library(fGarch)

library(rugarch)

library(astsa)

library(forecast)

library(quantmod)Tema 4: Modelos no lineales. ARCH, GARCH y extensiones

1 librerías

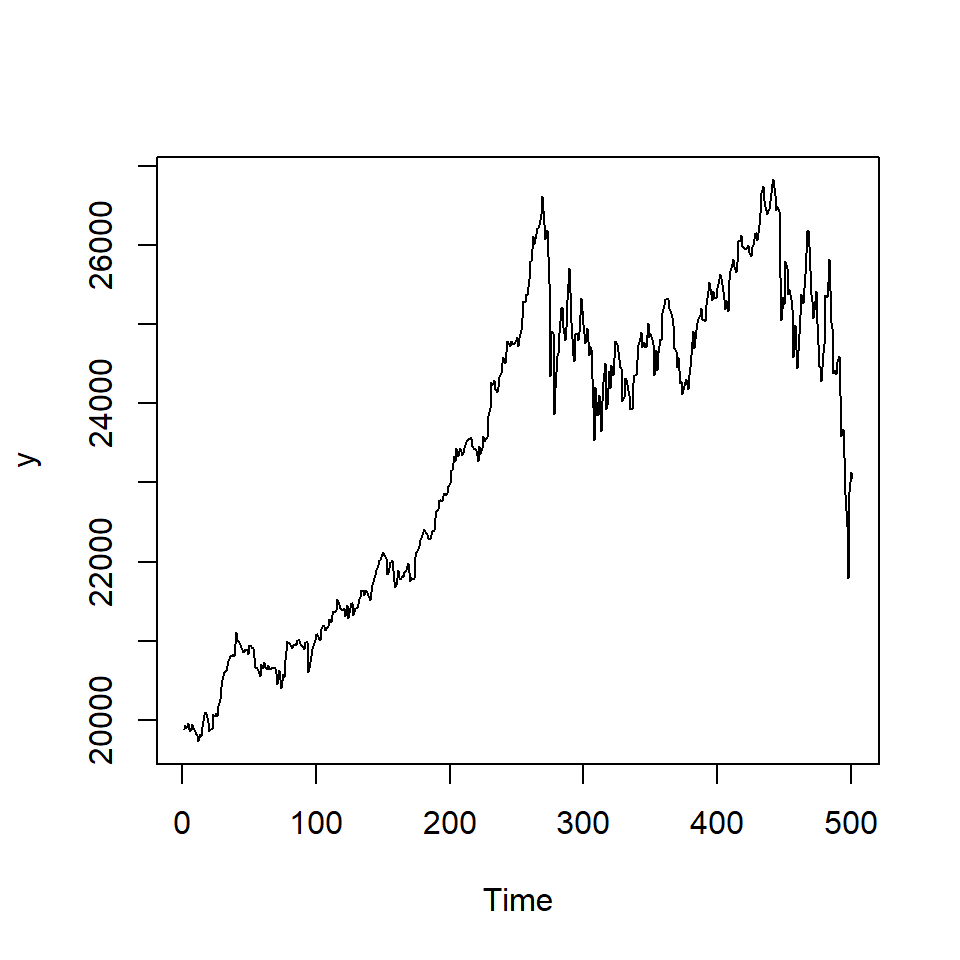

2 Ejemplo: promedio diario industrial Dow Jone

getSymbols("^DJI",from = "2016/12/31",

to = "2018/12/31",

periodicity = "daily")[1] "DJI"y <- DJI$DJI.Close2.1 Retornos

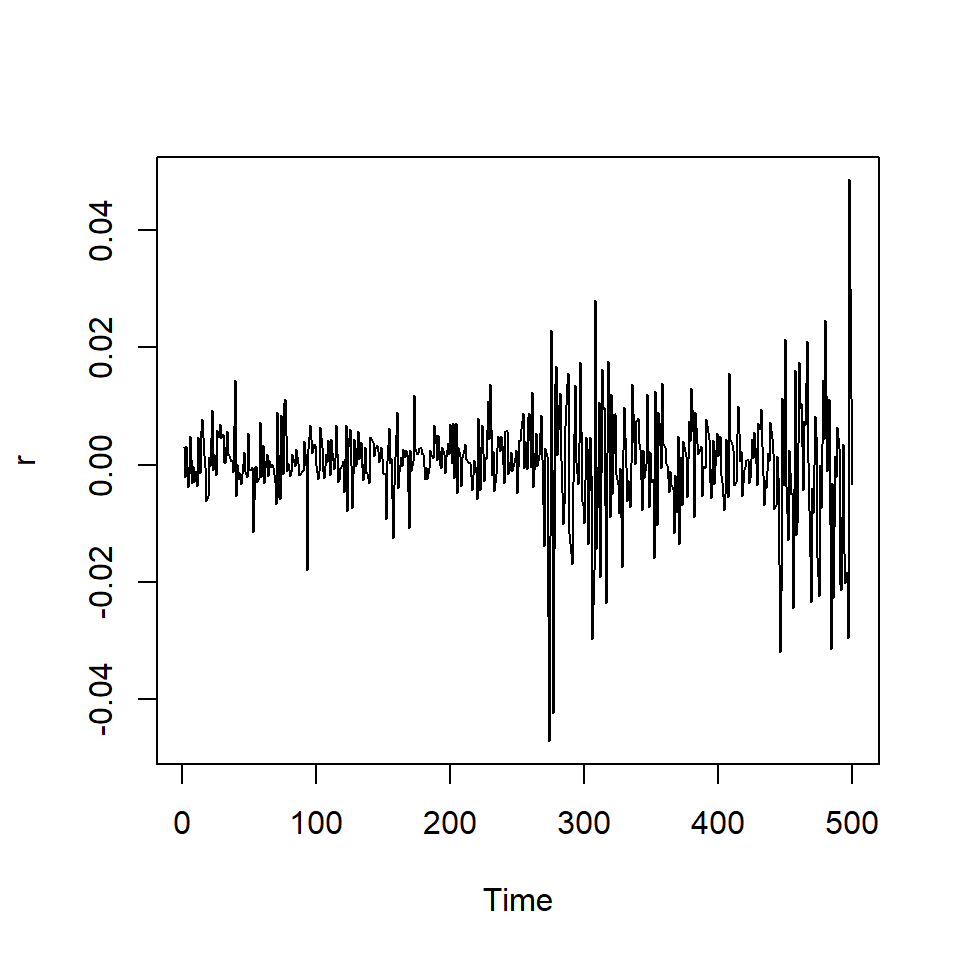

r <- diff(log(y))[-1]

colnames(r)<-"r"

ts.plot(y)

ts.plot(r)

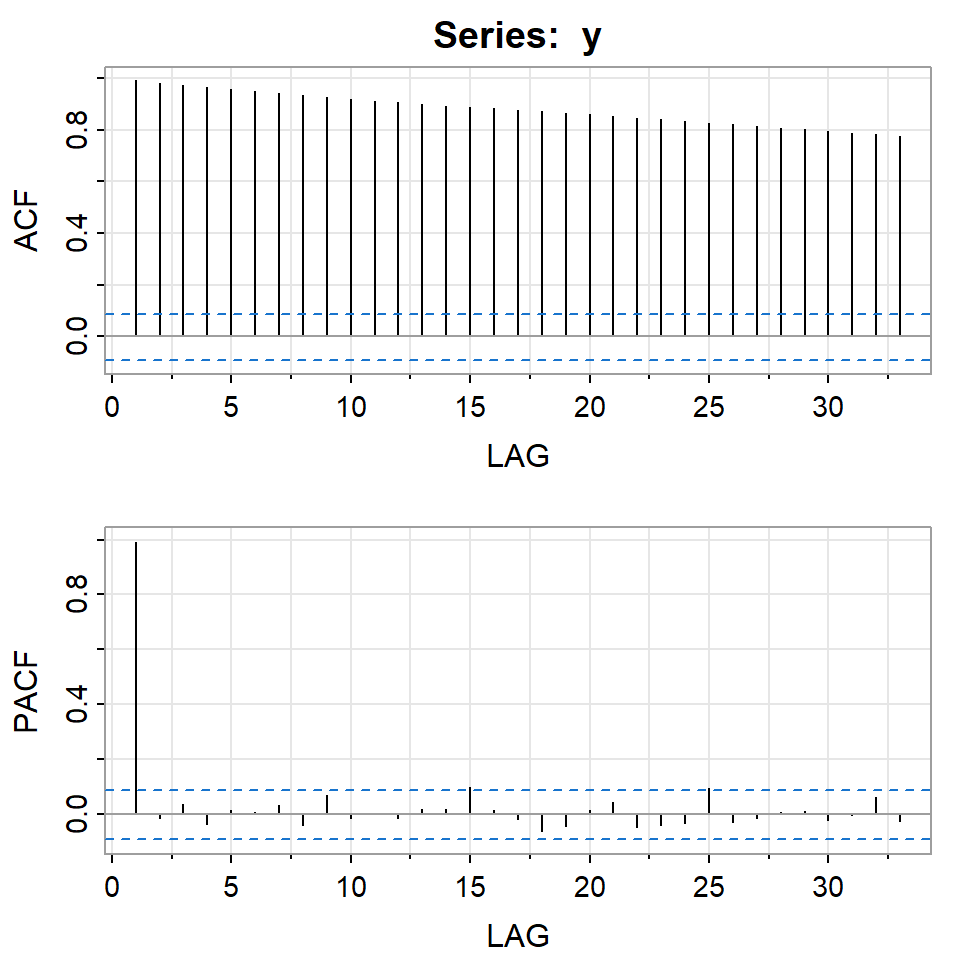

acf2(y)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.99 0.98 0.97 0.97 0.96 0.95 0.94 0.93 0.93 0.92 0.91 0.91 0.90

PACF 0.99 -0.02 0.04 -0.04 0.01 0.01 0.03 -0.04 0.07 -0.02 0.00 -0.02 0.02

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF 0.89 0.89 0.88 0.88 0.87 0.87 0.86 0.85 0.85 0.84 0.83 0.83

PACF 0.02 0.10 0.02 -0.02 -0.06 -0.04 0.01 0.04 -0.05 -0.04 -0.03 0.09

[,26] [,27] [,28] [,29] [,30] [,31] [,32] [,33]

ACF 0.82 0.81 0.81 0.80 0.79 0.79 0.78 0.78

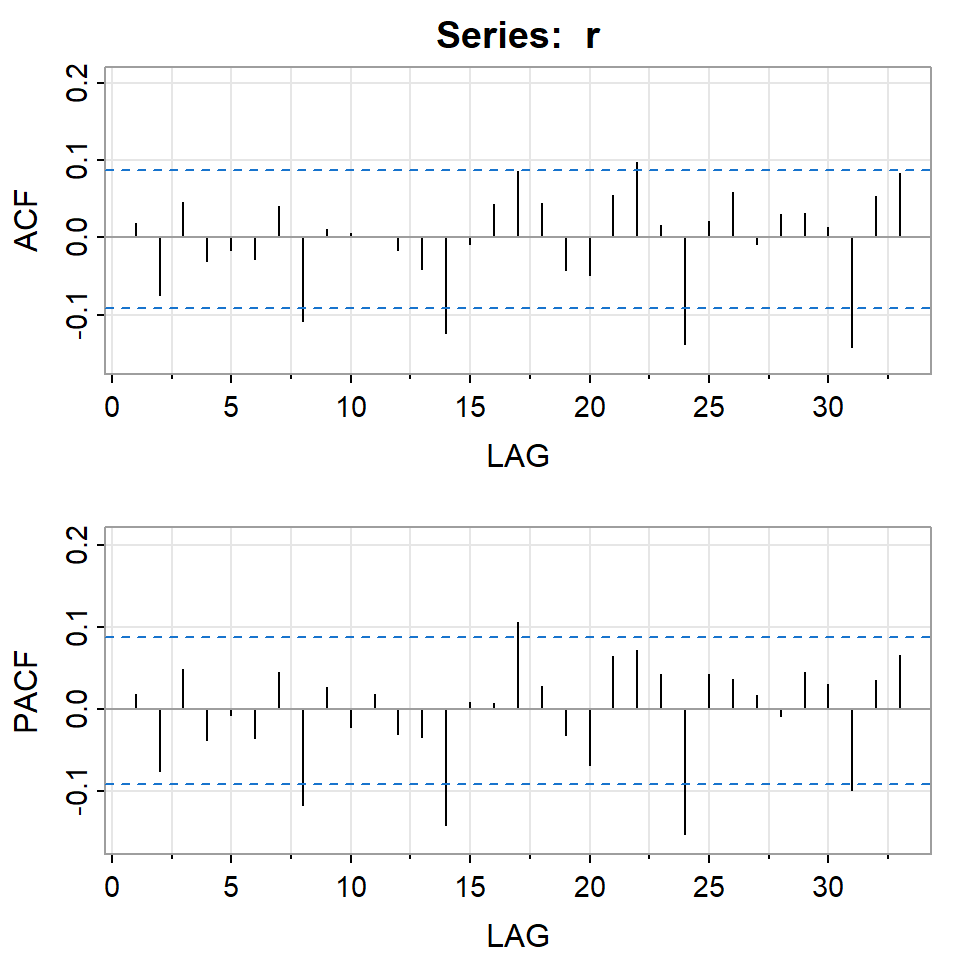

PACF -0.03 -0.02 0.01 0.01 -0.02 -0.01 0.06 -0.02acf2(r)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.02 -0.07 0.05 -0.03 -0.02 -0.03 0.04 -0.11 0.01 0.01 0.00 -0.02 -0.04

PACF 0.02 -0.08 0.05 -0.04 -0.01 -0.04 0.04 -0.12 0.03 -0.02 0.02 -0.03 -0.03

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF -0.12 -0.01 0.04 0.09 0.05 -0.04 -0.05 0.05 0.10 0.02 -0.14 0.02

PACF -0.14 0.01 0.01 0.11 0.03 -0.03 -0.07 0.06 0.07 0.04 -0.15 0.04

[,26] [,27] [,28] [,29] [,30] [,31] [,32] [,33]

ACF 0.06 -0.01 0.03 0.03 0.01 -0.14 0.05 0.08

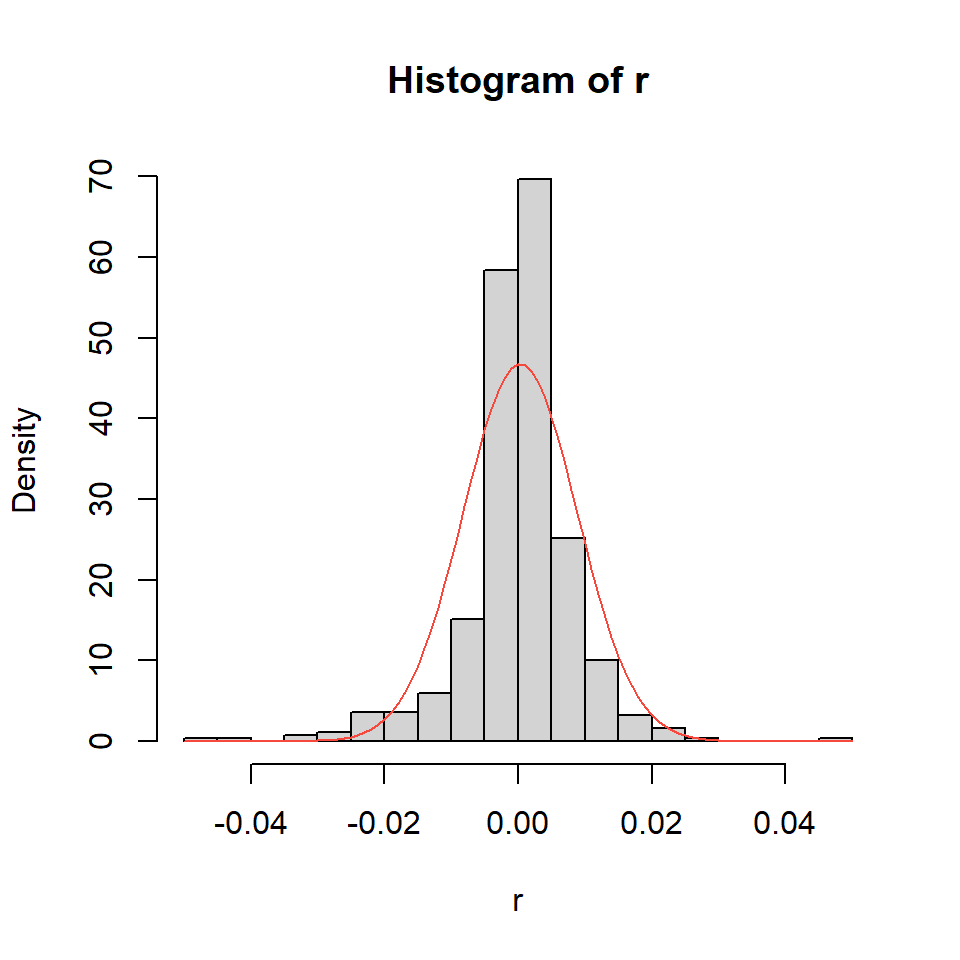

PACF 0.04 0.02 -0.01 0.04 0.03 -0.10 0.04 0.07- Los retornos tienen colas pesadas y son asimétricos.

hist(r,breaks=25,freq=FALSE)

curve(dnorm(x,mean(r,na.rm = T),sd(r,na.rm = TRUE)),add=T,col=2)

2.2 auto.arima

- Empezamos con un modelo ARMA.

auto_arima <- auto.arima(r)

summary(auto_arima)Series: r

ARIMA(1,0,1) with zero mean

Coefficients:

ar1 ma1

-0.8620 0.9465

s.e. 0.0412 0.0250

sigma^2 = 7.115e-05: log likelihood = 1679.09

AIC=-3352.18 AICc=-3352.14 BIC=-3339.54

Training set error measures:

ME RMSE MAE MPE MAPE MASE

Training set 0.0002870584 0.008418193 0.005530544 97.79074 159.9398 0.7157715

ACF1

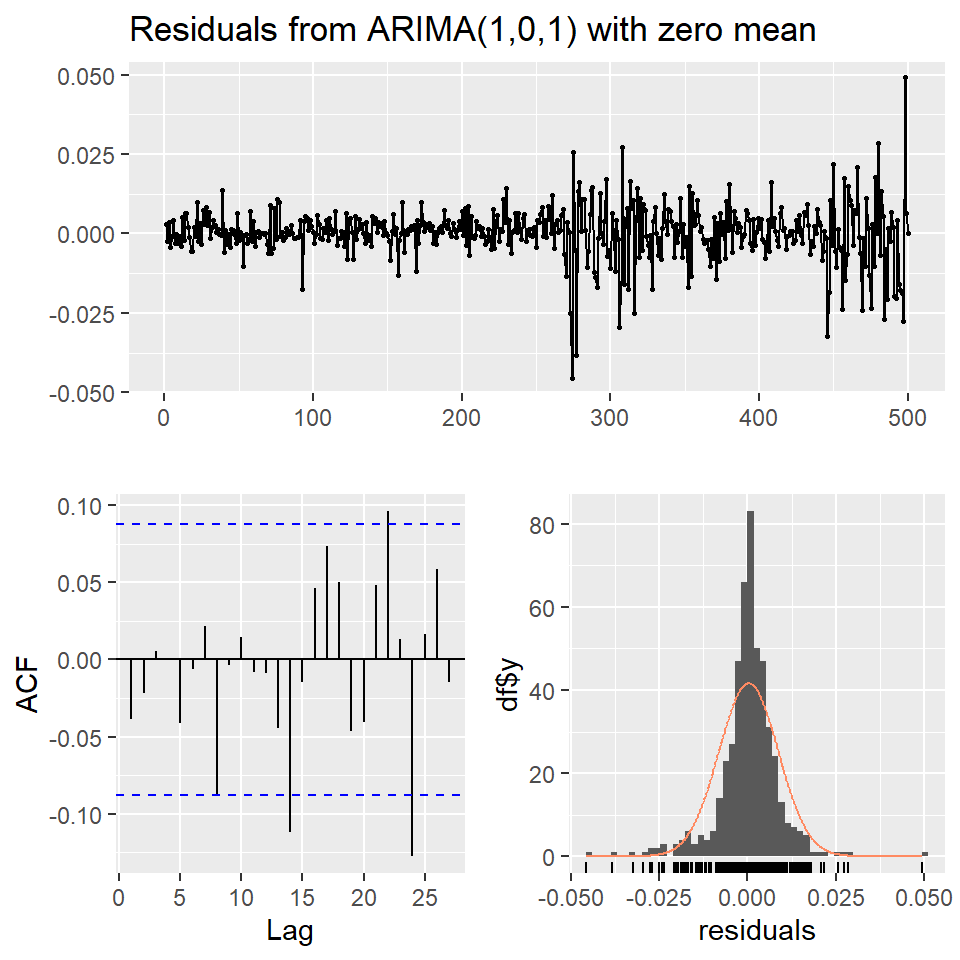

Training set -0.03871362checkresiduals(auto_arima)

Ljung-Box test

data: Residuals from ARIMA(1,0,1) with zero mean

Q* = 6.1604, df = 8, p-value = 0.6293

Model df: 2. Total lags used: 10residuals<-auto_arima$res

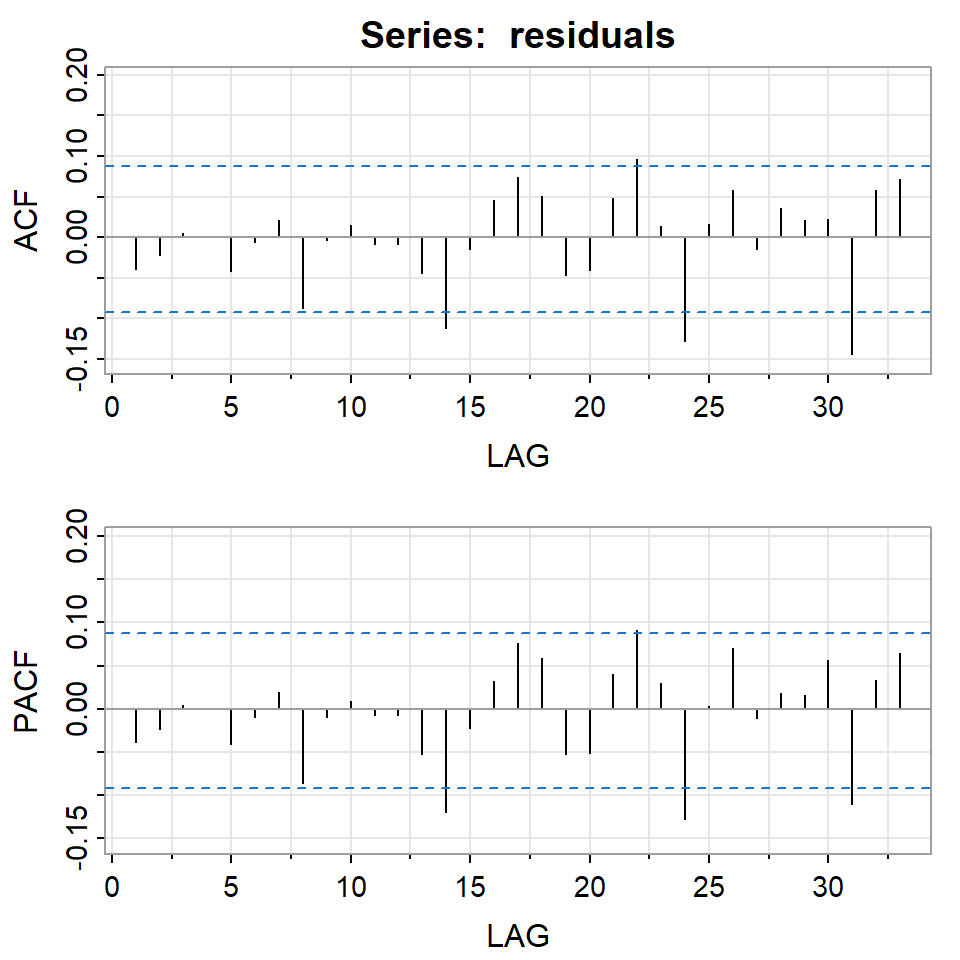

acf2(residuals)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF -0.04 -0.02 0.01 0 -0.04 -0.01 0.02 -0.09 0.00 0.01 -0.01 -0.01 -0.04

PACF -0.04 -0.02 0.00 0 -0.04 -0.01 0.02 -0.09 -0.01 0.01 -0.01 -0.01 -0.05

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF -0.11 -0.01 0.05 0.07 0.05 -0.05 -0.04 0.05 0.10 0.01 -0.13 0.02

PACF -0.12 -0.02 0.03 0.08 0.06 -0.05 -0.05 0.04 0.09 0.03 -0.13 0.00

[,26] [,27] [,28] [,29] [,30] [,31] [,32] [,33]

ACF 0.06 -0.01 0.04 0.02 0.02 -0.14 0.06 0.07

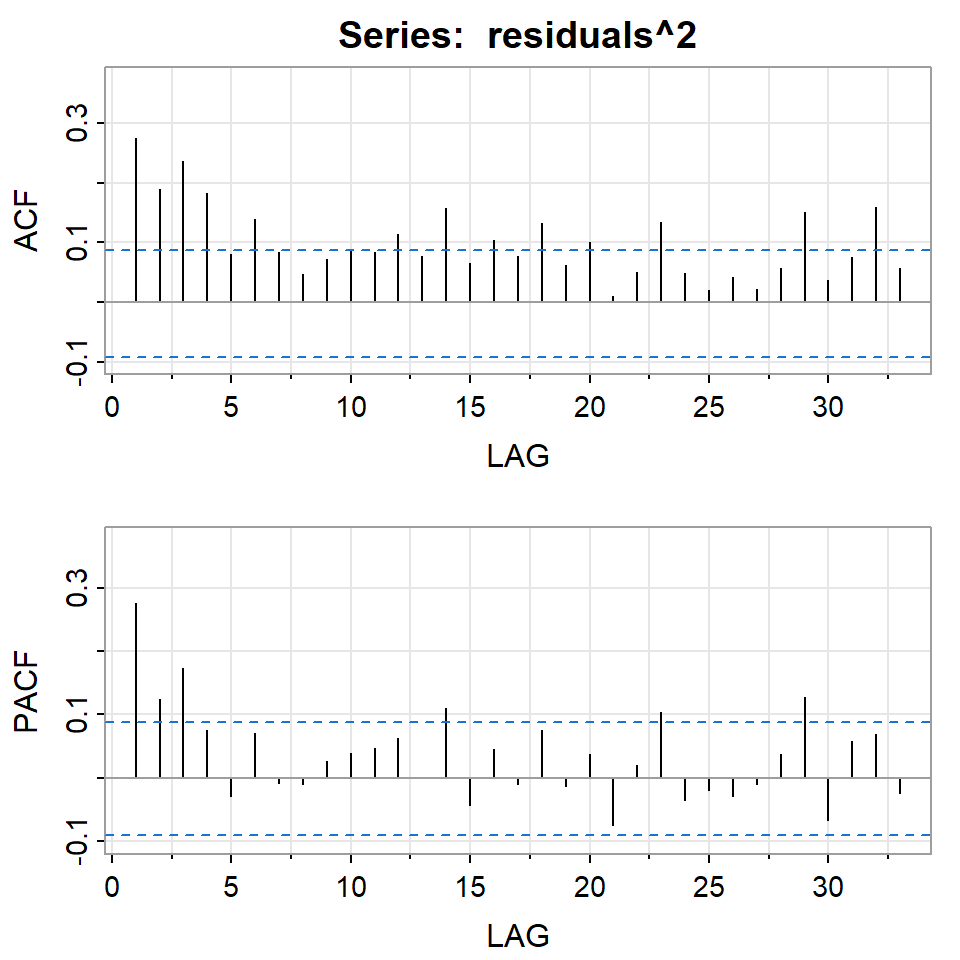

PACF 0.07 -0.01 0.02 0.02 0.06 -0.11 0.03 0.06acf2(residuals^2)

[,1] [,2] [,3] [,4] [,5] [,6] [,7] [,8] [,9] [,10] [,11] [,12] [,13]

ACF 0.28 0.19 0.24 0.18 0.08 0.14 0.08 0.05 0.07 0.09 0.08 0.11 0.08

PACF 0.28 0.12 0.17 0.08 -0.03 0.07 -0.01 -0.01 0.03 0.04 0.05 0.06 0.00

[,14] [,15] [,16] [,17] [,18] [,19] [,20] [,21] [,22] [,23] [,24] [,25]

ACF 0.16 0.07 0.10 0.08 0.13 0.06 0.10 0.01 0.05 0.13 0.05 0.02

PACF 0.11 -0.04 0.04 -0.01 0.08 -0.01 0.04 -0.08 0.02 0.10 -0.04 -0.02

[,26] [,27] [,28] [,29] [,30] [,31] [,32] [,33]

ACF 0.04 0.02 0.06 0.15 0.04 0.08 0.16 0.06

PACF -0.03 -0.01 0.04 0.13 -0.07 0.06 0.07 -0.03Hay autocorrelación de los residuales al cuadrado.

Indicación de que hay variabilidad condicional.

2.3 ARMA(1,1)+ARCH(1)

arma.arch1 <- garchFit(r~arma(1,1)+garch(1,0), data=r,trace=F)

round(arma.arch1@fit$matcoef, 4) Estimate Std. Error t value Pr(>|t|)

mu 0.0008 0.0006 1.2336 0.2173

ar1 -0.8282 0.0505 -16.3953 0.0000

ma1 0.9204 0.0365 25.2337 0.0000

omega 0.0000 0.0000 11.8647 0.0000

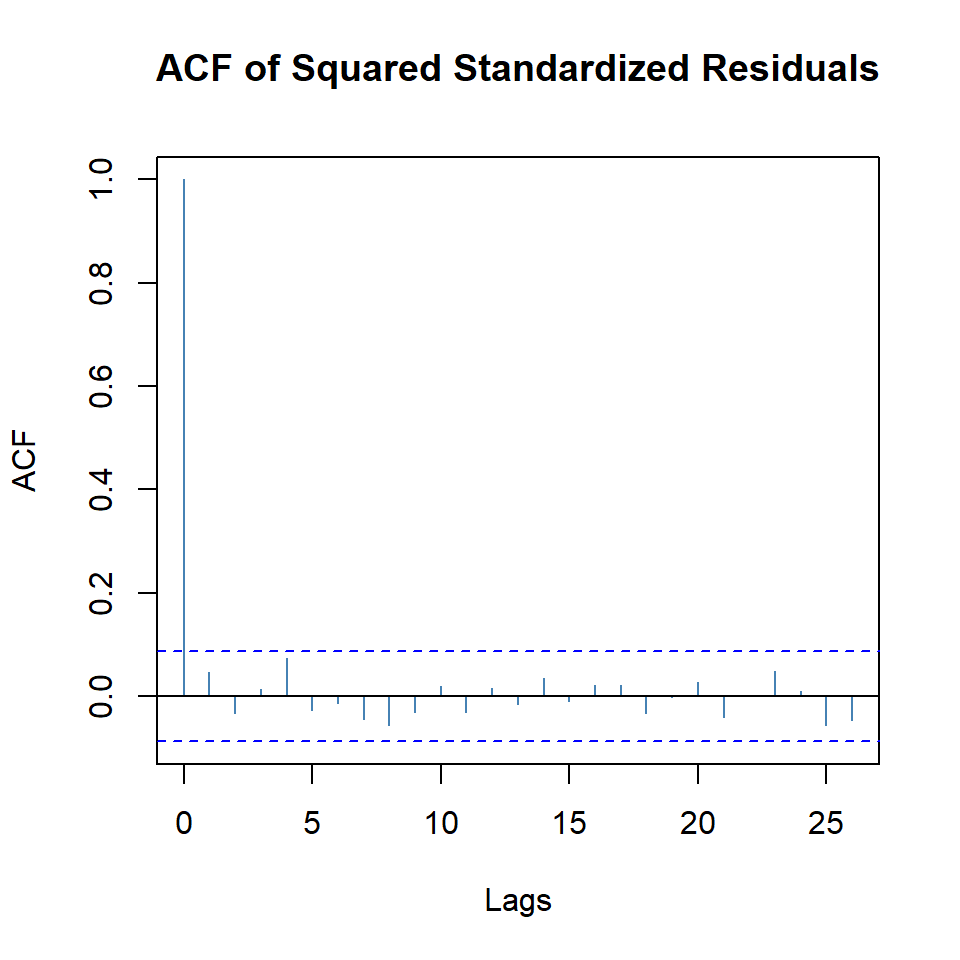

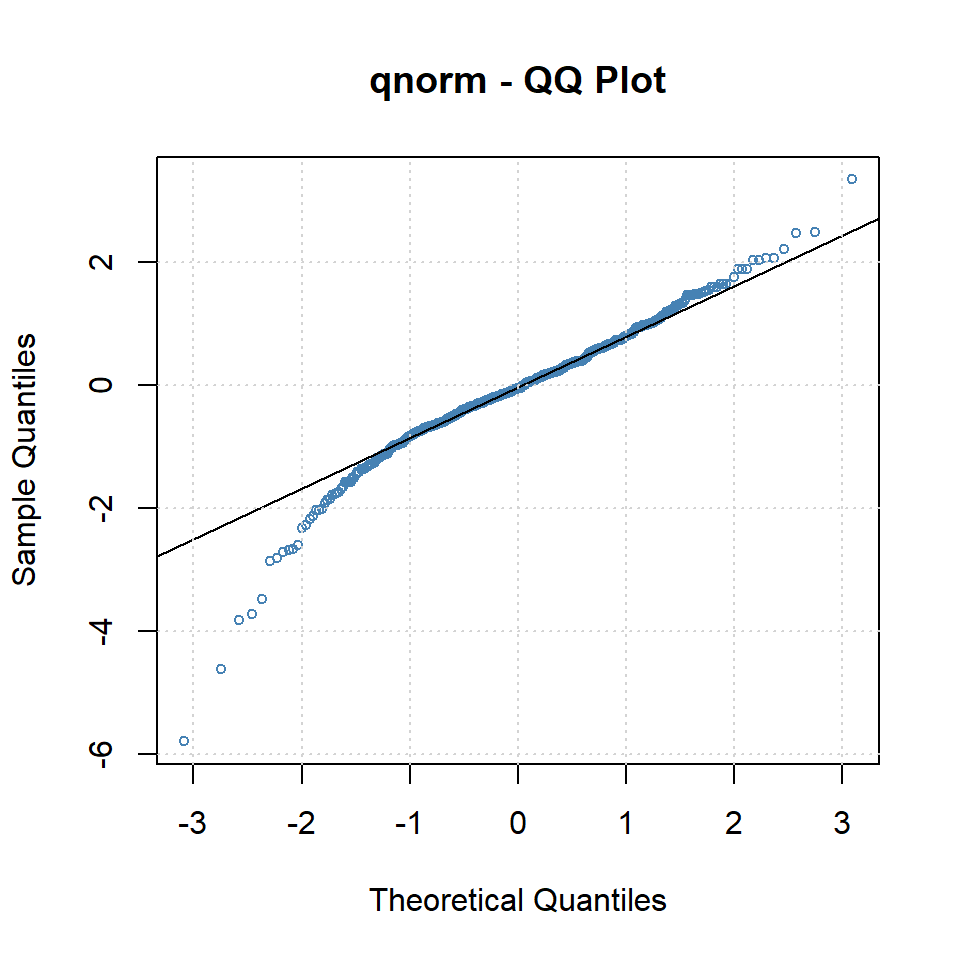

alpha1 0.3820 0.0874 4.3736 0.0000plot(arma.arch1,which=10)

plot(arma.arch1,which=11)

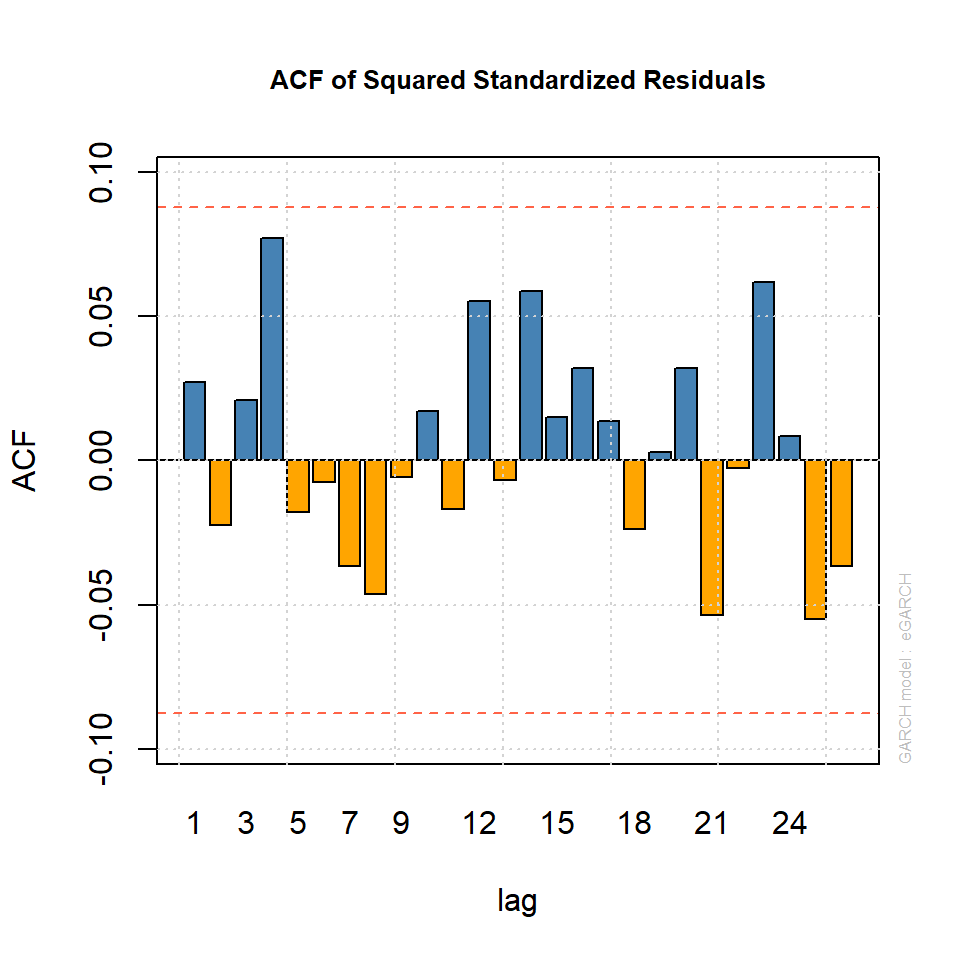

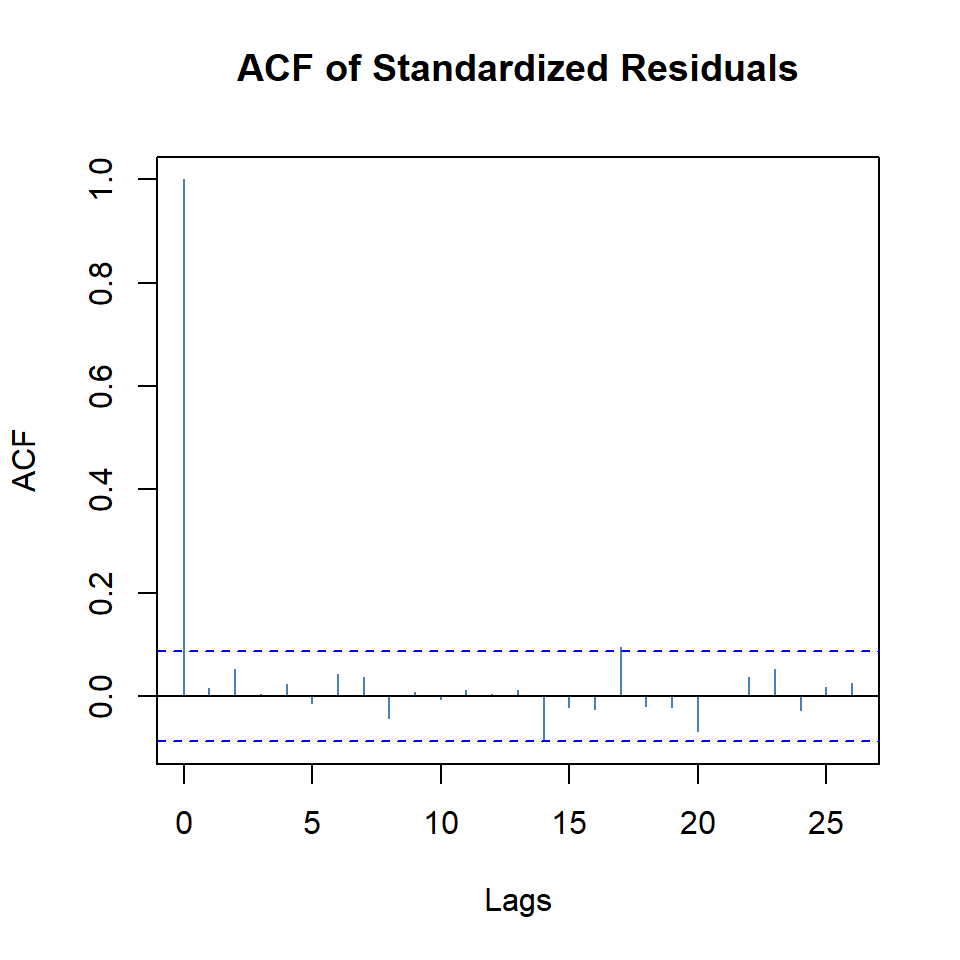

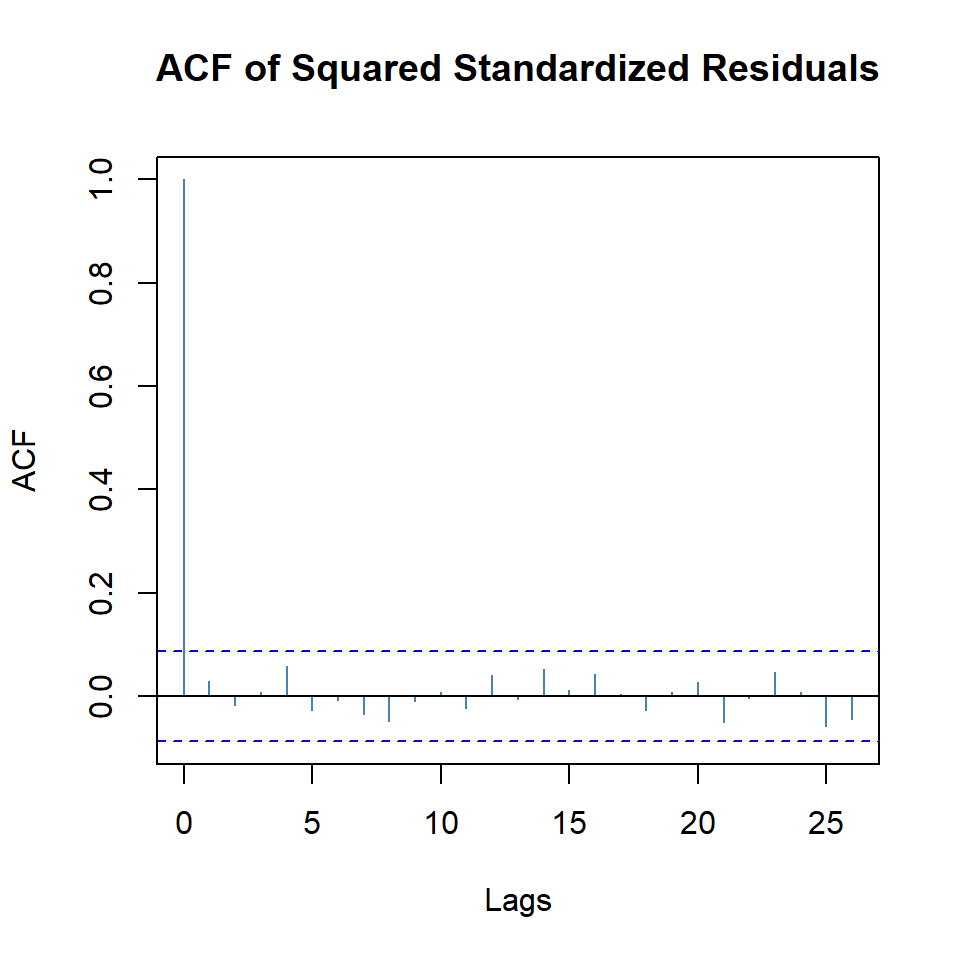

- Note que todavía existe autocorrelación de los residuales al cuadrado.

2.4 ARMA(1,1)+GARCH(1,1)

arma.garch11 <- garchFit(r~arma(1,1)+garch(1,1), data=r,trace=F)

round(arma.garch11@fit$matcoef, 4) Estimate Std. Error t value Pr(>|t|)

mu 0.0015 0.0007 2.2800 0.0226

ar1 -0.5869 0.5305 -1.1062 0.2686

ma1 0.5889 0.5449 1.0808 0.2798

omega 0.0000 0.0000 2.2750 0.0229

alpha1 0.1598 0.0400 3.9919 0.0001

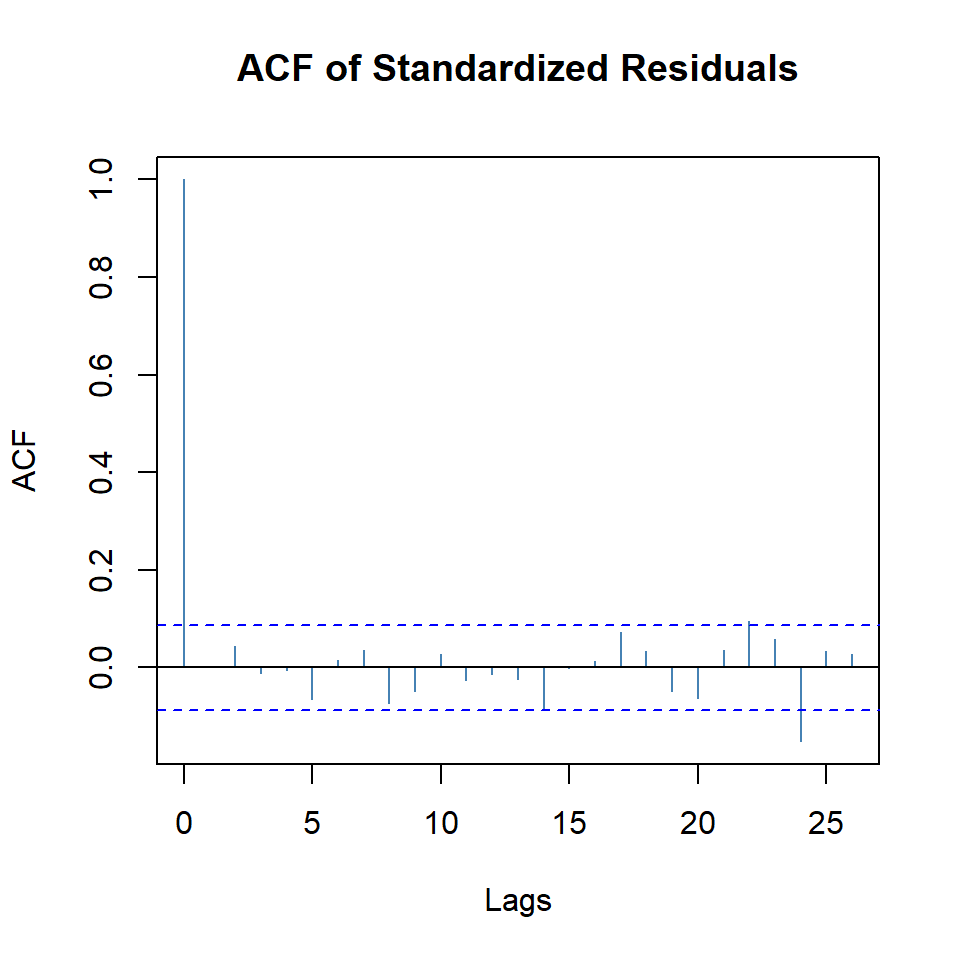

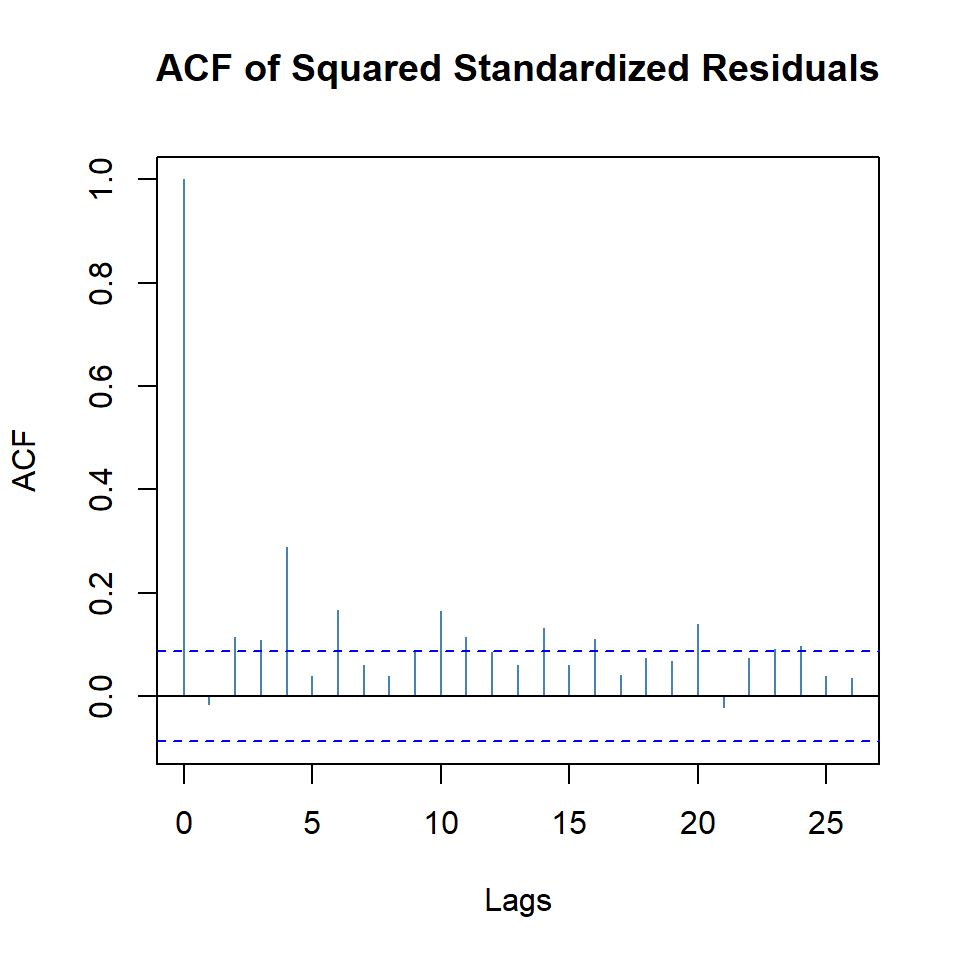

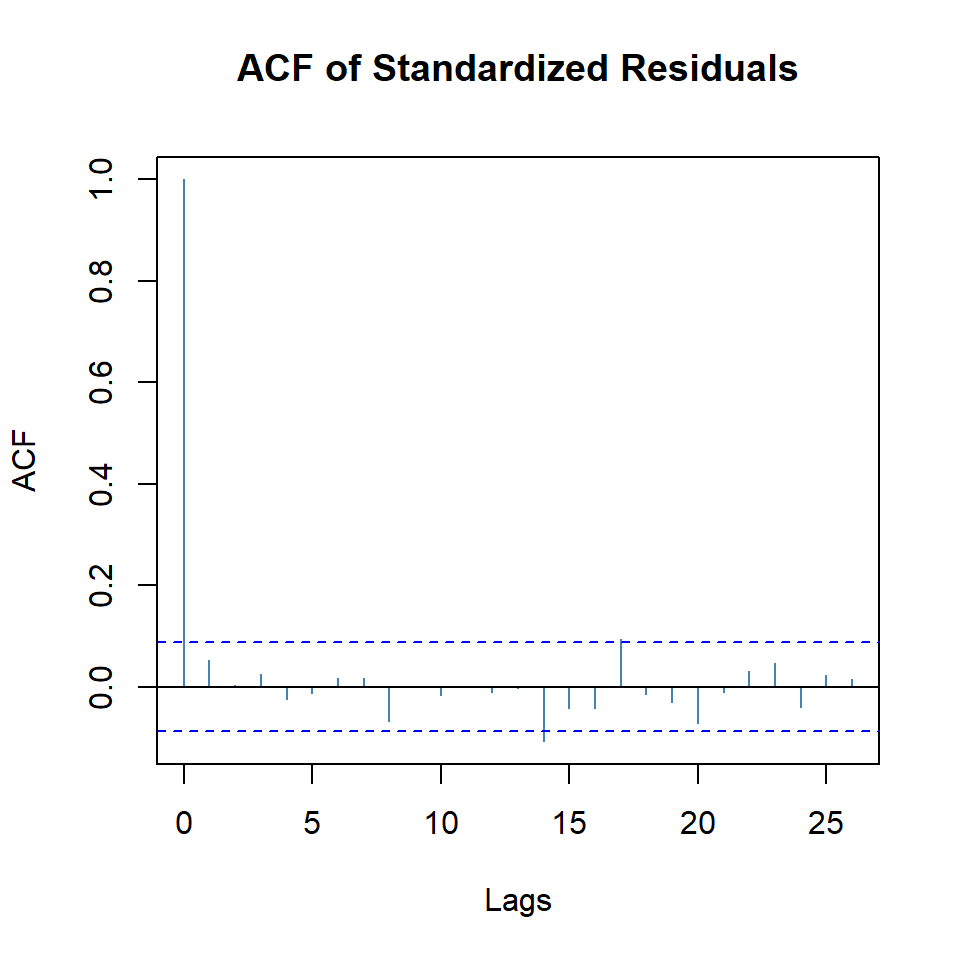

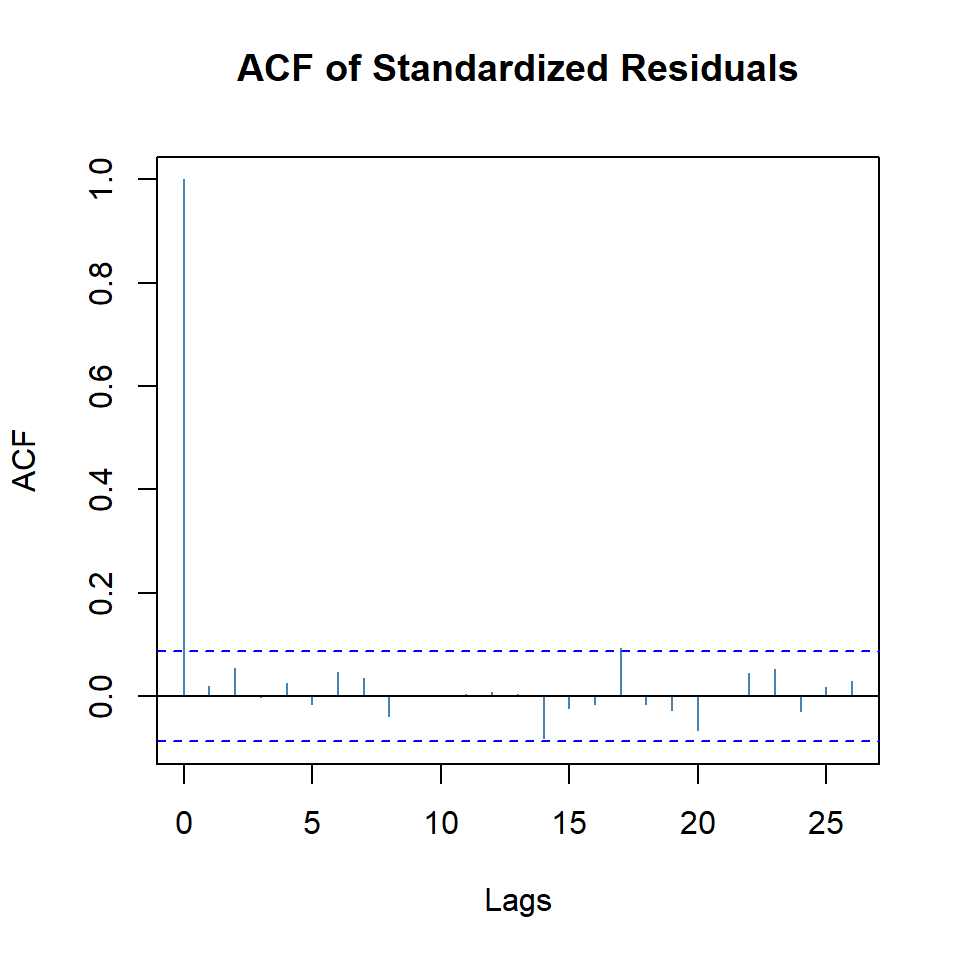

beta1 0.8281 0.0431 19.2312 0.0000plot(arma.garch11,which=10)

plot(arma.garch11,which=11)

:::

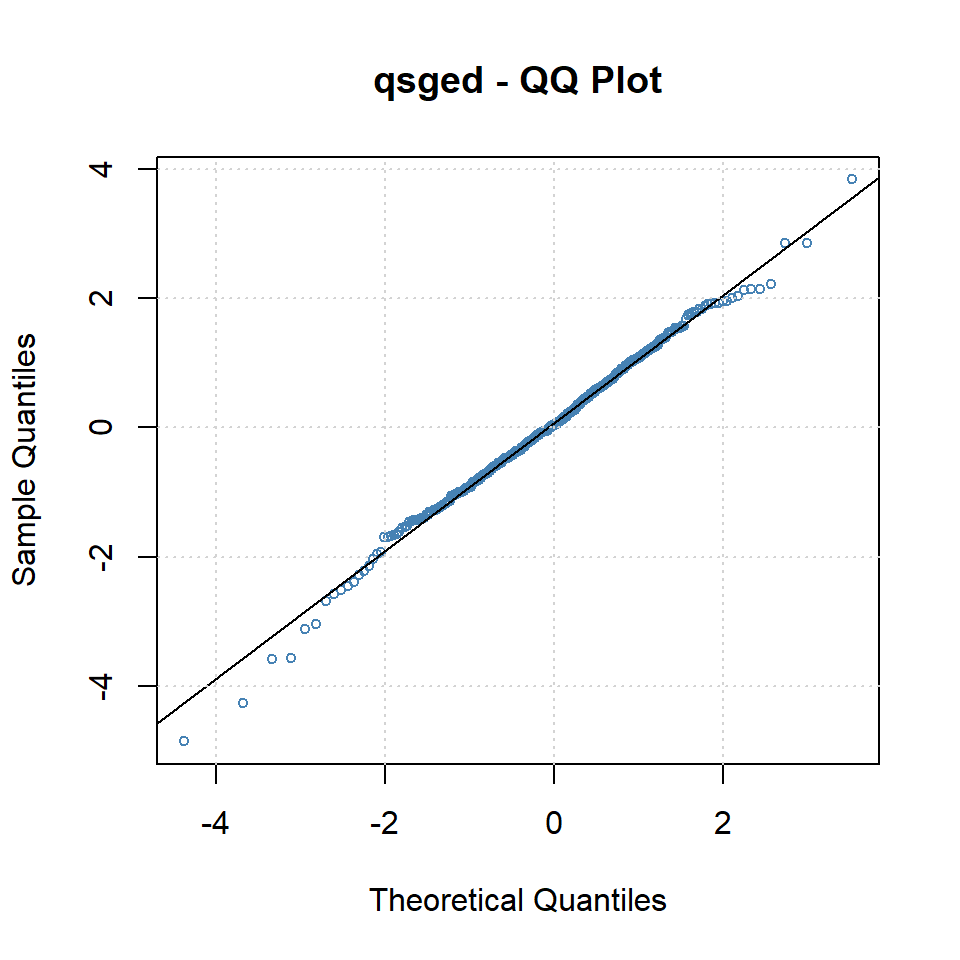

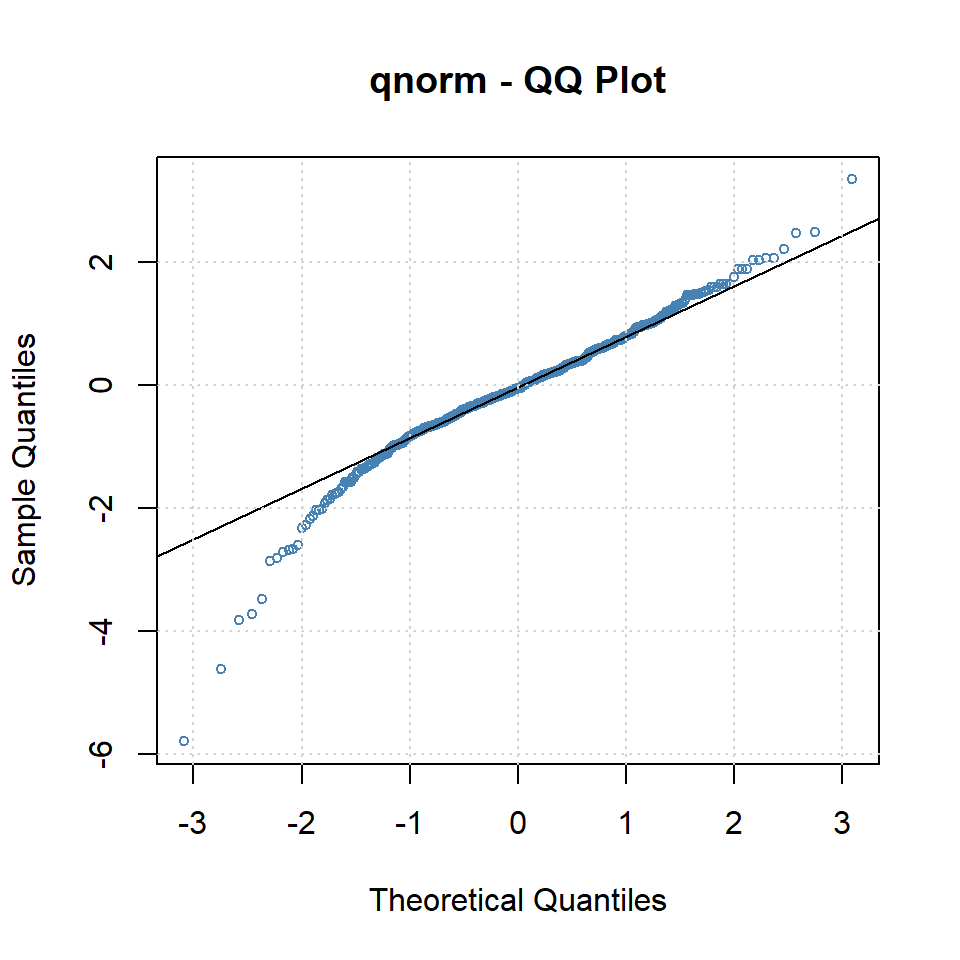

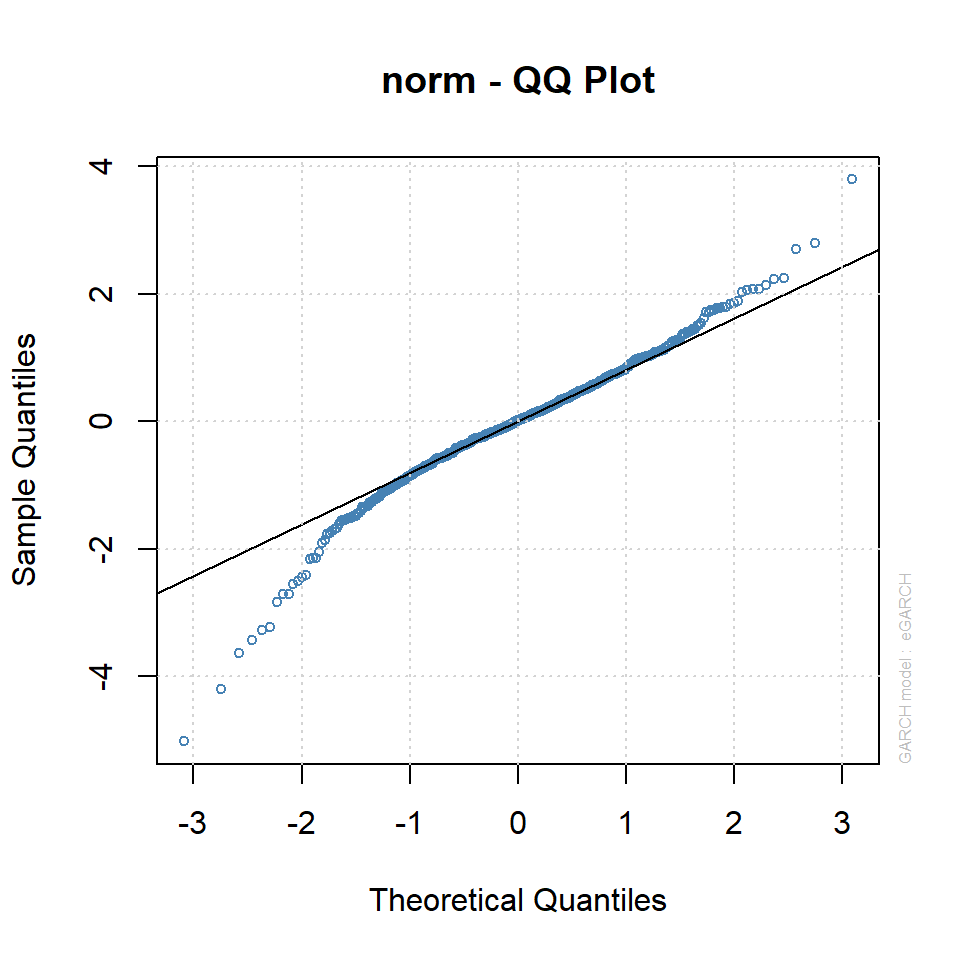

plot(arma.garch11,which=13)

- Note que no existe autocorrelación de los residuales al cuadrado, pero los residuales no son normales.

- El modelo está bien, pero hay coeficientes no significativos.

- Procedemos a eliminarlos.

2.5 GARCH(1,1)

garch11 <- garchFit(r~garch(1,1), data=r,trace=F)

round(garch11@fit$matcoef, 4) Estimate Std. Error t value Pr(>|t|)

mu 0.0010 0.0003 3.6563 0.0003

omega 0.0000 0.0000 2.2971 0.0216

alpha1 0.1594 0.0397 4.0151 0.0001

beta1 0.8285 0.0426 19.4699 0.0000- Comparando los criterios de información, el modelo reducido es mejor.

garch11@fit$ics AIC BIC SIC HQIC

-7.151073 -7.117356 -7.151200 -7.137843 arma.garch11@fit$ics AIC BIC SIC HQIC

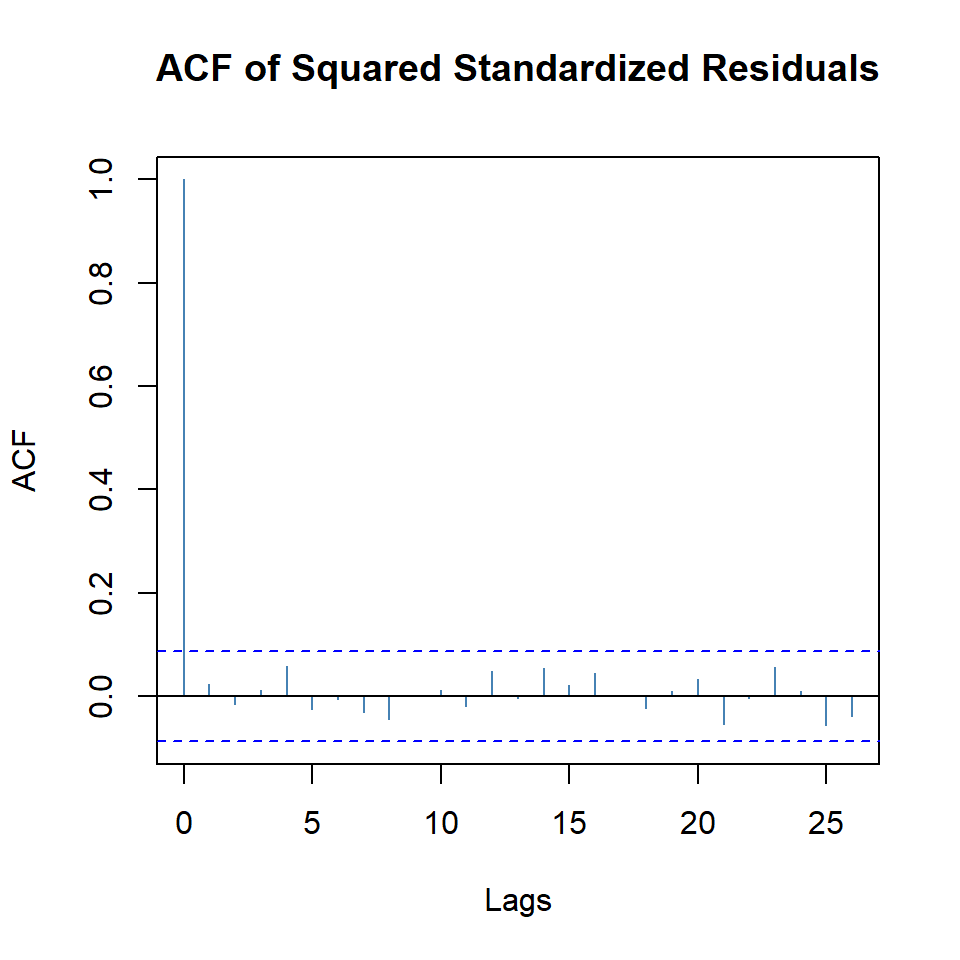

-7.143874 -7.093298 -7.144157 -7.124028 plot(garch11, which = 10)

plot(garch11, which = 11)

plot(arma.garch11,which=13)

- El modelo GARCH(1,1) va ganando, pero la normalidad no se cumple.

2.6 T-GARCH

- Empezamos con TGARCH con valor absoluto,

delta=1.

tgarch11.1 = garchFit(r~garch(1,1),delta=1,leverage=T,data=r,trace=F,include.mean=F)

arma.tgarch11.1 = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,data=r,trace=F,include.mean=F)- Empezamos con TGARCH con cuadrado,

delta=2.

tgarch11.2 = garchFit(r~garch(1,1),delta=2,leverage=T,data=r,trace=F,include.mean=F)

arma.tgarch11.2 = garchFit(r~arma(1,1)+garch(1,1),delta=2,leverage=T,data=r,trace=F,include.mean=F)garch11@fit$ics AIC BIC SIC HQIC

-7.151073 -7.117356 -7.151200 -7.137843 tgarch11.1@fit$ics AIC BIC SIC HQIC

-7.123718 -7.090002 -7.123845 -7.110488 arma.tgarch11.1@fit$ics AIC BIC SIC HQIC

-7.199735 -7.149160 -7.200019 -7.179890 tgarch11.2@fit$ics AIC BIC SIC HQIC

-7.173335 -7.139618 -7.173461 -7.160104 arma.tgarch11.2@fit$ics AIC BIC SIC HQIC

-7.166148 -7.115572 -7.166431 -7.146302 - El modelo ganador es

arma.tgarch11.1

round(arma.tgarch11.1@fit$matcoef, 4) Estimate Std. Error t value Pr(>|t|)

ar1 -0.8429 0.0667 -12.6414 0

ma1 0.8996 0.0596 15.0830 0

omega 0.0005 0.0001 4.4732 0

alpha1 0.1494 0.0292 5.1203 0

gamma1 0.7858 0.1627 4.8302 0

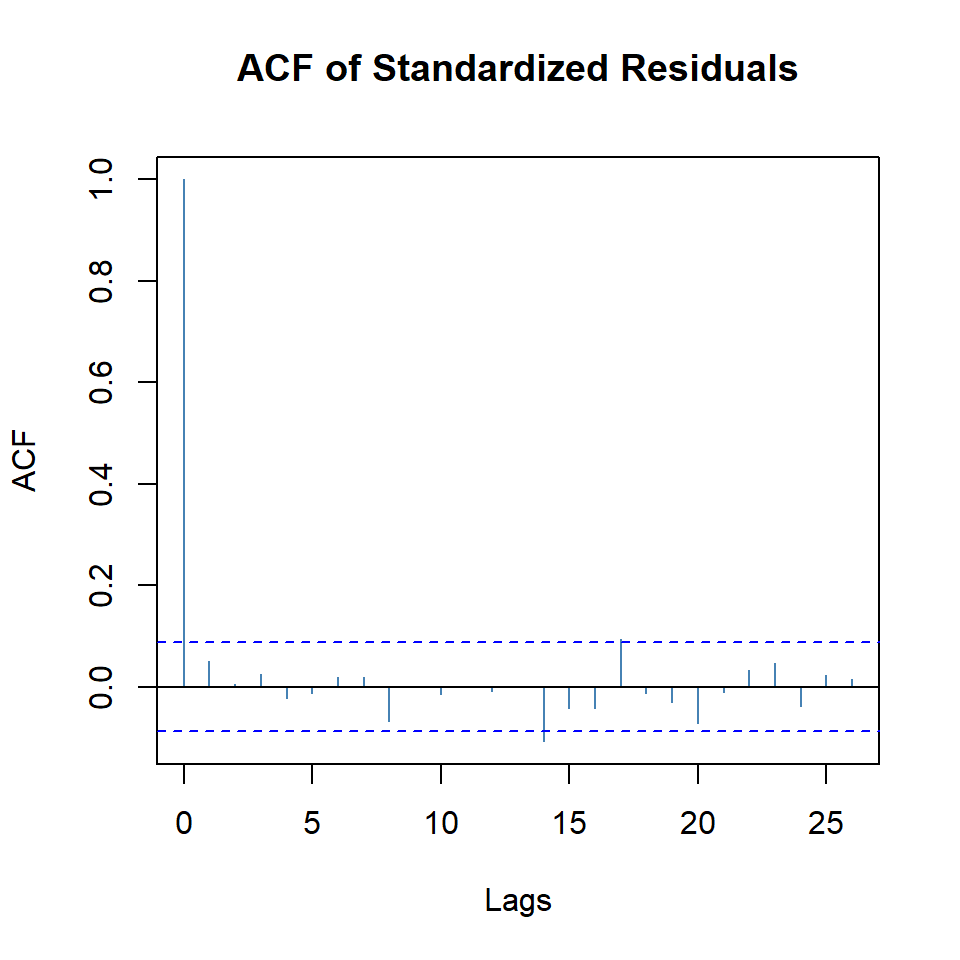

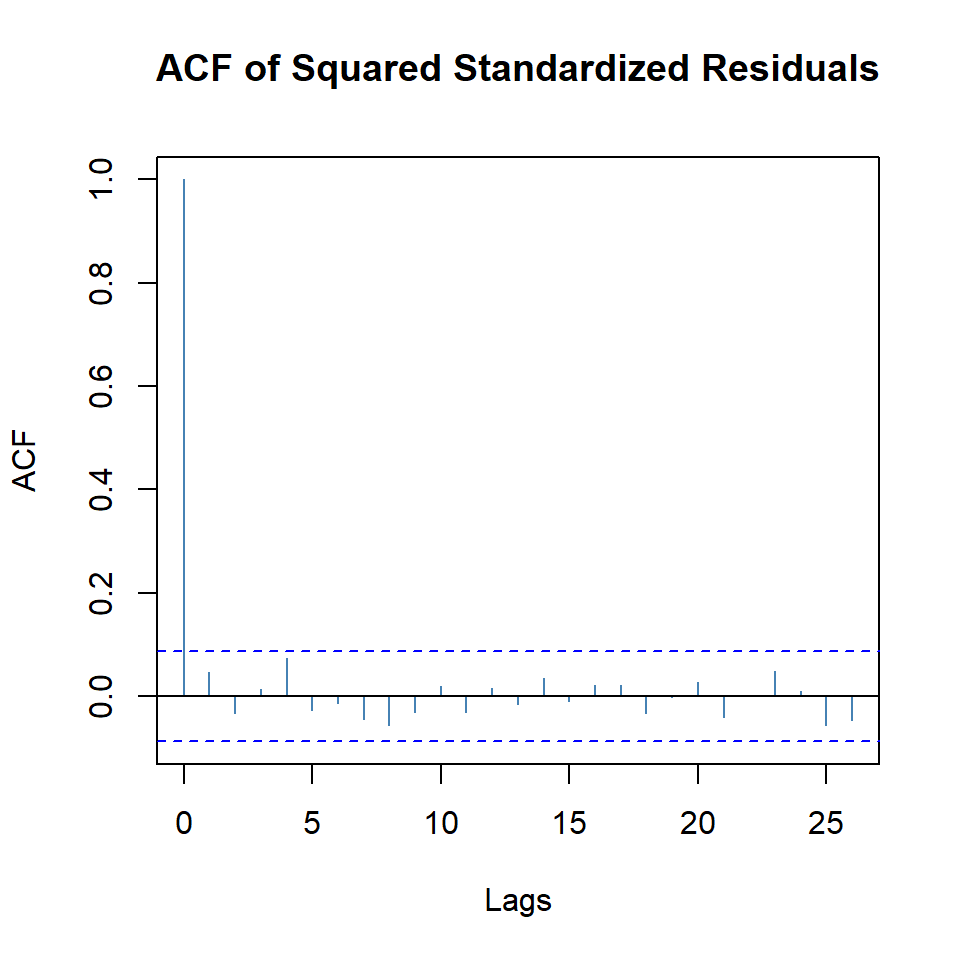

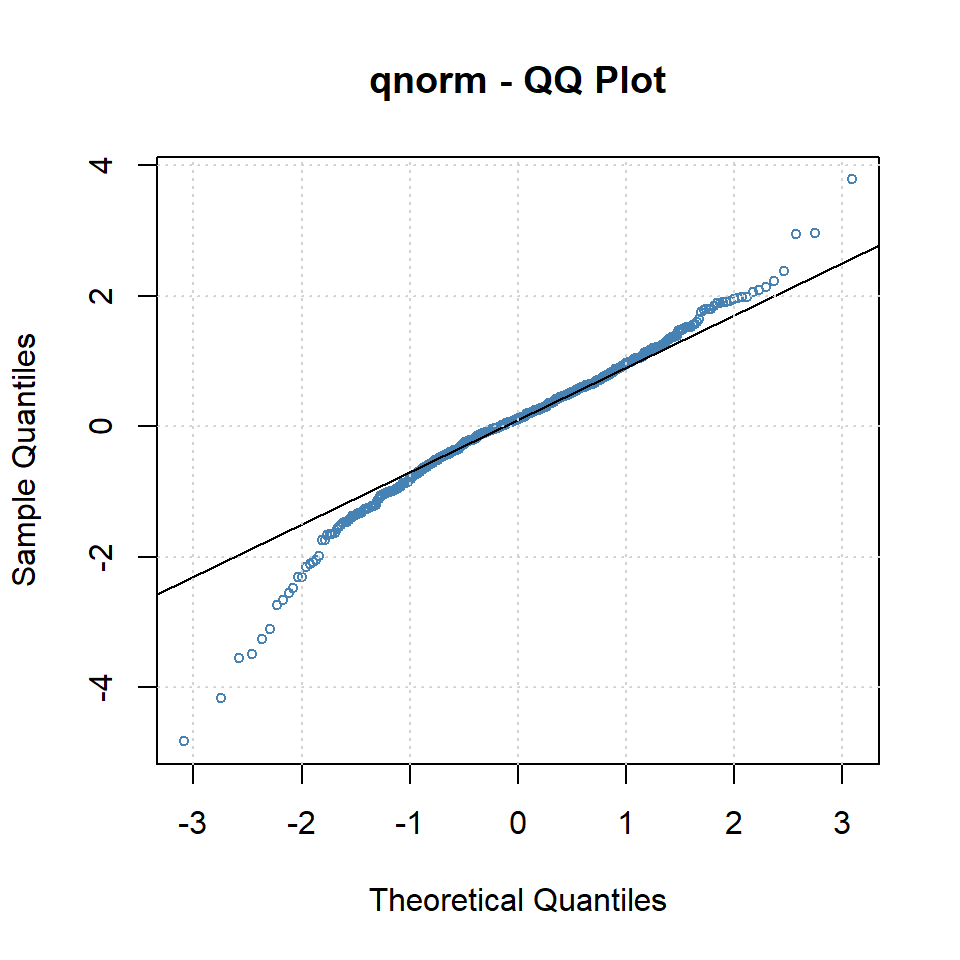

beta1 0.8284 0.0297 27.9142 0plot(arma.tgarch11.1, which = 10)

plot(arma.tgarch11.1, which = 11)

plot(arma.tgarch11.1,which=13)

2.7 EGARCH

egarch11=ugarchfit(ugarchspec(mean.model=list(armaOrder=c(1,1)),

variance.model=list(model="eGARCH",garchOrder=c(1,1),

submodel=NULL,external.regressors=NULL, variance.targeting = FALSE)),r)

round(egarch11@fit$matcoef,4) Estimate Std. Error t value Pr(>|t|)

mu 0.0007 0.0004 1.8398 0.0658

ar1 -0.9057 0.0215 -42.0812 0.0000

ma1 0.9470 0.0170 55.8450 0.0000

omega -0.5505 0.0490 -11.2374 0.0000

alpha1 -0.1584 0.0292 -5.4328 0.0000

beta1 0.9435 0.0051 183.8661 0.0000

gamma1 0.2534 0.0421 6.0259 0.0000infocriteria(egarch11)

Akaike -7.175679

Bayes -7.116675

Shibata -7.176064

Hannan-Quinn -7.152526plot(egarch11, which=11)

plot(egarch11, which=9)

- Todo parece indicar que TGARCH tiene mejor ajuste pero los residuales no son normales.

infocriteria(egarch11)

Akaike -7.175679

Bayes -7.116675

Shibata -7.176064

Hannan-Quinn -7.152526arma.tgarch11.1@fit$ics AIC BIC SIC HQIC

-7.199735 -7.149160 -7.200019 -7.179890 2.8 Intentos con otras distribuciones

arma.tgarch11.snorm = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,cond.dist="snorm",

data=r,trace=F,include.mean=F)

arma.tgarch11.ged = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,cond.dist="ged",

data=r,trace=F,include.mean=F)

arma.tgarch11.sged = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,cond.dist="sged",

data=r,trace=F,include.mean=F)

arma.tgarch11.std = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,cond.dist="std",

data=r,trace=F,include.mean=F)

arma.tgarch11.sstd = garchFit(r~arma(1,1)+garch(1,1),delta=1,leverage=T,cond.dist="sstd",

data=r,trace=F,include.mean=F)arma.tgarch11.snorm@fit$ics AIC BIC SIC HQIC

-7.220865 -7.161861 -7.221250 -7.197712 arma.tgarch11.ged@fit$ics AIC BIC SIC HQIC

-7.269333 -7.210328 -7.269717 -7.246179 arma.tgarch11.sged@fit$ics AIC BIC SIC HQIC

-7.285290 -7.217856 -7.285791 -7.258829 arma.tgarch11.std@fit$ics AIC BIC SIC HQIC

-7.268835 -7.209830 -7.269220 -7.245681 arma.tgarch11.sstd@fit$ics AIC BIC SIC HQIC

-7.282483 -7.215050 -7.282985 -7.256022 - El modelo ganador es

arma.tgarch11.sged.

round(arma.tgarch11.sged@fit$matcoef, 4) Estimate Std. Error t value Pr(>|t|)

ar1 -0.8105 0.1250 -6.4858 0.0000

ma1 0.8659 0.1257 6.8903 0.0000

omega 0.0004 0.0001 3.1025 0.0019

alpha1 0.1495 0.0399 3.7443 0.0002

gamma1 0.6927 0.2073 3.3415 0.0008

beta1 0.8383 0.0398 21.0874 0.0000

skew 0.8681 0.0450 19.3077 0.0000

shape 1.1957 0.1017 11.7524 0.0000plot(arma.tgarch11.sged, which = 10)

plot(arma.tgarch11.sged, which = 11)

plot(arma.tgarch11.sged, which = 13)