,1,1)

Coefficients:

ma1

-0.6918

s.e. 0.0644

sigma^2 = 0.001248: log likelihood = 256.11

AIC=-508.22 AICc=-508.12 BIC=-502.44

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.0006404213 0.03505771 0.02747198 -5.725771 22.02557 0.8434379

ACF1

Training set -0.0009184472#creación de las variables indicadoras

I1 <- c(rep(0,134),rep(1,142)) #intervención durante la semana 135

I2 <- c(rep(0,135),rep(1,141)) #intervención durante la semana 136

X<-cbind(I1,I2)

modb <- Arima(crest, xreg=X, order=c(0,1,1))

summary(modb)Series: crest

Regression with ARIMA(0,1,1) errors

Coefficients:

ma1 I1 I2

-0.7782 0.0654 0.1119

s.e. 0.0437 0.0434 0.0434

sigma^2 = 0.001902: log likelihood = 472.22

AIC=-936.44 AICc=-936.29 BIC=-921.98

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.00186971 0.04329952 0.03363337 -3.49533 16.66087 0.7903928

ACF1

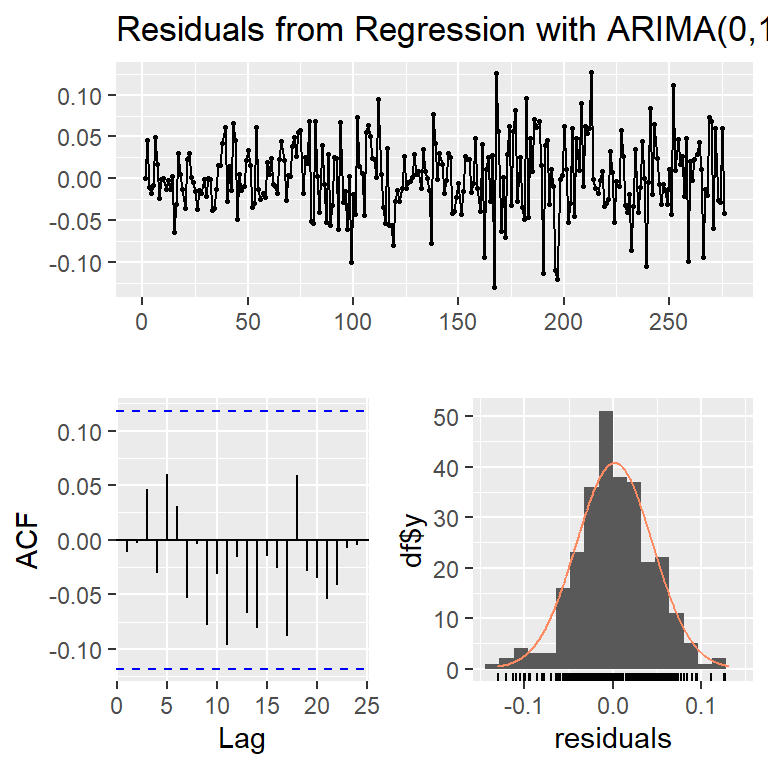

Training set -0.01155037checkresiduals(modb,lag=20)

Ljung-Box test

data: Residuals from Regression with ARIMA(0,1,1) errors

Q* = 15.279, df = 19, p-value = 0.7047

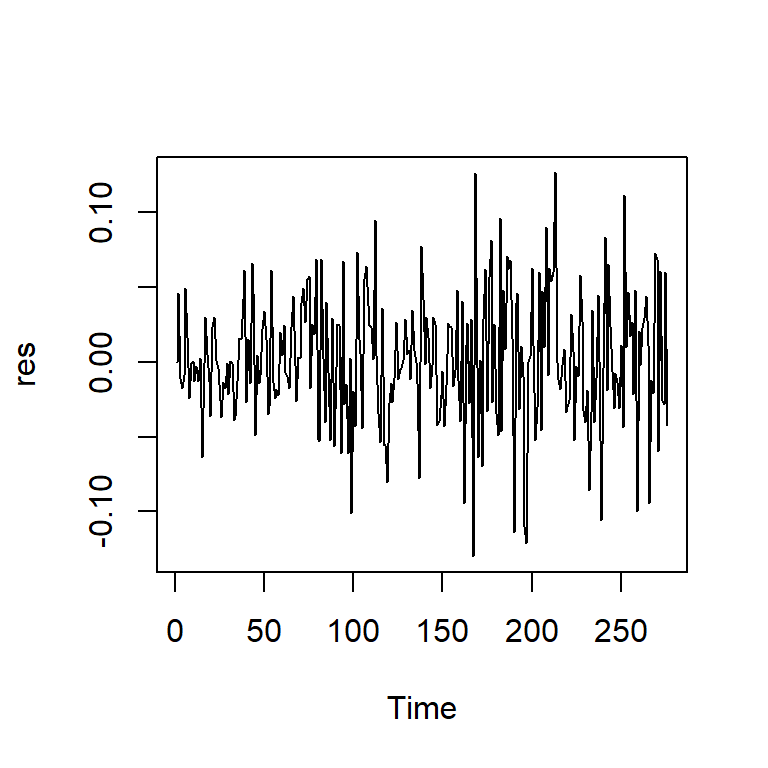

Model df: 1. Total lags used: 20res<-modb$res

ts.plot(res)

acf2(res)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF -0.01 0 0.05 -0.03 0.06 0.03 -0.05 0.00 -0.08 -0.03 -0.1 -0.02 -0.07

PACF -0.01 0 0.05 -0.03 0.06 0.03 -0.05 -0.01 -0.08 -0.03 -0.1 -0.01 -0.07

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF -0.08 -0.01 -0.03 -0.09 0.06 -0.03 -0.03 -0.05 -0.04 -0.01 -0.01 -0.02

PACF -0.07 -0.02 -0.02 -0.09 0.04 -0.02 -0.05 -0.08 -0.06 -0.04 -0.04 -0.04

[,26] [,27]

ACF -0.03 0.05

PACF -0.06 0.04shapiro.test(res)

Shapiro-Wilk normality test

data: res

W = 0.99157, p-value = 0.1157qqPlot(res)

[1] 167 213