library(ggplot2)

library(forecast)

library(fpp2)

library(astsa)

library(car)

library(gamair)

library(mgcv)

library(dplyr)Tema IV: Regresión con series de tiempo

Curso: Análisis de series temporales

1 librerías

2 Modelo de Regresión

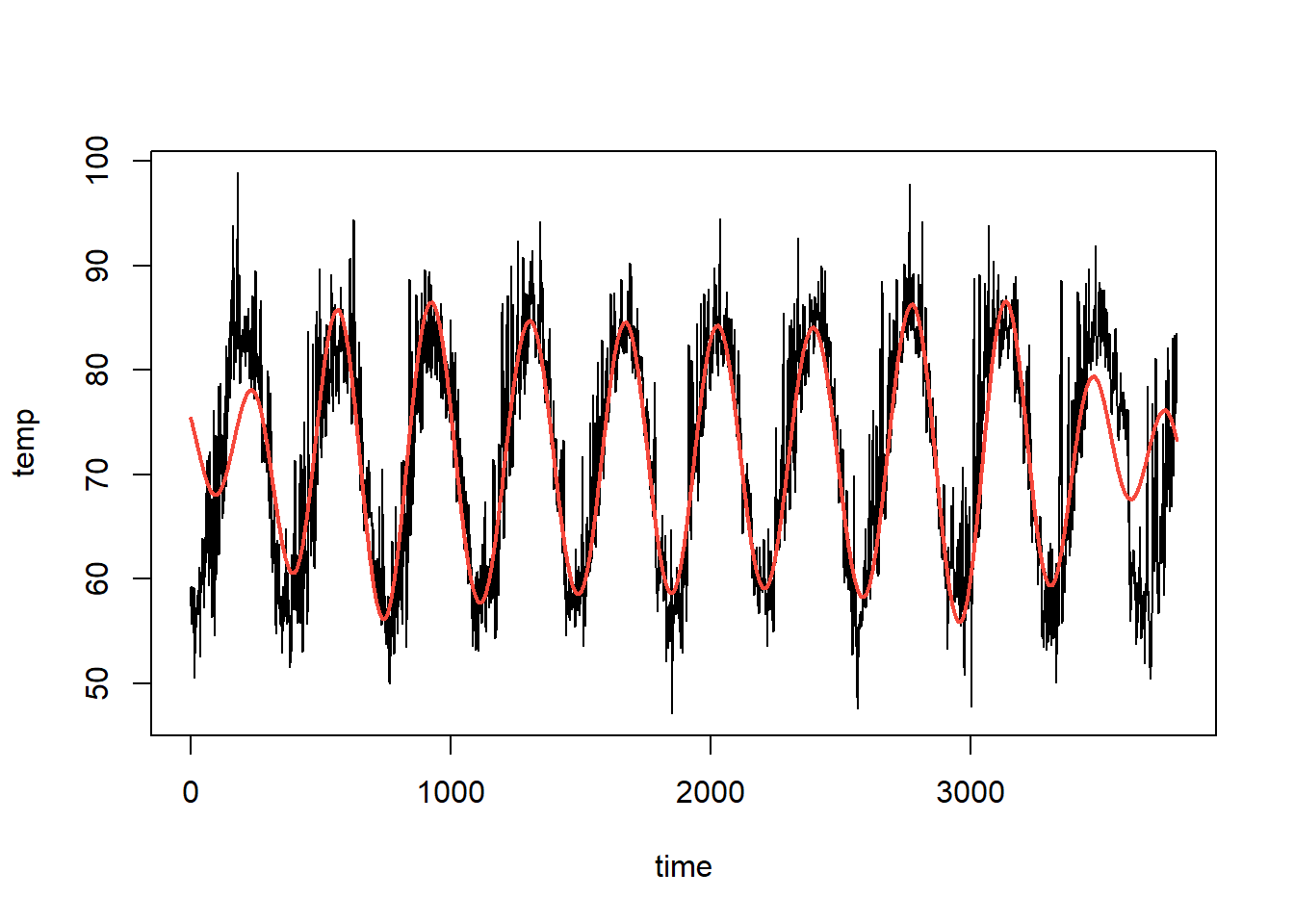

Cambios porcentuales trimestrales (tasas de crecimiento) del gasto de consumo personal real (Y) e ingresos disponibles(X), para EE.UU. desde 1970 a 2016.

data(uschange)

autoplot(uschange[,1:5], facets = TRUE, colour=TRUE) +

ylab("") + xlab("Year") +

guides(colour="none")

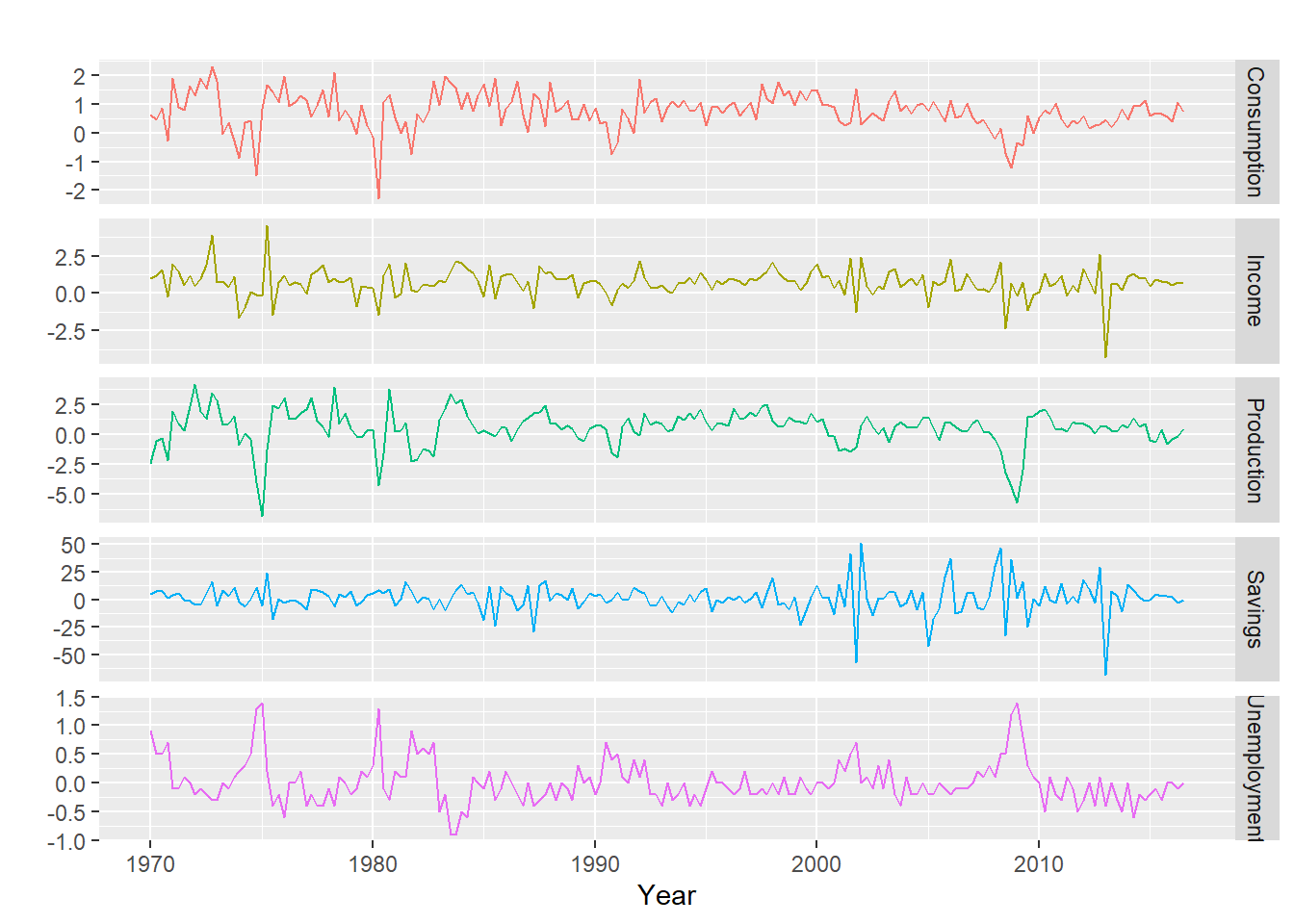

uschange %>%

as.data.frame() %>%

GGally::ggpairs()Registered S3 method overwritten by 'GGally':

method from

+.gg ggplot2

mod0 <- lm(

Consumption ~ Income + Production + Unemployment + Savings,

data=uschange)

summary(mod0)

Call:

lm(formula = Consumption ~ Income + Production + Unemployment +

Savings, data = uschange)

Residuals:

Min 1Q Median 3Q Max

-0.88296 -0.17638 -0.03679 0.15251 1.20553

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.26729 0.03721 7.184 1.68e-11 ***

Income 0.71449 0.04219 16.934 < 2e-16 ***

Production 0.04589 0.02588 1.773 0.0778 .

Unemployment -0.20477 0.10550 -1.941 0.0538 .

Savings -0.04527 0.00278 -16.287 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.3286 on 182 degrees of freedom

Multiple R-squared: 0.754, Adjusted R-squared: 0.7486

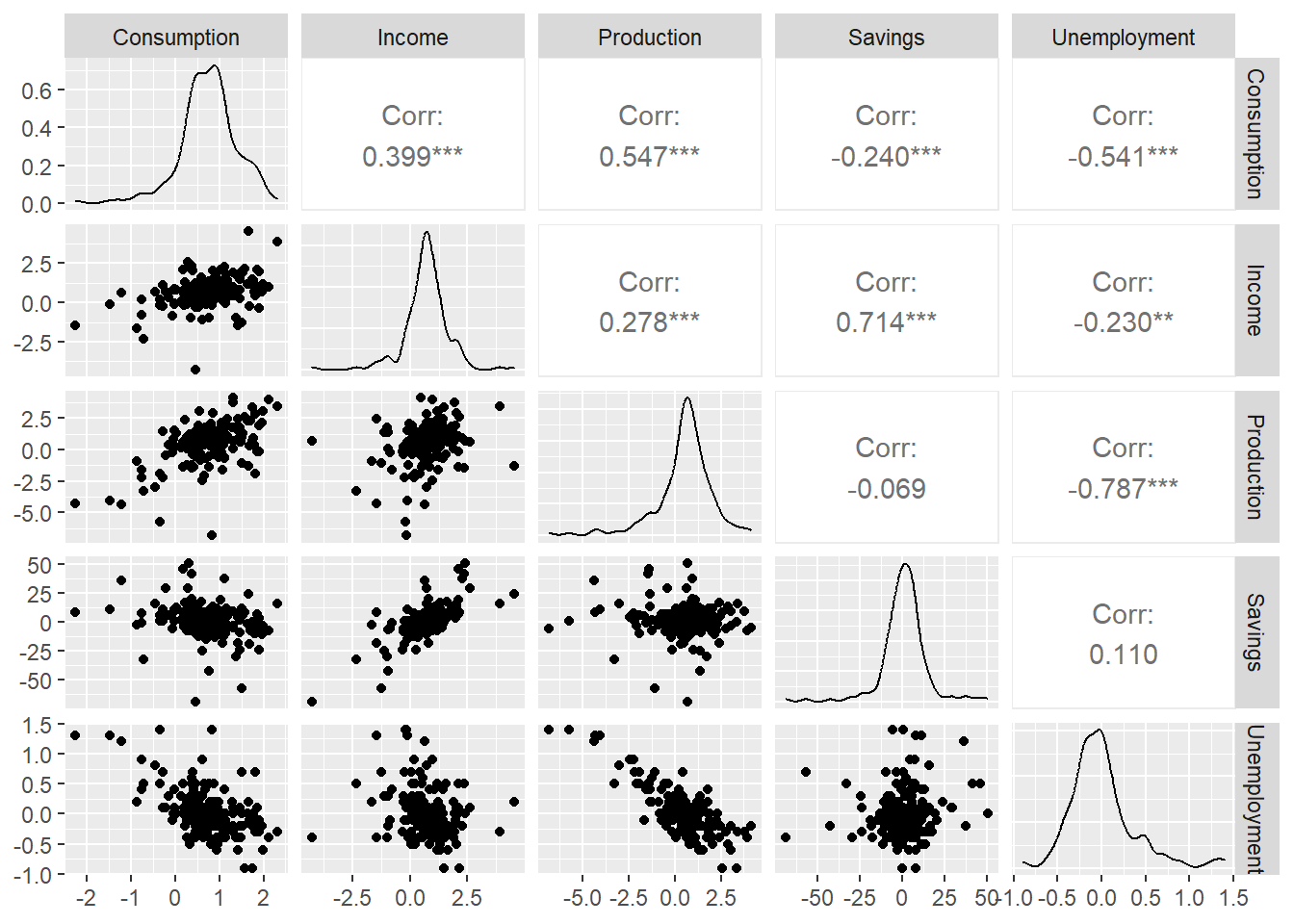

F-statistic: 139.5 on 4 and 182 DF, p-value: < 2.2e-16mod0 <- tslm(

Consumption ~ Income + Production + Unemployment + Savings,

data=uschange)

summary(mod0)

Call:

tslm(formula = Consumption ~ Income + Production + Unemployment +

Savings, data = uschange)

Residuals:

Min 1Q Median 3Q Max

-0.88296 -0.17638 -0.03679 0.15251 1.20553

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.26729 0.03721 7.184 1.68e-11 ***

Income 0.71449 0.04219 16.934 < 2e-16 ***

Production 0.04589 0.02588 1.773 0.0778 .

Unemployment -0.20477 0.10550 -1.941 0.0538 .

Savings -0.04527 0.00278 -16.287 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.3286 on 182 degrees of freedom

Multiple R-squared: 0.754, Adjusted R-squared: 0.7486

F-statistic: 139.5 on 4 and 182 DF, p-value: < 2.2e-16autoplot(uschange[,'Consumption'], series="Data") +

forecast::autolayer(fitted(mod0), series="Fitted") +

xlab("Year") + ylab("") +

ggtitle("Cambio porcentual de gastos de consumo en EE.UUU ") +

guides(colour=guide_legend(title=" "))

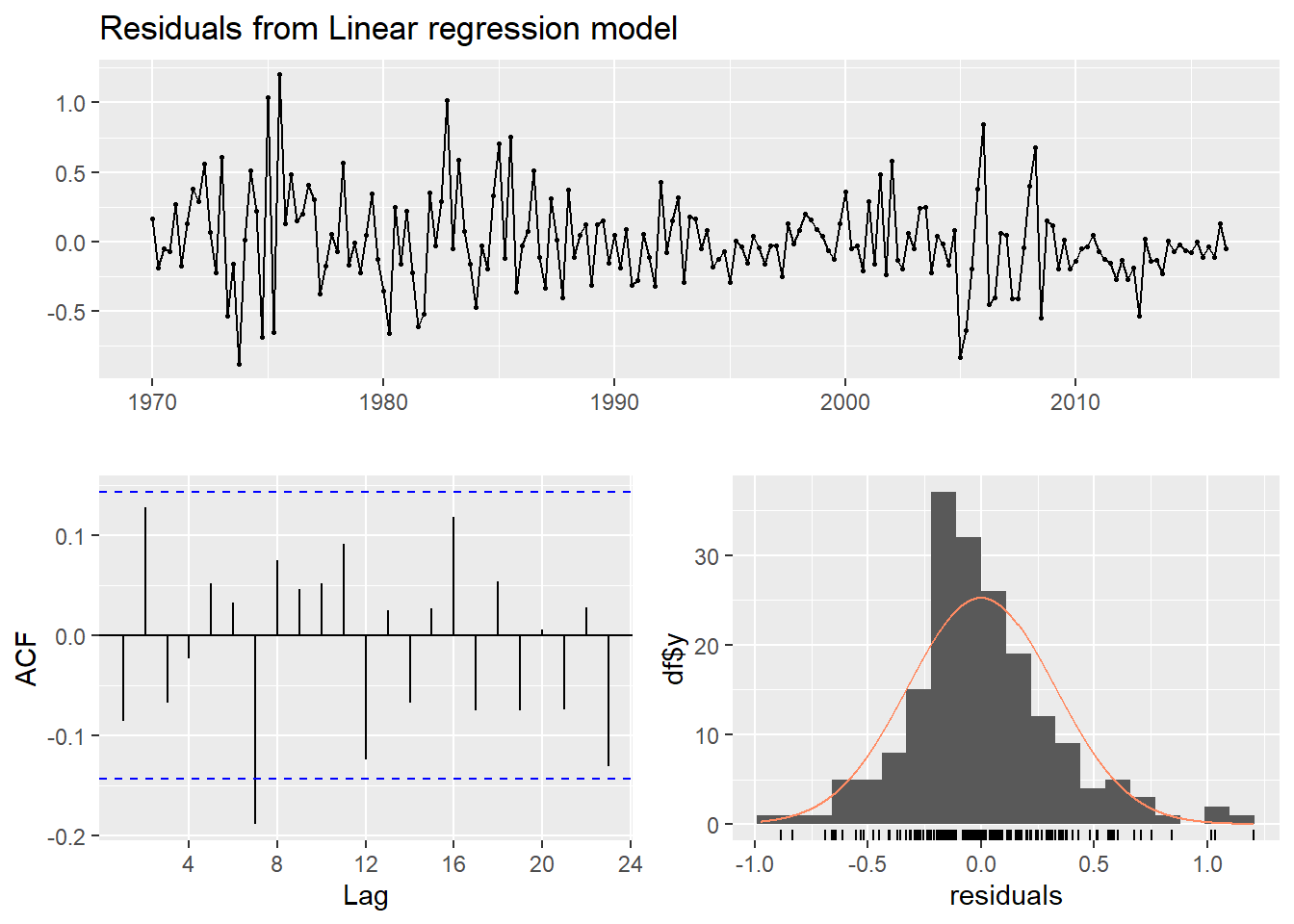

checkresiduals(mod0)

Breusch-Godfrey test for serial correlation of order up to 8

data: Residuals from Linear regression model

LM test = 14.874, df = 8, p-value = 0.061633 Modelos de tendencia

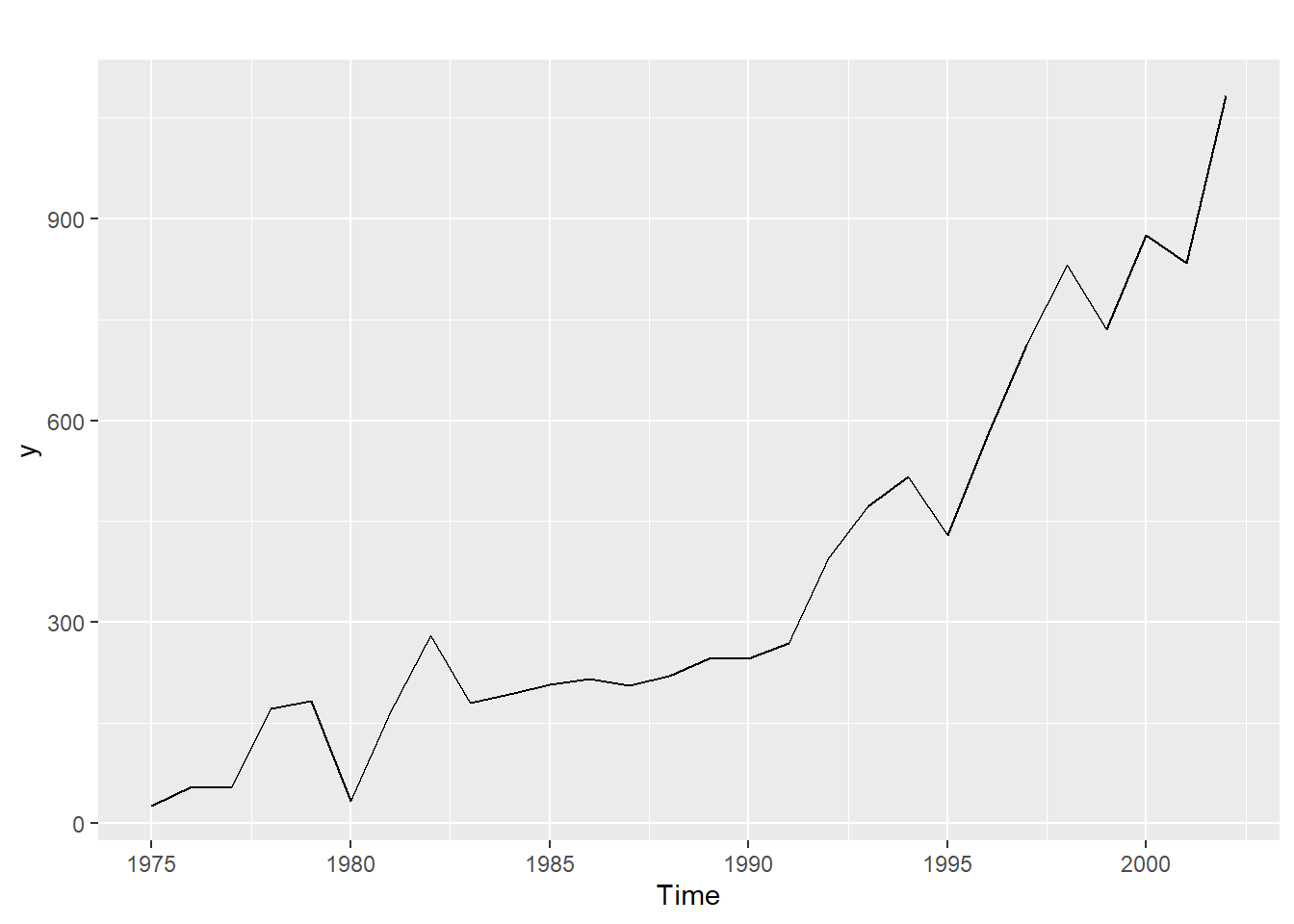

3.1 Ejemplo con graduados de ITCR de 1975 a 2002

itcrgrad<-read.csv("ITCR.csv",sep=",")

y<-ts(itcrgrad$graduados,start=1975)

autoplot(y)

3.2 Crear variables independientes

tiempo<-seq(1,length(y))

tiempo2<-tiempo^2

datos.itcrgrad<-data.frame(y,tiempo,tiempo2)

mod1<-lm(y~tiempo+tiempo2,datos.itcrgrad)

summary(mod1)

Call:

lm(formula = y ~ tiempo + tiempo2, data = datos.itcrgrad)

Residuals:

Min 1Q Median 3Q Max

-117.932 -49.683 4.506 43.234 155.390

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 127.0021 43.6818 2.907 0.00753 **

tiempo -12.7887 6.9427 -1.842 0.07736 .

tiempo2 1.5612 0.2323 6.720 4.83e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 71.61 on 25 degrees of freedom

Multiple R-squared: 0.944, Adjusted R-squared: 0.9395

F-statistic: 210.6 on 2 and 25 DF, p-value: 2.268e-16mod.ts1<-tslm(y~trend+trend^2) #note la salida no incluye a la tendencia al cuadrado.

summary(mod.ts1)

Call:

tslm(formula = y ~ trend + trend^2)

Residuals:

Min 1Q Median 3Q Max

-183.89 -78.69 -23.75 90.52 273.76

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -99.373 45.678 -2.175 0.0389 *

trend 32.486 2.752 11.805 6.03e-12 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 117.6 on 26 degrees of freedom

Multiple R-squared: 0.8428, Adjusted R-squared: 0.8367

F-statistic: 139.3 on 1 and 26 DF, p-value: 6.026e-12mod.ts2<-tslm(y~trend+I(trend^2))

summary(mod.ts2)

Call:

tslm(formula = y ~ trend + I(trend^2))

Residuals:

Min 1Q Median 3Q Max

-117.932 -49.683 4.506 43.234 155.390

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 127.0021 43.6818 2.907 0.00753 **

trend -12.7887 6.9427 -1.842 0.07736 .

I(trend^2) 1.5612 0.2323 6.720 4.83e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 71.61 on 25 degrees of freedom

Multiple R-squared: 0.944, Adjusted R-squared: 0.9395

F-statistic: 210.6 on 2 and 25 DF, p-value: 2.268e-16par(mfrow = c(1,1))

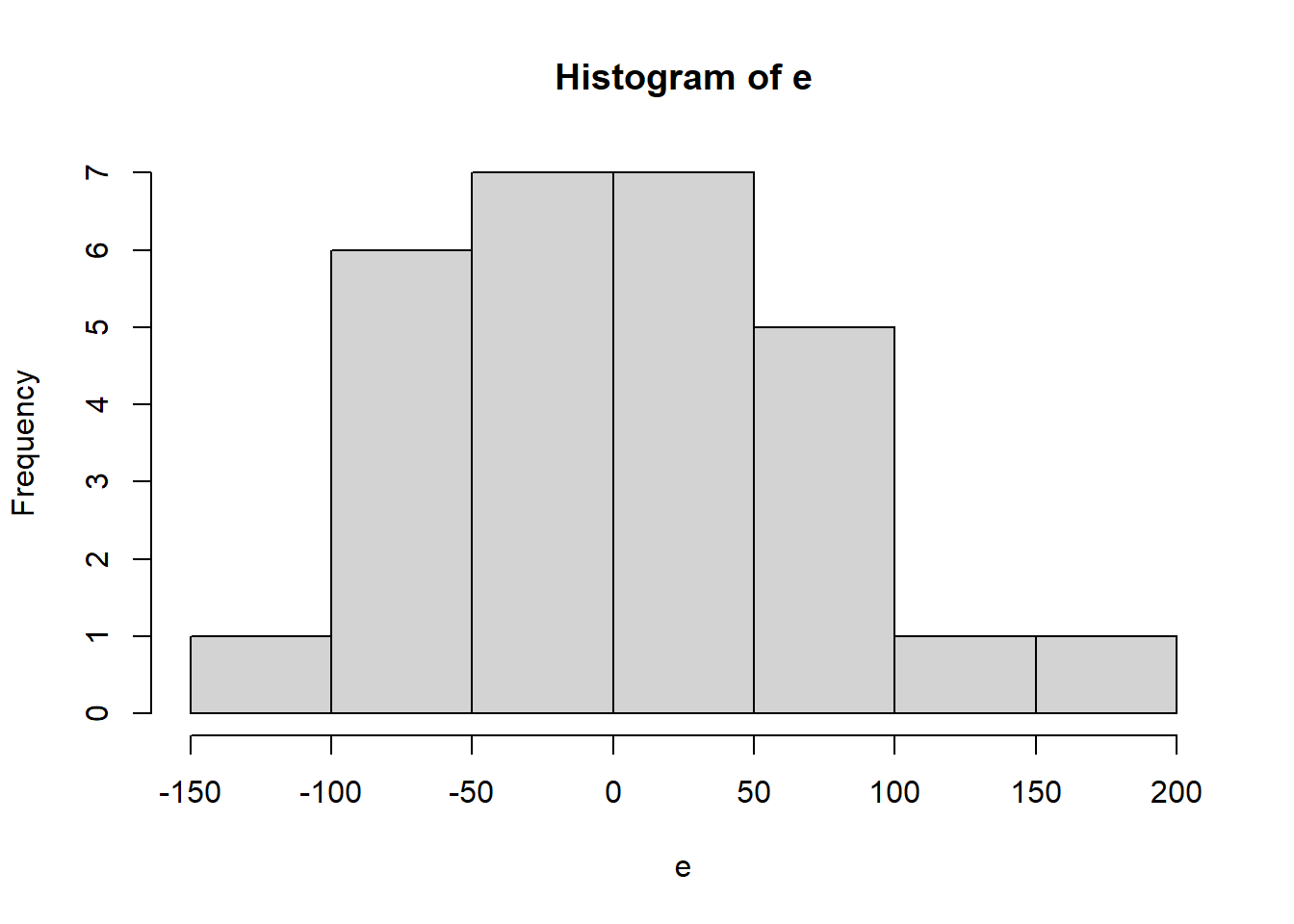

e<-mod1$residuals3.3 Normalidad

hist(e)

shapiro.test(e)

Shapiro-Wilk normality test

data: e

W = 0.97509, p-value = 0.72113.4 Homoscedasticidad

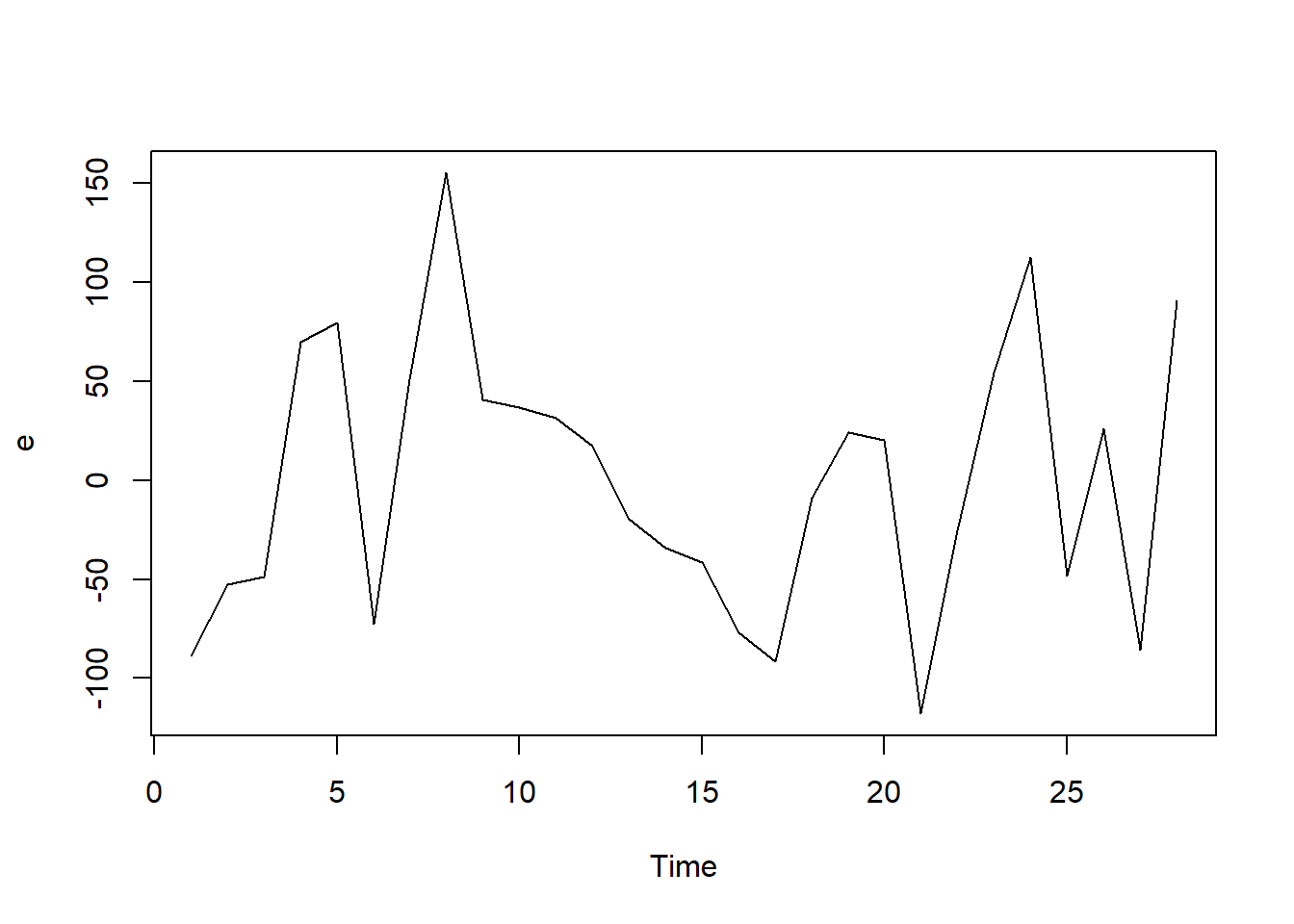

ts.plot(e)

lmtest::bptest(mod1)

studentized Breusch-Pagan test

data: mod1

BP = 1.0404, df = 2, p-value = 0.59443.5 Autocorrelación

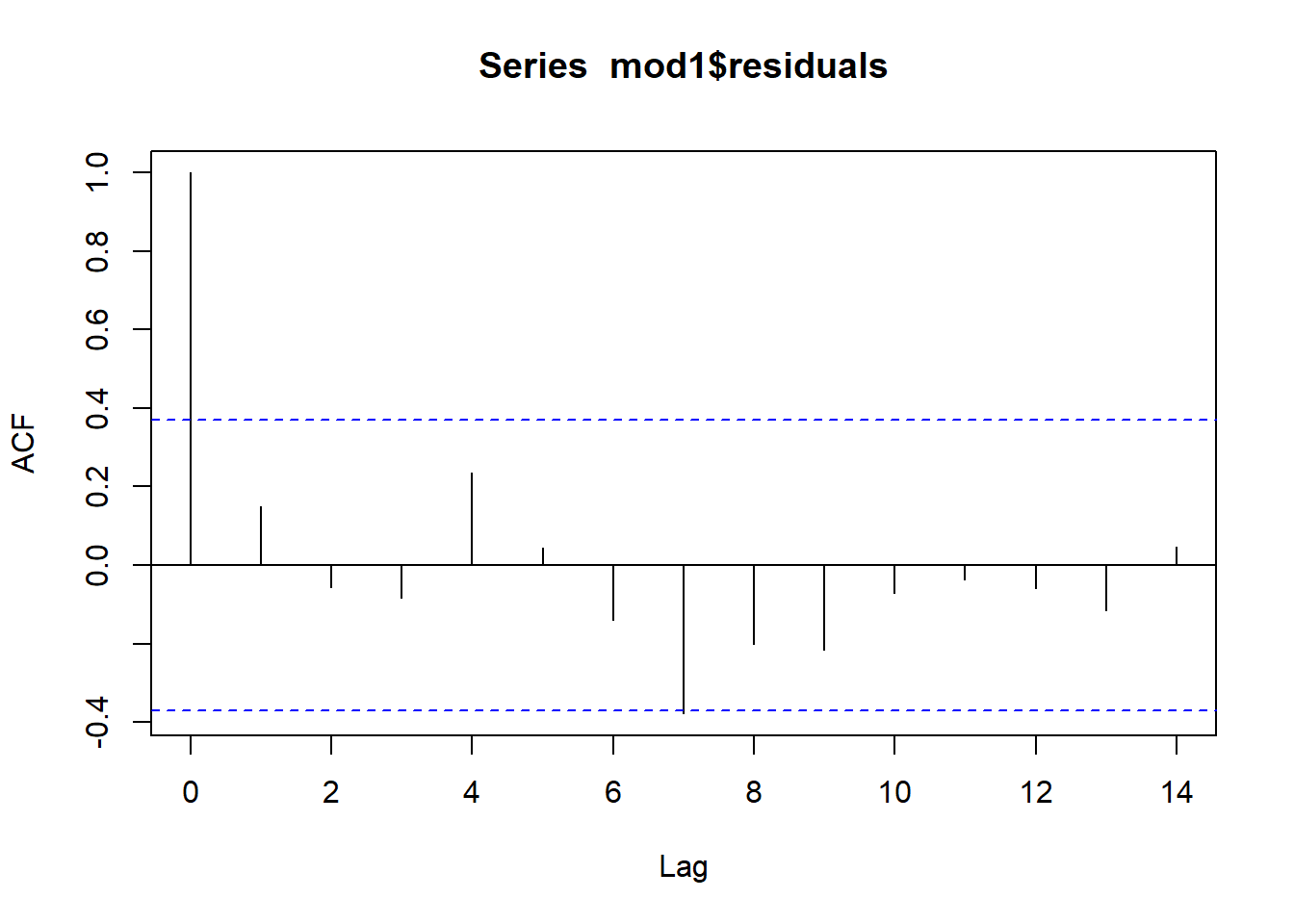

acf(mod1$residuals)

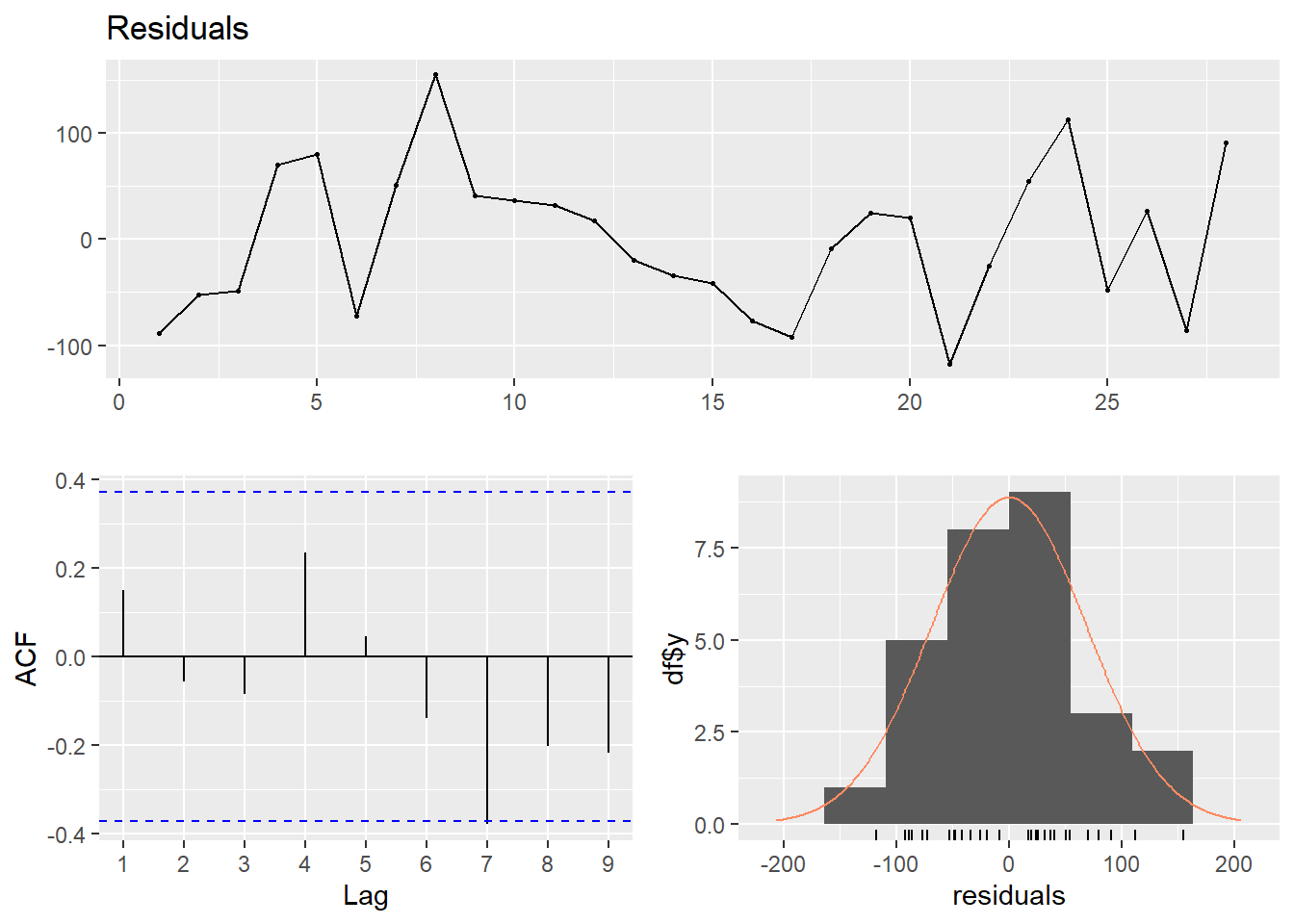

checkresiduals(mod1)

Breusch-Godfrey test for serial correlation of order up to 6

data: Residuals

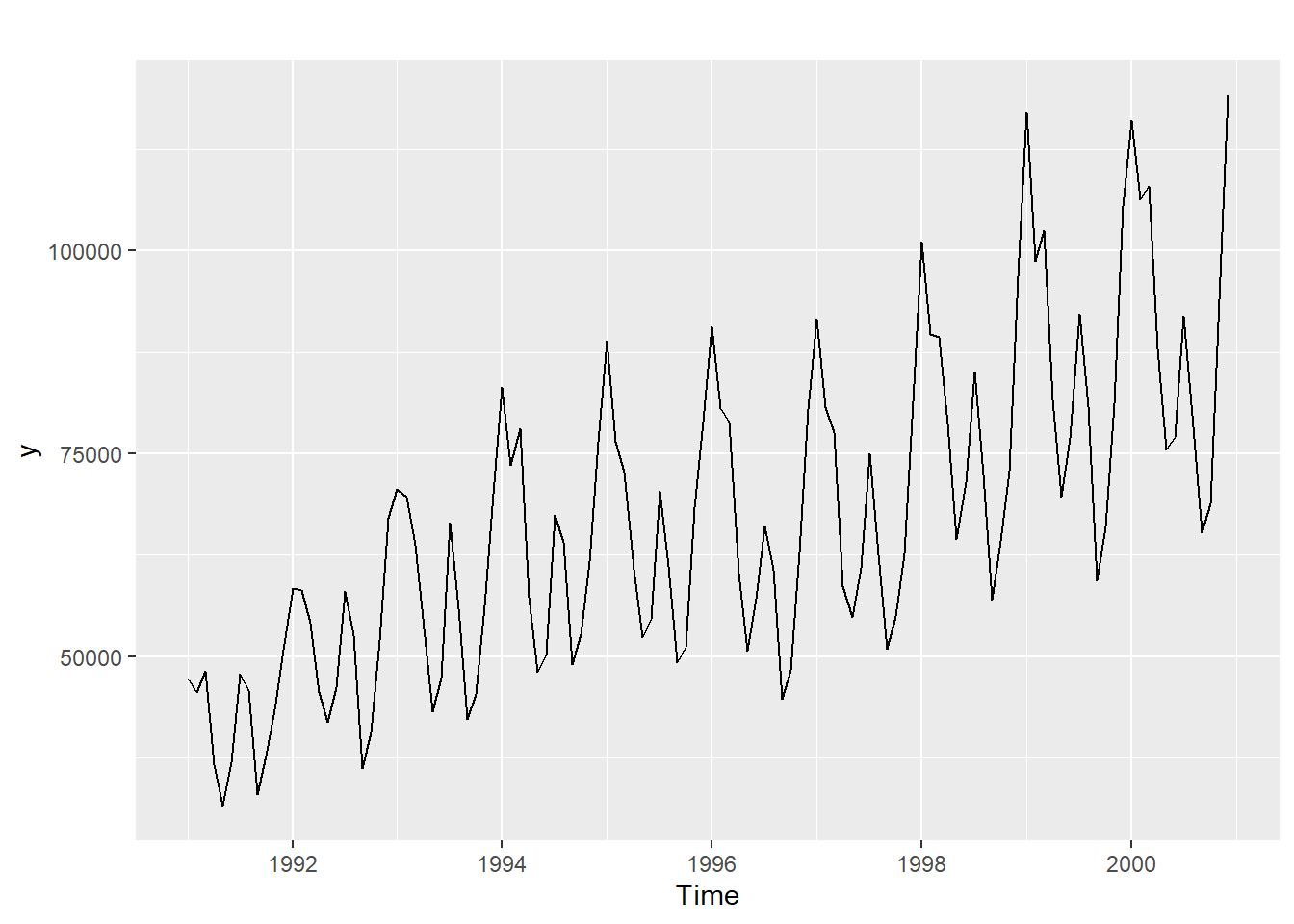

LM test = 3.9215, df = 6, p-value = 0.68734 Regresión con series estacionales

turistas<-read.csv("turistas.csv",sep=";")

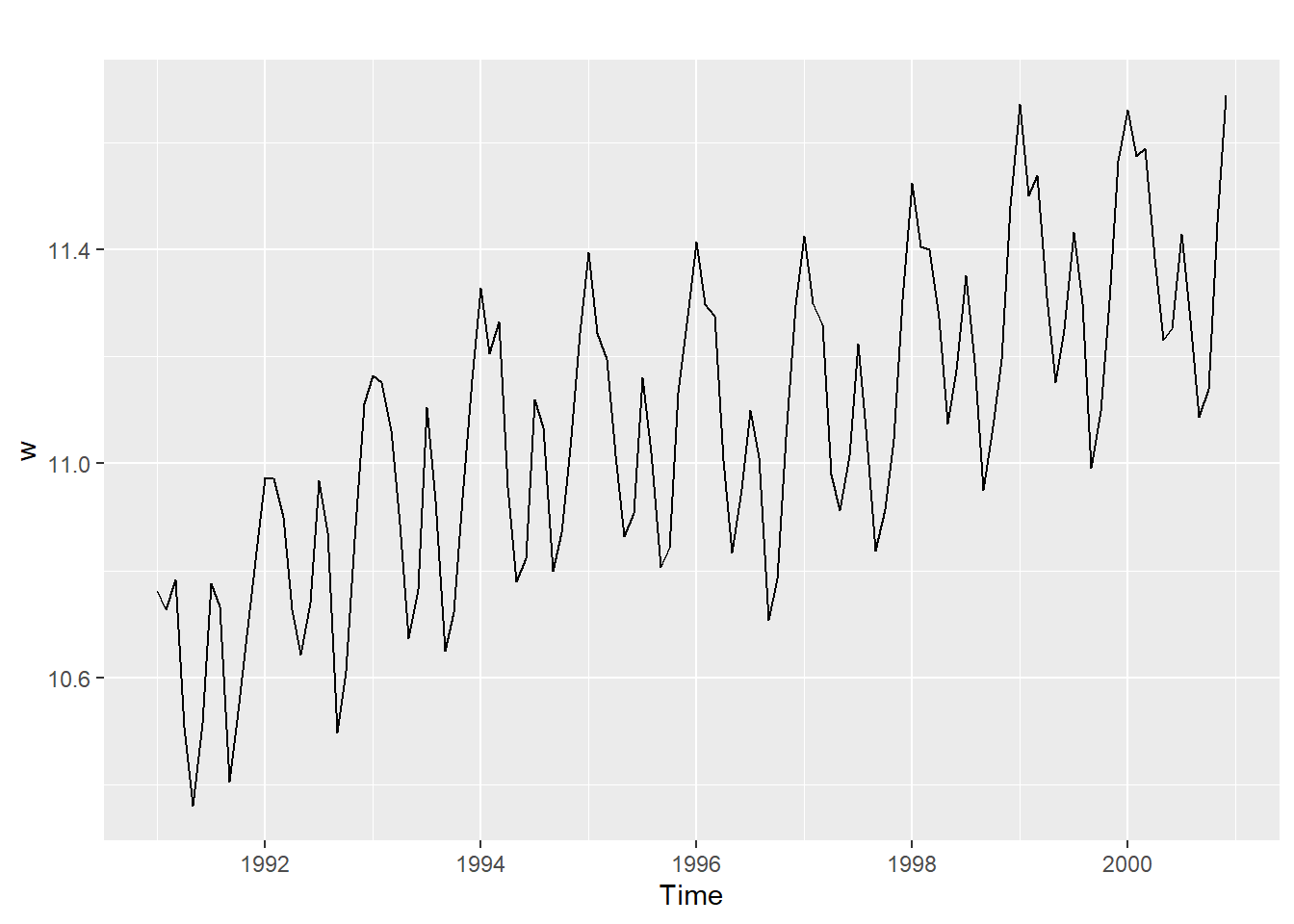

y<-ts(turistas$turistas,start=c(1991,1),frequency=12)4.1 transformacion logarítmica

w<-log(y)

autoplot(y)

autoplot(w)

tiempo<-seq(1,length(y))

tiempo2<-tiempo^2

mes<-rep(seq(1,12),10)

mes<-as.factor(mes)

datos1<-data.frame(w,tiempo,tiempo2,mes)

mod1<-lm(w~tiempo+tiempo2+mes,datos1)

summary(mod1)

Call:

lm(formula = w ~ tiempo + tiempo2 + mes, data = datos1)

Residuals:

Min 1Q Median 3Q Max

-0.188378 -0.048245 0.007514 0.052592 0.135323

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.094e+01 2.940e-02 372.182 < 2e-16 ***

tiempo 8.617e-03 7.707e-04 11.181 < 2e-16 ***

tiempo2 -1.992e-05 6.169e-06 -3.229 0.001654 **

mes2 -1.013e-01 3.243e-02 -3.125 0.002297 **

mes3 -1.181e-01 3.243e-02 -3.641 0.000422 ***

mes4 -3.467e-01 3.243e-02 -10.690 < 2e-16 ***

mes5 -5.050e-01 3.244e-02 -15.568 < 2e-16 ***

mes6 -4.243e-01 3.244e-02 -13.077 < 2e-16 ***

mes7 -2.037e-01 3.245e-02 -6.278 7.65e-09 ***

mes8 -3.326e-01 3.246e-02 -10.248 < 2e-16 ***

mes9 -6.091e-01 3.247e-02 -18.760 < 2e-16 ***

mes10 -5.293e-01 3.248e-02 -16.299 < 2e-16 ***

mes11 -3.263e-01 3.249e-02 -10.043 < 2e-16 ***

mes12 -1.042e-01 3.250e-02 -3.207 0.001775 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.07251 on 106 degrees of freedom

Multiple R-squared: 0.9439, Adjusted R-squared: 0.937

F-statistic: 137.3 on 13 and 106 DF, p-value: < 2.2e-16levels(datos1$mes) [1] "1" "2" "3" "4" "5" "6" "7" "8" "9" "10" "11" "12"datos2 <- within(datos1, mes <- relevel(mes, ref = 12))

levels(datos2$mes) [1] "12" "1" "2" "3" "4" "5" "6" "7" "8" "9" "10" "11"mod2 <- lm(w~tiempo+tiempo2+mes,datos2)

summary(mod2)

Call:

lm(formula = w ~ tiempo + tiempo2 + mes, data = datos2)

Residuals:

Min 1Q Median 3Q Max

-0.188378 -0.048245 0.007514 0.052592 0.135323

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.084e+01 3.022e-02 358.594 < 2e-16 ***

tiempo 8.617e-03 7.707e-04 11.181 < 2e-16 ***

tiempo2 -1.992e-05 6.169e-06 -3.229 0.00165 **

mes1 1.042e-01 3.250e-02 3.207 0.00177 **

mes2 2.885e-03 3.249e-02 0.089 0.92940

mes3 -1.386e-02 3.248e-02 -0.427 0.67035

mes4 -2.425e-01 3.247e-02 -7.470 2.39e-11 ***

mes5 -4.008e-01 3.246e-02 -12.348 < 2e-16 ***

mes6 -3.201e-01 3.245e-02 -9.863 < 2e-16 ***

mes7 -9.952e-02 3.244e-02 -3.067 0.00274 **

mes8 -2.284e-01 3.244e-02 -7.041 1.98e-10 ***

mes9 -5.049e-01 3.243e-02 -15.565 < 2e-16 ***

mes10 -4.251e-01 3.243e-02 -13.108 < 2e-16 ***

mes11 -2.220e-01 3.243e-02 -6.847 5.09e-10 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.07251 on 106 degrees of freedom

Multiple R-squared: 0.9439, Adjusted R-squared: 0.937

F-statistic: 137.3 on 13 and 106 DF, p-value: < 2.2e-164.2 Pronóstico

mod1<-lm(w~tiempo+tiempo2+mes,datos1)

summary(mod1)

Call:

lm(formula = w ~ tiempo + tiempo2 + mes, data = datos1)

Residuals:

Min 1Q Median 3Q Max

-0.188378 -0.048245 0.007514 0.052592 0.135323

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.094e+01 2.940e-02 372.182 < 2e-16 ***

tiempo 8.617e-03 7.707e-04 11.181 < 2e-16 ***

tiempo2 -1.992e-05 6.169e-06 -3.229 0.001654 **

mes2 -1.013e-01 3.243e-02 -3.125 0.002297 **

mes3 -1.181e-01 3.243e-02 -3.641 0.000422 ***

mes4 -3.467e-01 3.243e-02 -10.690 < 2e-16 ***

mes5 -5.050e-01 3.244e-02 -15.568 < 2e-16 ***

mes6 -4.243e-01 3.244e-02 -13.077 < 2e-16 ***

mes7 -2.037e-01 3.245e-02 -6.278 7.65e-09 ***

mes8 -3.326e-01 3.246e-02 -10.248 < 2e-16 ***

mes9 -6.091e-01 3.247e-02 -18.760 < 2e-16 ***

mes10 -5.293e-01 3.248e-02 -16.299 < 2e-16 ***

mes11 -3.263e-01 3.249e-02 -10.043 < 2e-16 ***

mes12 -1.042e-01 3.250e-02 -3.207 0.001775 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.07251 on 106 degrees of freedom

Multiple R-squared: 0.9439, Adjusted R-squared: 0.937

F-statistic: 137.3 on 13 and 106 DF, p-value: < 2.2e-16try(

pronostico<-forecast(mod1) #error

)Error in forecast.lm(mod1) :

argument "newdata" is missing, with no defaultmod3<-tslm(w~trend+I(trend^2)+season)

summary(mod3)

Call:

tslm(formula = w ~ trend + I(trend^2) + season)

Residuals:

Min 1Q Median 3Q Max

-0.188378 -0.048245 0.007514 0.052592 0.135323

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.094e+01 2.940e-02 372.182 < 2e-16 ***

trend 8.617e-03 7.707e-04 11.181 < 2e-16 ***

I(trend^2) -1.992e-05 6.169e-06 -3.229 0.001654 **

season2 -1.013e-01 3.243e-02 -3.125 0.002297 **

season3 -1.181e-01 3.243e-02 -3.641 0.000422 ***

season4 -3.467e-01 3.243e-02 -10.690 < 2e-16 ***

season5 -5.050e-01 3.244e-02 -15.568 < 2e-16 ***

season6 -4.243e-01 3.244e-02 -13.077 < 2e-16 ***

season7 -2.037e-01 3.245e-02 -6.278 7.65e-09 ***

season8 -3.326e-01 3.246e-02 -10.248 < 2e-16 ***

season9 -6.091e-01 3.247e-02 -18.760 < 2e-16 ***

season10 -5.293e-01 3.248e-02 -16.299 < 2e-16 ***

season11 -3.263e-01 3.249e-02 -10.043 < 2e-16 ***

season12 -1.042e-01 3.250e-02 -3.207 0.001775 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.07251 on 106 degrees of freedom

Multiple R-squared: 0.9439, Adjusted R-squared: 0.937

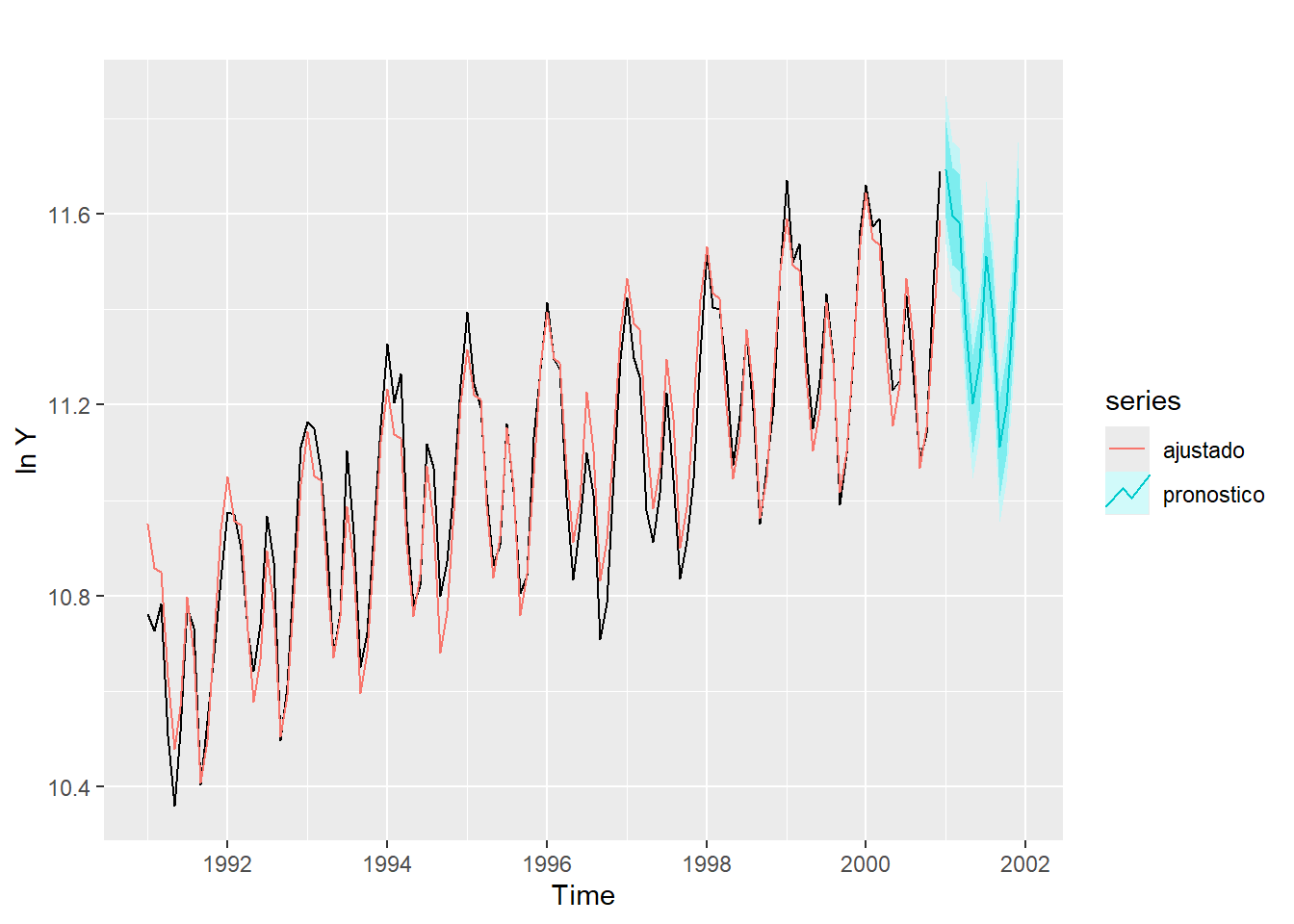

F-statistic: 137.3 on 13 and 106 DF, p-value: < 2.2e-16pronostico<-forecast(mod3,h=12)

pronostico Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 2001 11.69308 11.59176 11.79439 11.53732 11.84883

Feb 2001 11.59552 11.49401 11.69704 11.43945 11.75159

Mar 2001 11.58251 11.48078 11.68425 11.42611 11.73892

Apr 2001 11.35756 11.25560 11.45952 11.20080 11.51431

May 2001 11.20294 11.10074 11.30513 11.04582 11.36006

Jun 2001 11.28729 11.18484 11.38974 11.12979 11.44479

Jul 2001 11.51140 11.40870 11.61411 11.35351 11.66930

Aug 2001 11.38605 11.28307 11.48902 11.22774 11.54436

Sep 2001 11.11311 11.00986 11.21636 10.95437 11.27185

Oct 2001 11.19632 11.09278 11.29985 11.03714 11.35549

Nov 2001 11.40279 11.29895 11.50663 11.24315 11.56243

Dec 2001 11.62822 11.52407 11.73236 11.46811 11.78833autoplot(w) +

ylab("ln Y") +

autolayer(mod3$fitted.values, series = "ajustado") +

autolayer(pronostico, series = "pronostico")

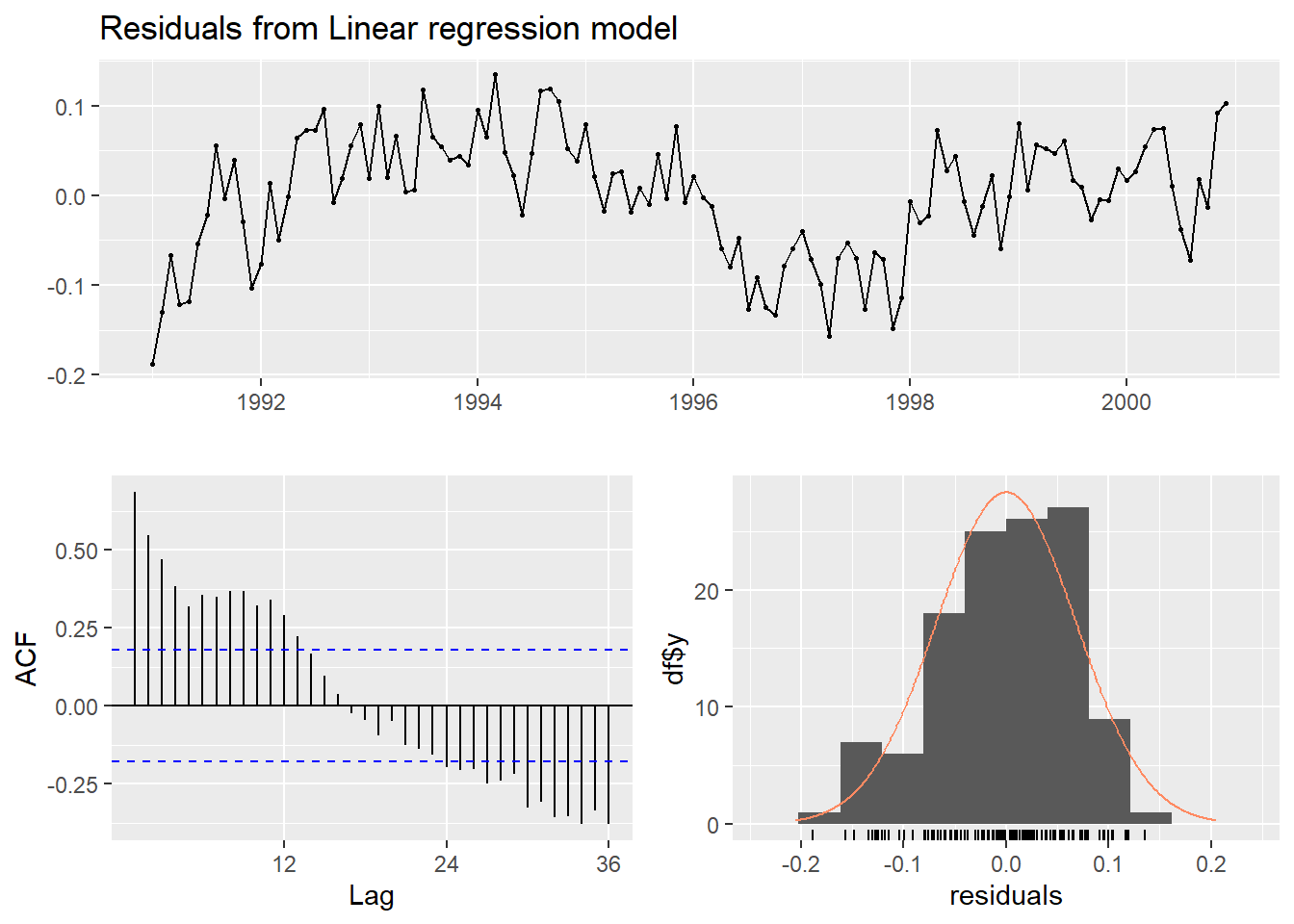

checkresiduals(mod3)

Breusch-Godfrey test for serial correlation of order up to 24

data: Residuals from Linear regression model

LM test = 69.582, df = 24, p-value = 2.529e-06y<-ts(turistas$turistas,start=c(1991,1),frequency=12)

y.train<-window(y,start=c(1991,1),end=c(1999,12))

y.test<-window(y,start=c(2000,1),end=c(2000,12))

mod4<-tslm(y.train~trend+I(trend^2)+season)

summary(mod4)

Call:

tslm(formula = y.train ~ trend + I(trend^2) + season)

Residuals:

Min 1Q Median 3Q Max

-16096.7 -3411.3 833.9 3542.2 15635.4

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 6.285e+04 2.312e+03 27.188 < 2e-16 ***

trend 4.557e+02 6.746e+01 6.755 1.18e-09 ***

I(trend^2) -5.924e-01 5.994e-01 -0.988 0.325522

season2 -8.809e+03 2.552e+03 -3.452 0.000836 ***

season3 -1.006e+04 2.552e+03 -3.942 0.000156 ***

season4 -2.517e+04 2.552e+03 -9.860 3.65e-16 ***

season5 -3.402e+04 2.553e+03 -13.325 < 2e-16 ***

season6 -2.947e+04 2.553e+03 -11.540 < 2e-16 ***

season7 -1.574e+04 2.554e+03 -6.162 1.77e-08 ***

season8 -2.419e+04 2.555e+03 -9.470 2.46e-15 ***

season9 -3.947e+04 2.556e+03 -15.446 < 2e-16 ***

season10 -3.551e+04 2.556e+03 -13.890 < 2e-16 ***

season11 -2.476e+04 2.558e+03 -9.680 8.82e-16 ***

season12 -8.906e+03 2.559e+03 -3.481 0.000761 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 5414 on 94 degrees of freedom

Multiple R-squared: 0.9158, Adjusted R-squared: 0.9041

F-statistic: 78.6 on 13 and 94 DF, p-value: < 2.2e-16pronostico<-forecast(mod4,h=12)

pronostico Point Forecast Lo 80 Hi 80 Lo 95 Hi 95

Jan 2000 105476.42 97842.25 113110.58 93731.85 117220.99

Feb 2000 96993.44 89340.12 104646.77 85219.39 108767.49

Mar 2000 96067.58 88394.02 103741.15 84262.40 107872.77

Apr 2000 81283.94 73589.07 88978.81 69445.98 93121.90

May 2000 72754.64 65037.40 80471.87 60882.27 84627.00

Jun 2000 77627.00 69886.35 85367.64 65718.62 89535.38

Jul 2000 91675.80 83910.71 99440.89 79729.81 103621.80

Aug 2000 83540.16 75749.59 91330.73 71554.97 95525.36

Sep 2000 68577.97 60760.90 76395.04 56552.01 80603.93

Oct 2000 72856.77 65012.19 80701.35 60788.49 84925.05

Nov 2000 83927.02 76053.94 91800.11 71814.89 96039.16

Dec 2000 100091.16 92188.58 107993.74 87933.65 112248.67accuracy(pronostico) ME RMSE MAE MPE MAPE MASE

Training set 5.729326e-13 5050.477 4024.289 -0.3434747 6.726303 0.6524221

ACF1

Training set 0.623945accuracy(pronostico,y.test) ME RMSE MAE MPE MAPE MASE

Training set 5.729326e-13 5050.477 4024.289 -0.3434747 6.726303 0.6524221

Test set 4.766925e+03 8704.755 6962.741 4.0412577 7.106520 1.1288072

ACF1 Theil's U

Training set 0.6239450 NA

Test set 0.5177485 0.51563885 Algunos temas adicionales

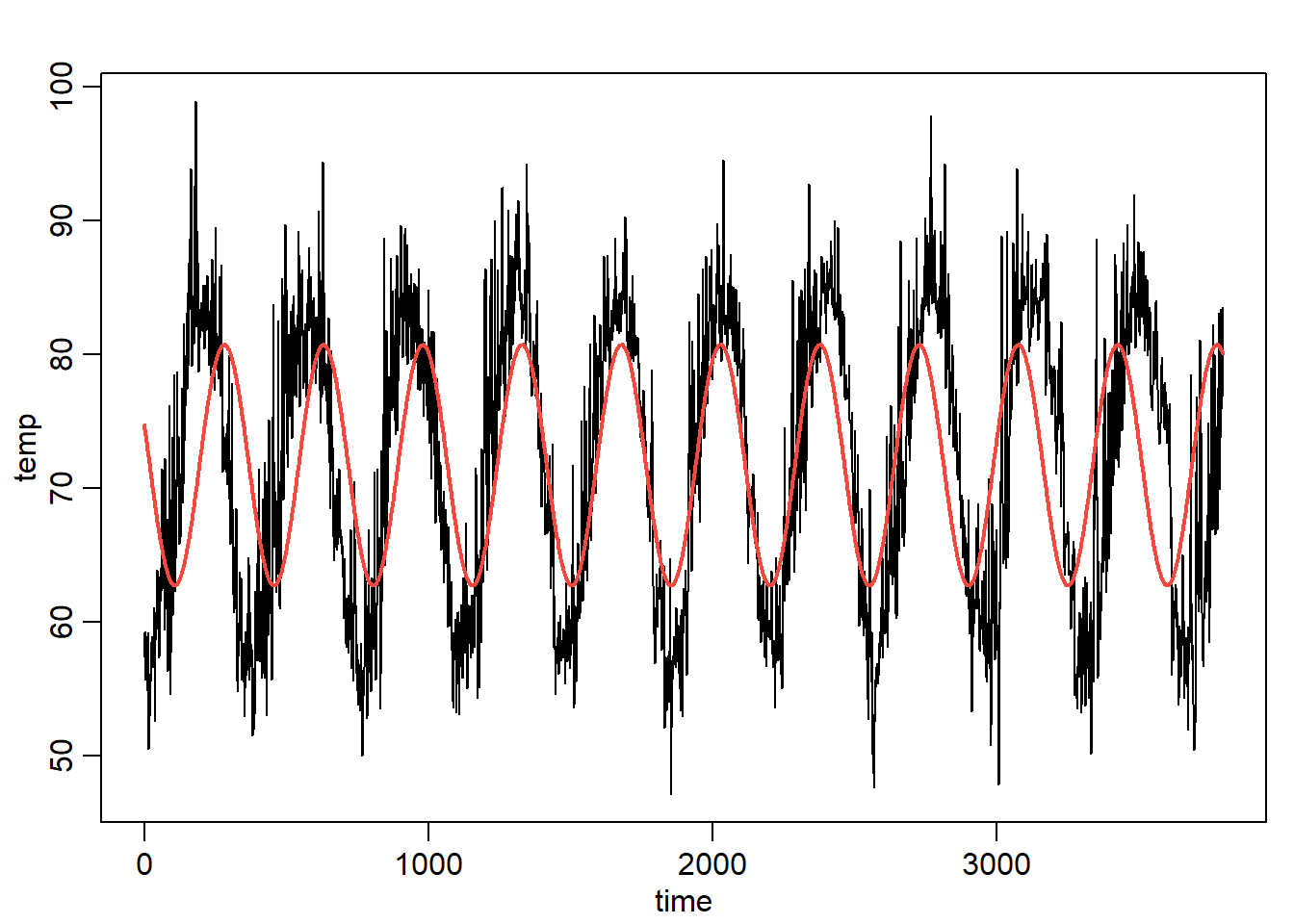

5.1 Modelos aditivos generalizados

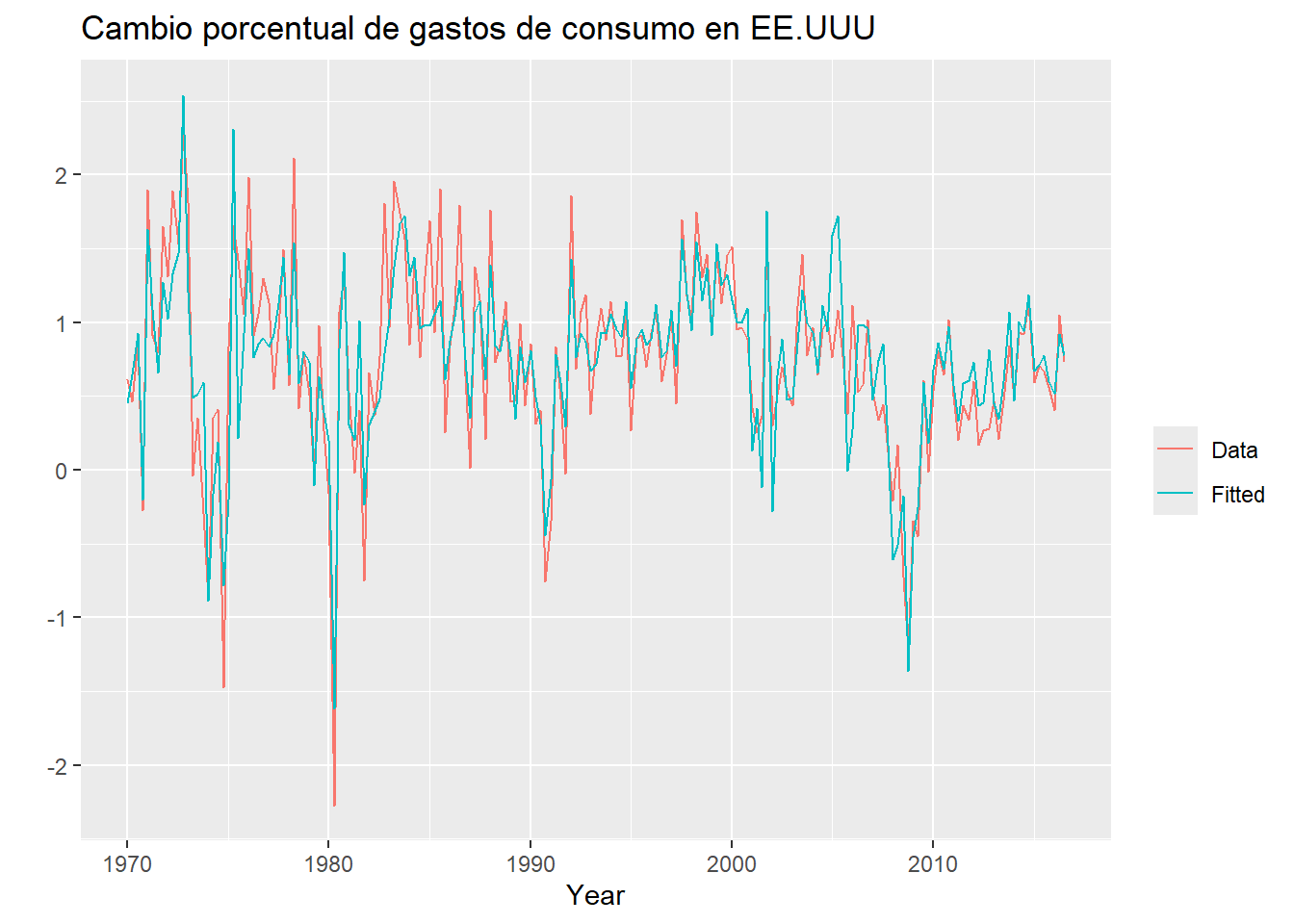

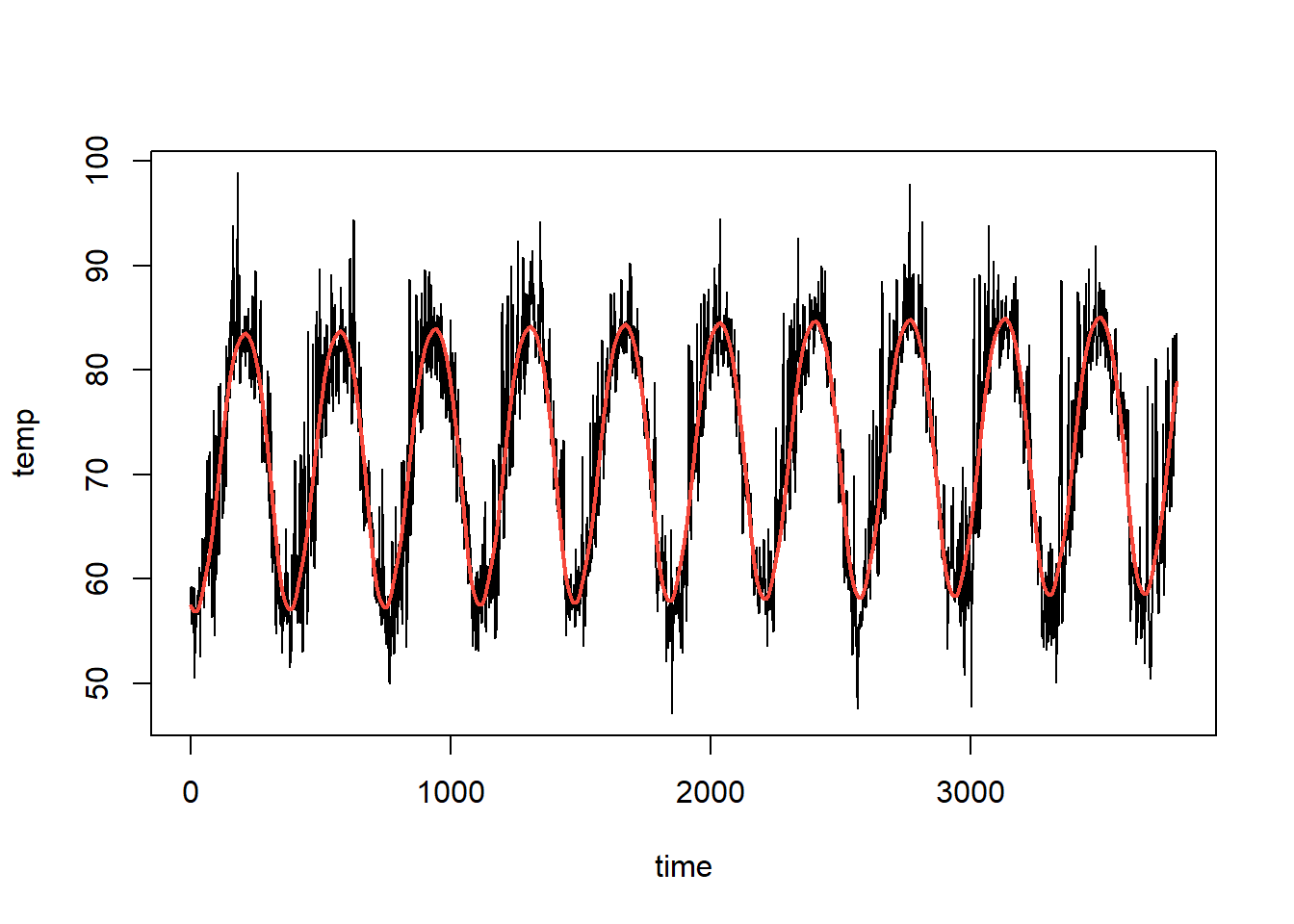

data("cairo")

ctamm <- gamm(temp~s(day.of.year,bs="cc",k=20)+s(time,bs="cr"),

data=cairo,correlation=corAR1(form=~1|year))

pred<-fitted(ctamm$gam)

plot(cairo$temp~cairo$time,type="l", ylab="temp",xlab="time")

points(cairo$time,pred,type="l",col=2,lwd=2)

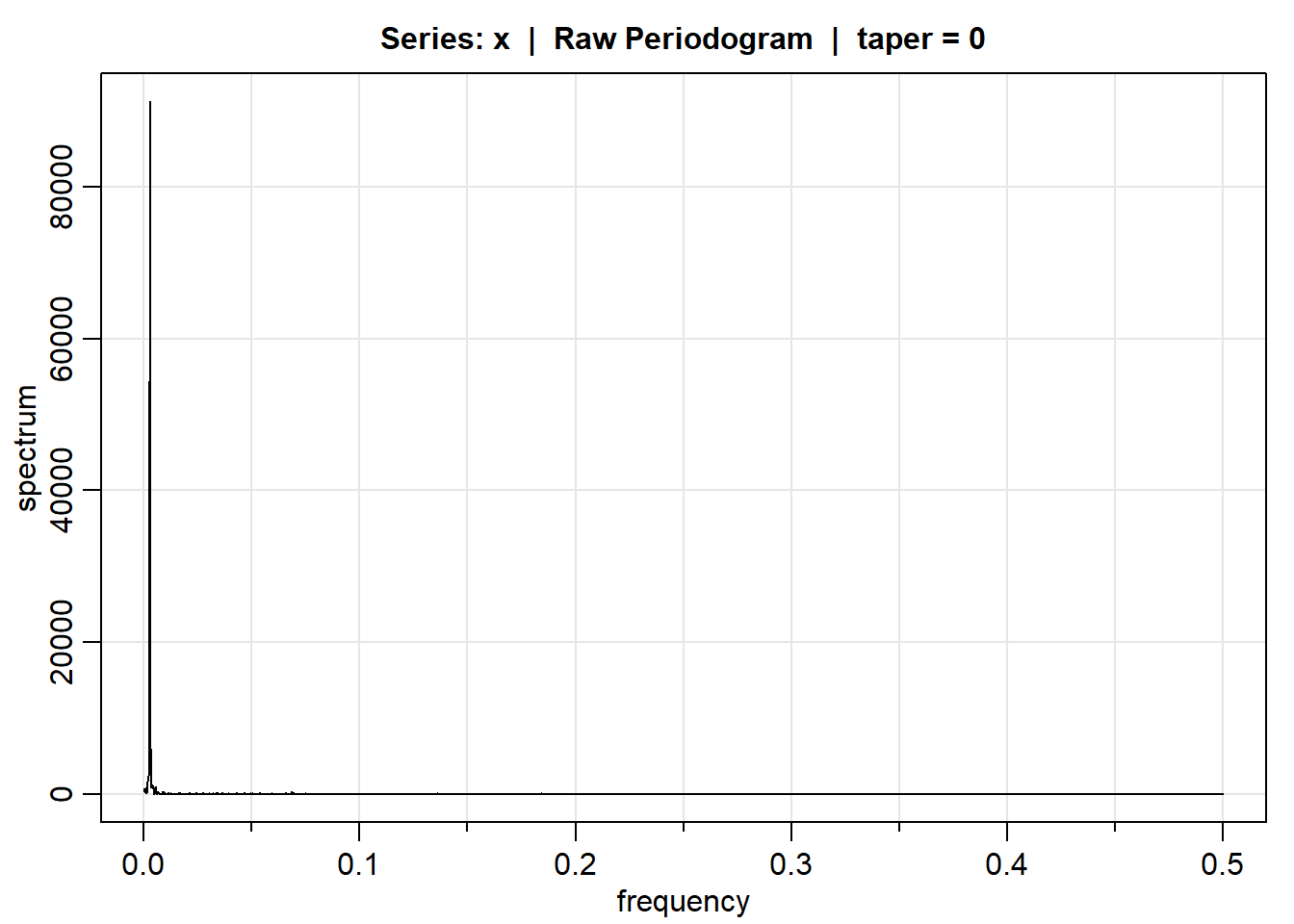

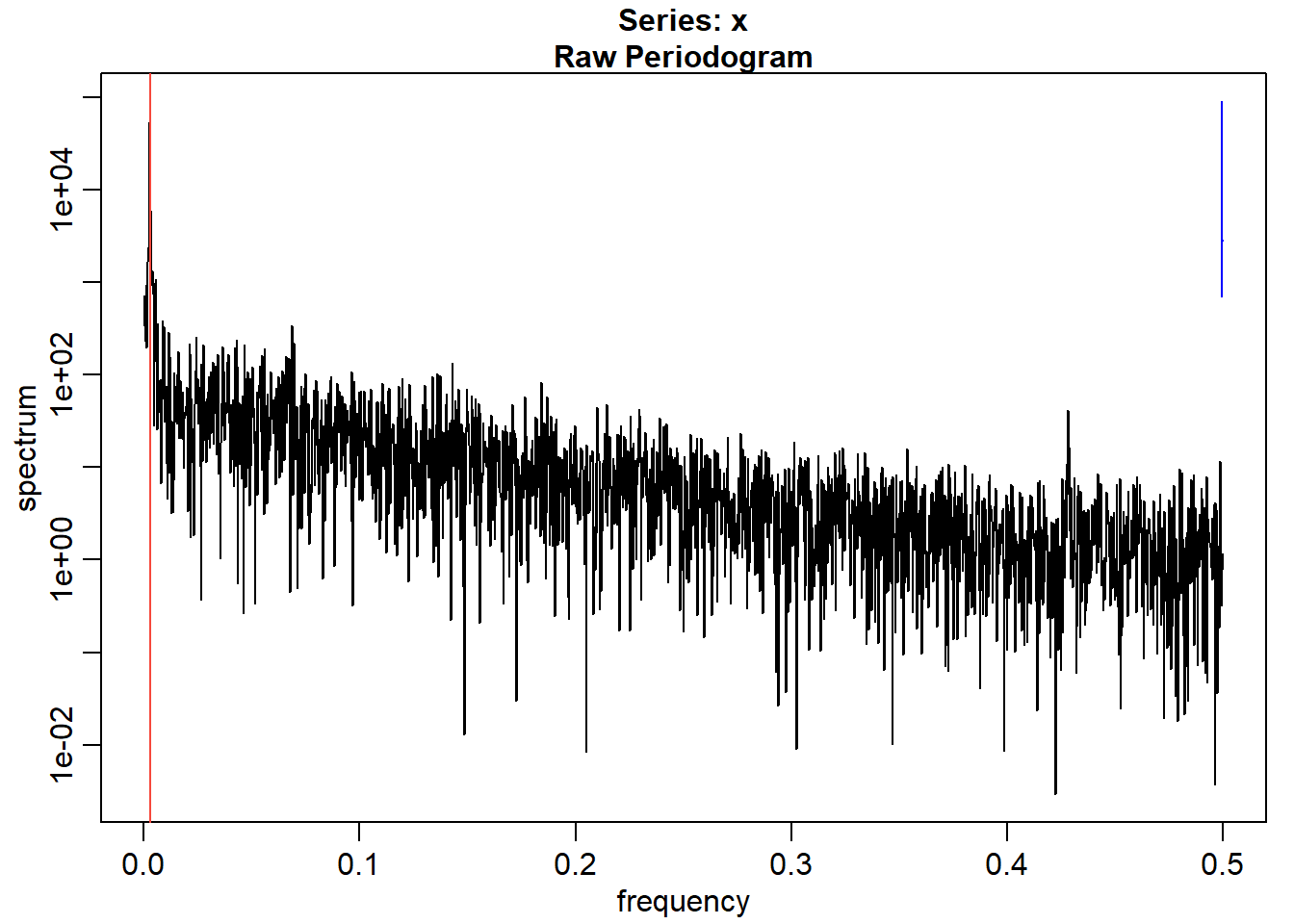

5.2 Análisis espectral

x<-cairo$temp

x.spec <-mvspec(x,log="no")

plot(x.spec)

frecuencia<-x.spec$freq[x.spec$spec==max(x.spec$spec)]

abline(v=frecuencia,col=2)

1/frecuencia[1] 349.0909cos1<-cos(2*pi*frecuencia*cairo$time)

sin1<-sin(2*pi*frecuencia*cairo$time)

data=data.frame(x=x,time=cairo$time,cos=cos1,sen=sin1)

mod<-lm(x~cos1+sin1,data=data)

plot(cairo$temp~cairo$time,type="l", ylab="temp",xlab="time")

points(cairo$time,fitted(mod),type="l",col=2,lwd=2)

dim(x.spec$details)[1] 1920 3head(x.spec$details) frequency period spectrum

[1,] 0.0003 3840 727.9763

[2,] 0.0005 1920 343.6813

[3,] 0.0008 1280 232.7334

[4,] 0.0010 960 930.7296

[5,] 0.0013 768 199.1892

[6,] 0.0016 640 1049.8714tail(x.spec$details) frequency period spectrum

[1915,] 0.4987 2.0052 11.6033

[1916,] 0.4990 2.0042 5.1899

[1917,] 0.4992 2.0031 0.9052

[1918,] 0.4995 2.0021 0.3214

[1919,] 0.4997 2.0010 0.7780

[1920,] 0.5000 2.0000 1.1591spectro_orden <- x.spec$details %>% as.data.frame() %>% arrange(desc(spectrum))

spectro_orden[1:8,] frequency period spectrum

1 0.0029 349.0909 91251.731

2 0.0026 384.0000 54420.640

3 0.0023 426.6667 8986.496

4 0.0031 320.0000 6148.723

5 0.0034 295.3846 2902.172

6 0.0021 480.0000 2409.255

7 0.0018 548.5714 1666.177

8 0.0039 256.0000 1331.423frecuencia1 <- spectro_orden$frequency[1]

frecuencia2 <- spectro_orden$frequency[2]

frecuencia3 <- spectro_orden$frequency[3]

frecuencia4 <- spectro_orden$frequency[4]

frecuencia5 <- spectro_orden$frequency[5]cos1<-cos(2*pi*frecuencia1*cairo$time)

sin1<-sin(2*pi*frecuencia1*cairo$time)

cos2<-cos(2*pi*frecuencia2*cairo$time)

sin2<-sin(2*pi*frecuencia2*cairo$time)

cos3<-cos(2*pi*frecuencia3*cairo$time)

sin3<-sin(2*pi*frecuencia3*cairo$time)

cos4<-cos(2*pi*frecuencia4*cairo$time)

sin4<-sin(2*pi*frecuencia4*cairo$time)

cos5<-cos(2*pi*frecuencia5*cairo$time)

sin5<-sin(2*pi*frecuencia5*cairo$time)

data=data.frame(x=x,

cos1=cos1,sen1=sin1,

cos2=cos2,sen2=sin2,

cos3=cos3,sen3=sin3,

cos4=cos4,sen4=sin4,

cos5=cos5,sen5=sin5)

mod2<-lm(x~.,data=data)

plot(cairo$temp~cairo$time,type="l", ylab="temp",xlab="time")

points(cairo$time,fitted(mod2),type="l",col=2,lwd=2)